Boss Uncaged Podcast Overview

“The first thing I always like to say is, what are your goals? Because, you know, I want to ensure that I’m a good match for you if you’re working with me. The second thing, too, is if you’re not, I just want you to have a vision of what you want your life to look like. So that the best thing that I can do is tell a person to pick up a book that’s got to do with real estate.”

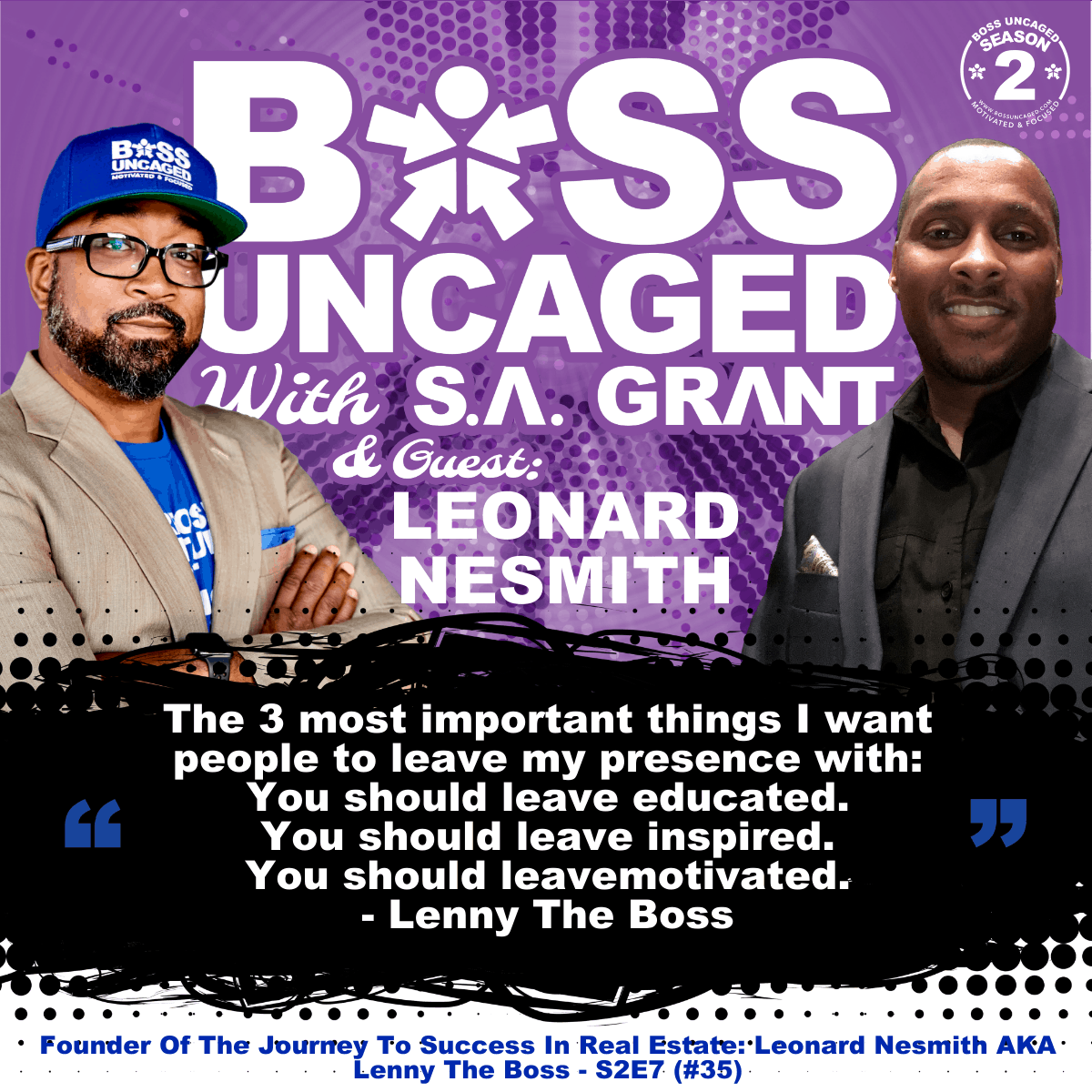

In Season 2, Episode 7 of the Boss Uncaged Podcast, S.A. Grant continues his Real Estate Month by interviewing Leonard Nesmith, a.k.a. “Lenny The Boss” – Founder of The Journey To Success In Real Estate. Leonard is a Real Estate Investor with a true passion for helping beginner Real Investors understand and perfect their craft.

“The three most important things I want people to leave when they leave me in my presence are these three things, right. You should leave me educated. You should leave me inspired. You should be motivated.”

With an aim to provide the best information and resources on the planet for Real Estate Investors, Leonard created a one-stop-shop boot camp to help would-be investors understand the challenges and benefits of getting into the real estate investment game. His program provides his students the golden ticket of access to many of the required investing knowledge and tools. His goal is to make the process that much easier to keep his students encouraged through the process of investing.

Grab your pen and paper and get ready to take notes on topics covering:

- Inside details on The Journey to Success in Real Estate Bootcamp

- Tools for tracking income and expenses

- Benefits of personal loans vs. loans under an LLC

- The power of affirmations as a part of your morning routine

- And so much more!

Want more details on how to contact Lenny The Boss? Check out the links below!

Leonard Nesmith

LinkedIn https://www.linkedin.com/in/leonard-nesmith-369b57128

Facebook https://www.facebook.com/leonard.nesmith.1

YouTube https://www.youtube.com/channel/UC8i-yDkbfRQe29mIiUfqiEw

Instagram http://www.instagram.com/lenny_the_boss723

Boss Uncaged Podcast Transcript

S2E07 – Leonard Nesmith.m4a – powered by Happy Scribe

Hit record on that record on. All right, three, two, one, welcome. Welcome back to Boston Cage podcast. On today’s show, we got a special guest. Well, let me start off the way he would start off his podcast. Great morning. Great morning. Great morning, Lenny.

The boss is in the building with so many bad.

Tell people a little bit about who you are and what you do.

You know, me and I you know, it’s funny because I really love people ask me that question because I’m a little differently if that’s saying who I am. You know, the first thing I like to say is may I have a strong relationship with my savior? Right. In the second thing, I just love for people to know about me is that I am a family guy, right. Like, I sit here and I love I’m a I’m amazing husband.

I’m an amazing father. I am a great father. Right. I have a host of brothers and sisters that I love and I have a host of friends. But the three most important things I want people to leave when they leave me in my presence is these three things, right. You should leave me educated. You should leave me inspired. You should be motivated. So those are the three things that you should leave those. Think I should put it to you after you leave my presence.

But outside it, you know, I’m a real estate investor. I really love real estate. I really love helping. You know, that is really the beginners that people who want to scale and just teach them on on how they can bring in some extra income on just to just to help out, help out with the bills, help out with, you know, going on more vacations, help out with their way of life, you know, and also some people just want to structure out a way where they can be rent free or leave their their employment.

So, you know, I love to do that. I love to work with nine to five. And I got that about myself. I’m a I’m a VP of operations manager, over a hundred thirty people. And, you know, and I relate like I relate with time management. I relate with those things. I teach those things because people just believe that they don’t have the time. They believe that they don’t have the focus. They believe that once they can’t make the decision because they don’t have the knowledge.

So that’s me in a nutshell.

I got it. Got it. Got so I mean by default, I mean this guy every single time I see him on the Internet. And the last time I seen you in person was like back December twenty. Nineteen. Yes. No matter when I see this man, his energy level is always on like twenty five thousand plus like guaranteed he is the power so of the situation. Right. So with all the energy. Right. So why did you get interested.

I mean you’re saying you’re a VP by day, right. So obviously that’s a well-paying position. Why did you decide? I granted I know your background. I know your family members. It’s kind of like you really don’t have a choice, but go ahead and tell a story about how did you get into real estate?

Well, you know, like, it’s funny because, you know, when when when you’re growing up in and I don’t want to start it when you grow up like, you know, I didn’t know too many entrepreneurs, so, you know, like everybody do.

Right. Like, I grew up in a very rough neighborhood, very poor background. I have nine brothers and sisters, so single family mother with ten kids.

Right. You know, and I, I just do what I need to do with the school. I finally got my act together around ninth grade, right. Yeah. With the college and I went out, I got a job now a couple of my buddies from the neighborhood were they were in the real estate and they were getting real estate and they were buying property, fixed it up it rent. But, you know, they were really, really good friends.

And so I always heard nothing but complaints, nothing but complaints up to about, oh, my God, these contracts. Oh, my God, these tenants, because I was the vending machine, they couldn’t go anywhere else. The city came. They kept me going out for some cocktails or they come into my house and now they’re just and I just never was like, wow. I always thought, oh, we’ll get to real estate one day.

That’s what I don’t want the headaches. Well, as time went on, they buy a property here, they buy property there. And I’m like, this is interesting years going in. I’m saying you complain so much about real estate, but you’re continuously buying them. So finally, I like to do, you know, let’s lift the covers up here. Like, what are you not telling me? And, you know, it’s kind of funny.

And the thing was, and this is probably something goofy listeners, is that he told me, he said, you never asked me this question on what was so beneficial about. So I never expressed it.

So, you know, for the listeners, just make sure that you ask that question. Right. So I did.

And finally, he mentioned like a you know, he said, you see, the vacations were going on. He said, you see the house that that we had, we’d be able to move up a level themselves up.

You see, they have new Mercedes Benz. But they had a new car, right, you know, and just money to go out and stuff like that, and I thought that they would just tear it up and over time. Right. Because they always used to tell me, oh, you know, we can’t make this. We can’t make this. I just with the job. But that was the case. You know, they make decent money.

Nothing anyone else can make right at DEPLOYMENT’S. And they just took their money and they just invested in real estate. And the accumulation over time allowed them to have that. So that was the really the eye opener to me to sit there and say, you know, that was the one thing to sit there, say, hey, I really need to jump in the real estate. The second thing is, you know, as you start to get older and you start to get mature, you start to have friends that lose employment and you start to see that it possibly could happen to you.

You know, you need to start putting yourself in a position to ensure that life from a financial perspective don’t hit you that hard. So that I mean, that’s like at that point in time, that was my mindset growing to go into that. But at that point, that was my mindset.

So, I mean, how long ago did you decide to jump into space?

You know what? To me, it was really late in the game. And because I’ve been in the game for about seven to eight years now by active, you know what I mean? And so, you know, like I like everybody says, you know, you should have done it sooner, you know, but it is what it is. But, yeah, I’ve been doing this about seven years now, and it’s fun. It’s exciting. Honestly speaking, it was a pretty challenging in the beginning, all because I did more from I had a mentor, but I did more from the ground trying to read all the books I could.

And and I was active on the properties it and just doing everything I could to say, hey, let me get this up and running to see, because I needed to make my wife a believer to write like said.

So, you know, she’s like, oh, you smell this.

Diagnosed up and coming in from the 80s, we spent a lot of money going out without going out, going out, going out, but not seeing too much going it coming in.

So. So, yeah, I’ve been I’ve been doing this added to people.

So yes. I mean it just it doesn’t that last 60 seconds, I mean you get so much information and it kind of turns and burns for me to give you so many more questions based on what you just said. Right. So I think one of them you talked about books and I think in the past couple of weeks you had made a post on your Facebook page and you were talking about like the top six things that anybody that successful should do.

And one of them was, I think one or two was reading books. Right. So what books are you reading right now?

The books I’m reading right now. So let me just let everybody know I got into my bookshelf. But I have the hardback books, of course, but I got into a lot of ordeals because, you know, when you think about it, you least have a basis. So we are all in the same boat when you start thinking about, oh, my God, you have to start finding it.

And so did the the big thing that I start doing is purchasing ordeals. Right. So and I say, hey, rather than listening to hip hop or any music on my way to work, which I have like a thirty to forty five minute drive I take in this audio book. Right. So you figure let’s just say a half an hour. That’s an hour a day, you know what I mean. That I was able to basically take in this knowledge and information in.

And then what happened was this knowledge and information became available because I was loving. So now I started to find the time. So I’m in the house. Right. And I needed to maybe do some cleaning or something in the house. I popped my earphones in, listen to audio book when I was exercising. Right. I’m like, OK, it’s a perfect time, right? You exercise twenty minutes, twenty minutes in the morning, go exercise to get twenty minutes of audio.

So you start to find these gaps at times and you start taking these knowledge. And the best thing I could say, I probably didn’t mention this, but this is probably no.

What you need a pen in the pad because you need to take what you taken in. Right. And not use the mind to store it. But you need to put it down on paper because there’s something about seeing it and writing it out. It is seeing it and having it reflect back into your mind. It sticks, you know, and it’s just it’s just a power that a lot of people don’t use that they should. But I’ll get back to the books.

I mean, what am I read right now?

I’m reading I just read the multifamily millionaires, right? I also read a book called How Credit is King.

I just read that I got a couple of the books that I read kind of look from a marketing perspective, you know, so on some of the click funnel guy named. Aggressive, aggressive. Yeah, I got a couple of books I’m read, one is now I actually just I got a dead Henry book that I read now. So, yeah. So that’s definitely.

Yes. I mean, you wrote up a solid point, but I mean, much like you are on the same way, like audio books are like my friends. Right. And to your point, I’m trying to get it to a situation to where every morning I have opportunity, no matter what I’m doing, to still listen to the audio. Right. So I’ve gotten kind of addicted on Aleksa devices and I made it kind of seamless to where my toothbrush is.

An Alexa device has a speaker built into it. My glasses are Aleksa device a little. When I wake up in the morning, I put my glasses on. The first thing I’m saying is open up. Wow, play the book, go and brush my teeth. Continue playing audible I’m going to shower. Still playing audible So in the first hour, to your point, I’m getting information and then I’m transitioning into about my day and I’m still in my car.

I have an Alexa device as well too. So I’m happy you brought that up because I’m just like you. I’m addicted as well. Right. It kind of gives you an opportunity to get the information, absorb the information and take action while you’re listening to it. So that’s definitely some great insight. So in your real estate business, right? I mean, what’s the most extreme or bizarre experience you’ve ever encountered working in the field?

Oh, OK.

Well, you know, you tend, you know, I guess the to the beholder, right. What’s extremely not. But, you know, so what I like to do is, of course, I think you should go into any and everything with some sort of budget, what you want to do. And and so so my strategy is when I purchase my properties, I typically do like like Rihad and then some properties, you know, we got it.

But I typically do like rehabs. And I like to put I like to fix everything up front or as much as I can.

So, you know, when I’m looking at the property to purchase it, I’m identifying all the things that should be fixed, you know, and then and to make my proposal to get the property. But so so the reason I’m saying that is because I think I prevent a lot of potential things that could come down the line for doing it. And that’s fine. But don’t let that stop you from getting the property right, because you need to get the right you know, even if you can fix those things in that fix what?

You can just take the money out of the bank and to fix it as you go if you need to, don’t wait. Right.

But OK, a bizarre thing. So one property lady, she’s she moved maybe about two or three hours away from where she originally lived with her roommate or whatever.

So she kind to kind of make a new life with them. And I guess he he he left her for whatever situation they broke up. Maybe I should say that. And so she was there. Love that. One of my best tennis ever had. I wish that she was she was still here.

She called me and she called me and she called me and she called me and she called me if it got me, I like the world. And she said, the house is under water. I like that she’s an exaggerator. But I’m like, what was my take? Is that it’s water coming from everywhere. I don’t know where it’s coming from. I had to call it a water company. They had to come and shut the water off from outside.

I said, OK, so I got there. And yes, she was right.

I mean, it was water everywhere. I had brought, like, my boss, those boots that the firemen wear, that I had purchased some of them. And what happened was there was a crack in the line that was on the ground and it was it was coming out from the kitchen. So, yeah. So that was that was probably one of the most bizarre things to me, that and then I had a tenant where Oroton got to the house and then.

So so the road got in and took probably a few weeks for us to get it out because that was a little bizarre, too, because, you know, I cut my point, got a road like, well, how can I be like, you know, and then that one, we got it out that we spent a lot of money on fixing that. That was really like this lady can’t be right. Like we fixed everything I could think of, even the things I couldn’t think of that was pissed off because my contract that we got to fix, you know, you know, that was that was a little bizarre.

It was squirrel. And not knowing what Wroten is, there is probably the most serious. And squirrels just let everybody know they make a lot of noise about, oh, my God, I never knew how destructive they can be and yet. But we got it out, so.

Gotcha. Gotcha. So, I mean, that leads me to my next question. So you’re talking about contracts and you have contracts in place that say that you have to fix up a place. So obviously in that business structure, I mean, are you more LLC s corp, a C corp? Which one are you and why?

OK, so let me talk on that a little bit in one of the reasons why I like to work with individuals that got nine to five. Right. Especially, you know, normally when women like me anyway in the people I work with, they don’t have that much money. OK, is. Despite that, right, and with that being said, you know, one of the power things you could do is leverage the bank. OK, obviously, you know, make sure that your credit is straight, save up a couple bucks.

But now the bank really, really, really likes to people, you know, so people who are W2 employees, you know, they tend to cover them with kid gloves. Right. Even though something won’t believe it because their credit score is bad. But they do. Right.

You know, it’s easier to get a loan. It’s much more simpler to get a loan when you are, you know, getting into personal versus getting an LLC. Now, this is going on record. I’m not an attorney and this is not legal advice by any means for anything like that. But obviously, you know of the protect yourself, do it the right way anyway is to get an LLC. Right.

But what I typically do and suggested individuals, because it’s an easier process, is not a roadblock, you know, is that you just get the loan in your name. And if at the table you want to change the LLC with your attorney and they could do that to people as well. So now now there is language in the note from the from the mortgage company that says, hey, if you do something like that, they can pool the mortgage and make you pay, you know, a hundred percent.

But at the end of the day, you know, I never heard any bank. It did that as long as you continue to to pay the mortgage. So that’s one of the things that you could do. So but I just really kind of coach people just to get into the game. It’s very easy to get a investment loan using your name versus an LLC.

I mean, you just it’s funny that you brought that up and I just felt like you just dropped like all these golden nuggets from the sky just started raining in. And I want people to really realize what he just kind of explained to you about the situation. Right. So just to kind of translate that a little bit and kind of stay on that topic a little bit more, is that he’s saying that because you have a W-2 is going to make it easier for the bank to give you loans because they know that your ass is going to have money to pay for that loan.

And that’s that’s that’s like the collateral is not necessarily a house or tangible objects or assets is the fact that you have reoccurring revenue that comes in every two weeks. Worst case scenario, they know you have a job and you can make the payments. And that’s definitely great insight and something that I think people that get into real estate don’t think about. Right. They don’t say, OK, I’m going to go to the bank, I’m going to present to them my business plan and I’m going to try to get a loan.

But to your point, if you have a job, well, that job is your collateral.

One of the biggest things that I found to be funny and I laugh to this day is that like everybody don’t feel they made it till they got an LLC.

It’s like it’s like Lexically LLC only like only means one thing, you know, it only means that, you know, it’s big. They’ll get me wrong is limited liability. That’s it. But, you know, from a tax write off and all that good stuff is the same. So, you know, you get the same benefits. And this is where, you know, stop going to your aunt, your uncle, your cousin’s friend, your nephew who who who does taxes, go to a certified CPA and they can educate you to some things that you just don’t know.

And also because a book is about seventy thousand pages. Right. And in those CPAs, they go to school and they’re going to pass a crazy test. Right. You know, and you go to them because they’re the professionals and they get educated to some things. And L.L.C. is just that. It’s important that I’m not discrediting that by any means. But I don’t think that you had to make it because you got a L.L.C.. You made it.

When you’re sitting here bringing in some some extra income and building that financial wealth for you and your family or whatever your goals are, I mean, just diving into that topic a little bit more in the example I like to use to kind of put things in transparency for people to really understand.

It’s like everybody’s kind of familiar with amusement parks, like Six Flags. Right? So think about Six Flags as that is an umbrella corporation that that may be a C corp. Right. Then inside that organization, there’s multiple rides. Each plot of land is then set up as an LLC. Right. And then the ride itself may be underneath the S corp. And then why the hell would they do that? Well, to your point, like you want to limit your liability so someone gets hurt on a roller coaster, then you’re going to try to sue Six Flags, but you can’t sue Six Flags because that roller coaster is owned by a separate court and the land that is owned is owned by LLC.

You got two levels of protection before you could even get the Six Flags. So by default, you’ve got all these legalities and lawyers in between. You can’t sue. It’s not going to start if you start to get special. I mean, they got they got money and it turns out that wasn’t right. Destruction on the proper way. And that’s another thing, you know, I mean, it’s great to go online and open up your own, you know, LLC, but there is a way to get a structure to, you know, to make sure that you are safe because just because you got a.

LLC folks does not mean that you are safe, because if you use it the wrong way. Like one example I hear a lot from the attorneys is that if you intermingle your personal with your business, that’s just a loophole. So you can have an LLC and they can still to you personally.

So so you think that you got everything straight, so it’s rules to follow and all that stuff as well. But I guess the answer to the original question, you know, do I have an LLC? Of course know. But that didn’t stop me. And I got property. That’s that’s that’s so cool.

So, I mean, just evidence of so on the business topic a little bit. So business partnership. I mean, recently you had opportunity. You went with Tyco when you guys went to California. So just kind of ties your cousin, right? Yes. So you guys are you guys business partners in the real estate game or is he kind of this an investor? I mean, how do you guys have that set up? And I mean, what did you find out why you was in California?

All you ask of a question is this OK? First and foremost, he’s a he’s a friend of mine as well as a cousin. Right. His mother and my mother are sisters. He’s also a mentor of mine, you know, and and I just he sees what I’m doing in real estate and he loves it.

And so we partnered up there.

So before we were like we was looking at, I think was a 50 unit in North Carolina that he loved.

I mean, he was gung ho about it.

And unfortunately, the numbers didn’t work. He wanted to stab me in the back. But the numbers, it was a gorgeous probably mean everything about it was awesome.

But the numbers and I think for the listeners, you know, the look and all that stuff beats nothing. Everything needs the numbers. But so he was out with California, man. And, you know, this is a power networking, right? You know, back in January when the country was open, you know you know, I went to this boot camp out in California. It was about, I don’t know, six hundred plus people there.

It was really amazing. And I met some fantastic people and just kind of stayed to touch with them. And we did virtual meet ups because obviously the time we live in it and then they just, you know, we just communicate.

No one Zovko kind of, you know, like this. And at the end, we kind of stayed on and three guys all live in California in the apartments. And I just was talking he was hearing something that they were doing to do. I want to come out and learn some of the things he done because I don’t have no knowledge in Arabic. So they was like, come on, come on out. So I said, I’ll call Thai like, Hey, Todd, do you want to fly out with me?

Say for sure. OK, so you know, he flew out from where he’s from and I flew out from to the East Coast in the Philadelphia area and flew to California and met up with these fantastic guys. And they are fantastic. But we ate a lot, just basically a mastermind about real estate, all different topics from taxes to, you know, what’s our magic number to to to all that stuff and also family. Right. Because when you network with individuals, I like to network with people that, you know, got some goals that’s outside of just real estate because it makes them just human to me.

You know, and I also like to hear because, you know, I love my family. And if someone could sit there and see these things they’re doing with their family and how they approach their family to make every day the best day, and I could benefit from all of that. I’m all for it. So we did that always out there, just looking at Airbnb and I’m looking at some new constructions out there, understanding the BMB model in.

And that’s kind of where so, you know, they plug this in, maybe publicised with a realtor. They put this in with a builder, they plug this with a financing system.

So we’re right now, we’re just in process of looking and seeing what makes sense so we can make a move. It makes sense for us.

Yes. The reason why I brought that up, because, you know, I love the fact that to your point, you’re always thinking about Family First, right? You’re always thinking about like business strategy and development and then you’re always networking. Right. So people just need to understand, like the power of the networking. Like you said, you met these guys pretty much online. You’ve been talking to them visually. And then you and your cousin hop on a plane and just go with it.

And by going over there, you took the initiative and you probably are now going to probably get property in California versus just being on the East Coast, which kind of diversified your portfolio tenfold. Yep, yep, yep.

And it’s amazing me like that. The power network is really amazing. And, you know, I don’t want people to understand the value that, you know, and try your best to do that when you’re not going to be buddy buddy with everybody in the world.

Right. But, you know, there are going to be a few people that you going to have some things in common. And with that being said, you know, we’re all in this thing together. You know, they they got nine. Five be all married, they got children, you know, and, you know, they all got goals and dreams, you know, and that’s me. I got goals and dreams, you know, to to do so fantastical thing.

So I love networking with folks like that, you know, and and when the great thing about it is, I think we took our level of relationship like 20 notches. So, you know, I foresee all of us doing some type of business venture together, just all because of this really does one visit. It’s going to, I think, kind of pull in the future to something nice.

So just going back maybe about like ten minutes or so, you was talking about banking, you was talking about opportunities. So touching back on that a little bit. I think a lot of people are also possibly thinking about the hurdles of getting that revenue right. So how much would you say kind of just coming out of pocket to someone, say, hey, I got five thousand, I should jump into the market, I got ten thousand, I should jump into the market?

Like, what’s that golden number to the kind of start out jumping into the market and picking up real estate, whether it’s land or apartment or whatever it may be, but truthfully is not one.

Right. And that’s just being honest, you know? And I think that that’s where this education is there. You know, what I do with my students is the first thing I ask is what are your goals? Because your goals is going to drive your strategy and your structure. Now, if they just say, hey, all I know is I want to bring in some extra and then I start to provide avenues and ways of doing that. You’ve got a house, right, with house hacking, which I believe is the most successful one, which takes the most minimal amount of money, because you can use that, like if you go out, OK, I have a student I’m working with right now, this whole story.

So he came he had about seven thousand in the bank. Right. Which I think was a decent amount of money to start with. You know, his his dreams is basically to have his rental income pay for his mortgages right where his house is, big house or whatever. So we mapped out a five year strategy for him. And basically he what he didn’t know, which was fantastic right for him, was that he had over eighty thousand dollars worth of equity in this current home.

Yeah, it’s OK.

Yeah. I mean, he had no clue about equity. Right. So, you know, and we found that out fairly early. You know, he was in FHA and I explained that in a minute. So what we did was I said the first thing you have to do is, you know, refinance out of your FHA into a conventional. We did some kind of cash out Refat. So he basically cashed out roughly about a little bit over fifty thousand dollars.

So the bank gave him a check for fifty thousand dollars and you refinance out of his FHA into a conventional loan. And then we had to make sure that when he rents out, he when they sell it at first, but then he got to rent it. Because if you go against real estate, hope there’s unless you you’re going to make a ton of money. Right. That’s your strategy. So we did that and we so basically we ran the numbers to make sure you can rent this place, which he can no prop, no issue near the market where he lives is excellent.

So now he’s looking to house and we just found him a duplex. He just closed on it actually closed in a week. That was the California. I couldn’t be there with him, but I wanted to be. But he closed on a duplex, but he’s going to live in one and rent out the other and the rent is enough to cover the mortgage. So now that the great thing about is that since he’s used it as his primary residence, he can get some of FHA loan and with an FHA loan, you could put down as low as three point five percent, you know, so just for even numbers, right?

If you find a property for one hundred thousand dollars, you know, you could just come out of your pocket. Thirty five hundred bucks. And also there’s programs and stuff that you can take that can help out with closing. You can also ask for some Sellers’s. So the truth be told is you can really get into the game, you know, looking for a property.

Four hundred thousand dollars with thirty five hundred bucks. Nice, nice.

Again this guy is dropping Nugget’s people, is rating meteoroids of road burning to the atmosphere right now. So I mean, I love that man. I definitely love your insight. And the fact is, like. So you’re saying student, right? So that leads me to believe that potentially you have online courses.

I mean, I’ve seen recently, I think you had to write a lot to talk about the write it down a little bit. OK, so the ride along, right.

Ride along, especially because you know what it is, is is one I got a sprinter van. Right. You know, and people come during a certain time, you know, getting to sprint event and we just start off. That’s when the network start because you got multiple times. We’ve got people who want to be straight investors. You’ve got electricians, you’ve got contractors, you got Vasey individuals. So you. I’ve got people that everybody want to get into real estate, and you need to network right there, right then and there, because you can have your core of individuals ready before you even actually find your first deal with property owners or where to go with no problems, no issues.

And everybody always want to work together. So people give people good numbers, better numbers of people to see succeed, also be making something off of it to education as well as financial. But yet so the right along man, you know, people come in and what we do is we go on site to some properties. Right. And what I like to do is I get my realtor and I take a look. I don’t I don’t want to pre prep anything.

So find some properties that is going to be fresh. So I must show them exactly how I get down. How you analyze deals, man. So we was out there just as one property. It was a pretty decent neighborhood that’s really coming up in value. And I teach everything. I teach everything from what to look for. Be a renter. Right. What are renters looking for in how you got there? I do some kind of compare method.

Right. Which you got to be a student to know that. Right. Which which which which was the compare method is basically for individuals that don’t know anything. Right. So you come up and say, you know what a gutter is. I don’t know what, you know, shelters are you don’t know what these are. And I use some called compare method, which allows you to basically do this, comparing where you don’t have to be educated in these things.

But you could do a compare to understand what needs to be repaired and what’s not. And in this case, how we walk these properties that give them the insight of an investor, you know, of things that they just never would pick up and never will see. And where they’re like this is this one was in the many homes. I mean, had holes all in the roof kitchen. And we walking through it and I’m showing them exactly how I would do it.

What I take down the five things you need every time you come up to a property, you know, everything. Like we just walked through the whole thing. We told stories, you know, it just was a beautiful thing. So we do that for the first half the day. And obviously we sit down, we do some fellowshipping with lunch and stuff like that. And then we go into the classroom to I bought them back at this time.

This right along had a duplex that was available that would affect a duplex that ran numbers with them and showed them how you know, why I bought it, how we add value to it and how we increase the rents, where I just basically put extra five hundred dollars in my pocket a month or because of I bought. Right. And also we take those properties that we saw and all we do is just crunch numbers. And then I actually teach obviously real estate.

I teach them, you know, the terminology. We cover about four different strategies for people to get in. So it’s really a fantastic time.

I mean I mean, everything that you just said I want people to to really understand is like not only are you figuring out how to monetize your information, but you’re also pooling a network of individuals that could possibly bring you more properties down the road or work on more property. So to of what you said, I think is an ingenious method. Right. It’s a diversified method that allows you to find contractors, find people to look at homes, educate them.

All of that has monetary gains associated to it. I’m sure you’re right along. Has a price come to your course as a price. And then two years down the road, somebody wants to partner with you to buy a house that also has a price as well, too. So, I mean, that’s a brilliant strategy, honestly, and it’s awesome.

I like I say, I just like to educate, man. And, you know, and once you leave me, you should leave. Educated.

Yes. Motivated and inspired to go out and make it happen. And and we have students that’s doing that.

And I have another student did the department they don’t own any property properties. And, you know, I’m not sure we got time to talk about that. But they were in there probably for about twenty three k it appraised for sixty five, if I remember correctly. And plus the fact that they was able to pull out forty thousand, they turned their twenty three thousand dollars into. Having an asset, collecting four hundred fifty dollars in cash flow and a cheque for forty thousand dollars would be nice, nice, nice.

I mean, if it works, it works, man. So do you point I mean, you just have to have the information and the knowledge behind you to be able to make the achievements. So definitely.

So what’s the biggest thing that you would have to do all over again if you could do it again? The biggest thing is I would have spent every last dime of my money just buying every piece of real estate that I could, you know, once again, you know, I came in thinking, buy one, fix it up, buy another, fix it up when I should have just bought them all and just my way. And eventually, obviously, they get fixed up.

You know, that was that’s the biggest thing that I would do that was different is that I just would have purchased purchase, purchase, purchase, purchase, purchase, purchase, purchase, purchase.

So, you know, and because what happens here is that, you know, the real estate market, you know, fluctuates, right. It goes up and down at times. You obviously want it to go up and that’s the property value. So if you buy properties where the price of the homes are incredible and you can afford them, then you need to buy them. All right. Now, because two years down the line, they might not be that price.

I mean, you’re definitely right. I mean, I think you brought up another solid point about if you have equity in a home, I mean, that’s probably more valuable than going to the bank. I mean, you essentially have access to this money that you’re sitting on. And if, you know, you can kind of turn that money into an asset that is going to pay for itself. So it only makes sense.

I think people got to understand it. You know, you and the money is great. Don’t get me wrong, me. But, you know, having money working for you is the best. You know, like I listen to Warren Buffett, he said, you know, they asked him a question, something like, you know, would you rather have more cash or or more businesses? He said, I’d rather have more revenue generating businesses than cash.

And when he said that, it makes sense, you know, because that’s what I’m about. Buy hold. Right. Because I buy I think I hold because I want that monthly income coming in. I call it I call it the day. Right. Because I think it’s a special thing. And that’s why I’m so happy all the time. Right. So any time you hear my phone go, dang, that means there is a payment. And just so, so like so in what I like to do, this is another strategy.

Can make you feel good about feeling good. Right. Yeah. The better you feel the Wellford that you are so good people in, in the first I like to put people in the city and people are paying also some people in the first. If you pay on the Thursday. Right. It isn’t your fault. Just dig it all through the first of the month. Then around the city you’re folding it again because you people are paying the 60, 70 people and you know, you’ve got these things.

And every time they go game, you can see this right here, you know, because it’s like, OK, great, more money in the bank.

You know, in one of the more powerful things, really, another thing that failed to mention was the the first property that I purchased on that property.

And I took me about three or three vacations like on weekend vacation and thinking money. And they in. I noticed that. All the money that I was using was basically from the from the rental property and I didn’t touch any of my I actually went on for vacations at the end of the year.

I save more money. That’s crazy. That’s what really like, oh, my God, we got to get him. Yeah, yeah, definitely. And to your point, it becomes an addiction for sure. Sure. So, I mean, going back to your background a little bit, do you come from an entrepreneurial background? I mean, I know you’re talking about Ty. We all know Ty as a hustler. But I mean, anybody else in your family outside of Ty, were they entrepreneurs?

No. So, no, not on his side. You know, we poor. You know what I mean?

I’m from North Philadelphia. You know, we were poor and we were financially poor.

Right. But he was rich in love, you know. And my mother, you know, did a fantastic job that, you know, we were poor, no entrepeneurs. You know, my mother worked the post office for over 30 years. You know, she had an unbelievable work ethic so that we all of us seeing that was what we thought was supposed to happen. But kind of kind of level that up. Right. Like, you know, we got to I mean, people always say, I want to own a store, I want to do this.

But I didn’t personally have any anybody that I knew that was an entrepreneur.

And like it just that environment, the environment was you go to school, you either go to college with a lot of people didn’t there’s a lot of small people.

But you went to work like everybody went out and got a job outside an individual that was selling drugs or doing some negative things. But you got a job. And that was the thing. That was what we saw. That’s what we knew. That guy from Connecticut. I’m from Philadelphia. So but it was something else out of him, right? He was bred to be, you know, and his time was his time to to to to to focus on that and titleholder to me.

So when we got together as a family, he always with my older brothers and sisters, you know, rather than with me. And I was with his younger brother and our cousin, whatever. So because he was like, when you’re younger, it’s a big deal. Like, you can’t you know, a 40 year old can’t be with a 18 year old like that. Don’t work out like that, you know, so so that’s kind of.

So we hooked up kind of later on in life just just basically knowing that we’re family. And and he really started out with just making sure our mother mother’s was getting older. Right. And make sure that our mothers just get the opportunity to see us and we just sit without you know, I think it’s like every quarter we get together. That’s what we’ve been doing. And obviously that became like we actually at those times is how we start to become friends, because you go from family, you know, to being a friend.

He was friends and we start vacations together just personally. I mean, with like his life and my wife and, you know, and then obviously that transpired to he opened my mind up to to some things that I just didn’t know. And and I became a mentor at that time. And then now the mentors. This is the business partner. So nice.

Nice, nice. I mean, it’s full circle, right. So, I mean, that’s a good segue to, like, talk about family. I mean, so I know you’re a big family man. I guess you got you got one son, correct?

One son. I have a stepdad. Yep. Got you.

So, I mean, how do you juggle your work life with your family life? Yeah. All right.

So, you know, you got to be committed, right. You know, in his heart. So I don’t want anybody to think that it’s a it’s a simplistic thing. It’s rough. It’s hard to do.

You know, I wake up early and I go to bed late. Right. There are times when I truly want to spend a whole bunch of time with my son throwing the football, you know? But I do know that there’s priorities and goals that we need to hit, you know?

So but what I do is I basically structure things to do, stuff to make sure that regardless of what goes on, we know that these are the two or three things we’re going to do. And my wife and I, prior to the college, though, we had a date night on the calendar so we can make sure we get babysitters and then we go out for like we we hooked up with our neighbor daughter, you know, down the street.

And we are we preschedule are KAUDER. So for the whole year, we knew what nights we was going on date night.

Right. And then what was cool about it was we said, all right, January, I’ll be picking where we going to do. And in February she said, and when I say I did say anything special, like you can go out to Friday, you can actually cook at the house and just be you to be intimate, you know, and that’s what we do. It’s kind of more practical. What’s cool became the kind of crushed, you know, everything.

But I have structured things. So when you have those structured things, you know those things, you’re going to be doing it. And obviously the things you do just during the week works out.

But I really go to bed pretty early. And I wake up pretty early to D.C. to work on a lot of personal things and stuff like that. Gotcha. So, I mean, you’re already on that topic, right? So, I mean, what’s your morning routine? What’s your morning habits?

So I’m going to have this man is one I fell off of exercise. So I have to get back there. Right. But you should exercise, man. And I’m a big affirmation guy. So, you know, I’m honestly speaking, I’m in the mirror saying my affirmations, you know, in the morning. I’m also an individual that’s grateful and thankful. So, you know, I had to get back to this. But I typically write out a few things why I’m grateful for my wife, why I’m grateful for my son, you know, and those things.

So, you know, and and then I read the Bible. So so I do that. I read the Bible. And then I get into, you know, my goals. I see. So, you know what what what are my goals for for the day. I look them over and I plan accordingly and I jump into.

Gotcha, gotcha. So, I mean, you’re talking about goals. I mean, what do you see yourself in your business? Twenty years.

Wow. So I see myself in 20 years. You know, in 20 years, I’m still going to be helping people. I’m still going to be real estate.

Obviously been around way before us.

Right. You know, and I think real estate is going to be a real boy after. That’s right.

So, you know, and obviously there’s always individuals that want to learn real estate. So this is something that I’m really passionate about. This is something that I really love to teach because I’m a I love to see people hit. And so with that being said, I 100 percent see myself educating, educating, educating and set up some type of I don’t know how I’m going to do it, but I’m a set of some type of way.

Where is the whole model where you kind of come in, you graduate, right? When you graduate, you get access to funding, you know, you get access to deal flow. Right. And we all work together to actually set you up the way that you need to be. So I want a one stop shop. You know, I want to I want you to come through my door and I want you to go through the bootcamp. Right.

You know, once you get through the boot camp, you get, you know, basically like the golden ticket where you are got you accessible now to all these things. Right. And then, you know, it just makes the process that much easier and make you get and hopefully it will discourage a whole bunch of folks that people get discouraged, that they credit people get discouraged, not having enough money or thinking they don’t have enough money, you know, because some people don’t got the personality to go out and find other ways to get money and stuff like that.

So so that’s that’s that’s where I see myself. It’s one years and and also just one of the on the stuff. That’s where I see myself.

So I mean, what tool do you use your business that you would not be able to run your business without?

So one of the biggest things is I use a landlord studio which, you know, allow me to track my income and allow me to track my expenses. One of the biggest things I do is look over my PNL, you know, once a week. Right. At minimum, you know, to ensure that the money that’s coming in is accurate and the money that’s gone out is accurate, you know, because everything is about, you know, your margin.

And then so that’s that’s one of the the biggest tools that I use. I mean, outside of using, like, any time we get a tenant, right. Or tenant candidate, we do a background check, credit check and check. So I use something called my smart move. You know, for that, I think that’s beneficial in a couple other tools. It’s not it’s not going to be. But yeah, I mean, those are two.

Just two by themselves. Right. Also by themselves or major ones that somebody’s probably never even heard of. And to your point. Right, some people trying to get into real estate, they’re looking for answers like that. And I think, you know, obviously you’re willing to take this out. So so I’m up and coming. Real estate guy, right? I’m maybe I’m. Twenty seven years old. Thirty years old. I’m trying to figure out my next move.

What words of wisdom would you give to me to influence me, to get me into the real estate problem?

And the first thing I always like to say, what are your goals? Because, you know, I want to ensure that one out. I’m a I’m a good match for you. If you work with me, then the second thing, too, is if you not, I just want you to have a vision of what you want your life to look like. And then so that the best thing that I can do is tell a person to say, hey, you know, I want to get in is man pick up.

They got to do it. Real estate. I don’t give a crap what it is. It could be rich. That poor dad. It could be first time. Landlord, whatever it is, you get into it, because you need to start to learn the terminology and you also need to learn how to analyze deals. All right. The biggest thing that you can learn is not what the property looked like because you could see a property. It looks gorgeous.

You can see a property, but the one that’s ugly is the one you should purchase because of the numbers. So it’s a big time numbers game. And, you know, and obviously they just they just pick up a book and start to get active. That’s the first thing that I didn’t tell anybody. OK, what the book is like, you know, is a thousand of them, something out of every book you want to learn something about.

Nice, nice, nice.

So, I mean, how could people I mean, obviously, you’ve got horses. You got to ride along like I mean, like, what’s your online government? I mean, what’s your Facebook Instagram website address.

Yeah, not a problem man. You know, I’m growing on Instagram so I’m Leny this for the on the scoreboard seven twenty three. So hit me up the ima follow me. We got some cool things there. Heavy on Facebook. Right. Know you can look me up. Lenny the boss or Facebook. Leonard Nesmith on Facebook. We have a YouTube channel. Same thing. Lenny the boss there. We re actually starting it but we about to drop a whole bunch of value on our YouTube channel.

We have probably have about 30 videos. Just wait to be dropped. So we are about to drop those and we will be dropping them on Instagram as well. And also, man, anyone who, who, who, who does me or probably messaged me and let me know that the rock with you, the I let them into the private Facebook group, you know, where we drop off some jewels there as well. And also you get some networking opportunities out of that as well.

Just DME let me know that you dealt with the boss and you automatically in with no problems, no issue. But yeah, if you want to hear more just about the next ride along, just me. I’m actually putting together the calendar now and I can get more insight. You link it coming over me. Yeah, definitely.

Definitely. So just go going with some bonus questions, right. Yeah. This is like my signature bonus question. I love accent because no matter who asks this question to, the answer is always no uniquely different. And the reason behind it’s going to be like different as well. So if you could spend twenty four hours in one day with anybody dead or alive, who would it be and why? Oh, wow. Oh, man, there’s so many who would it be and why I normally get this one hundred percent wrong when I get off this pack.

As I say, I should have said X man, you know, a person.

I’ve got to get you a person, man who will be with you.

I don’t know why his name come into my head, but I’m probably going to be with P. Diddy, man. And I’ma tell you why real quick is because that dude, you know, I was a heavy hip hop, you know, as a youngster. And I just see how he continuously reinvent himself and continuously go after goals and be a savage bad, you know, and I don’t know him personally, but I admire that, you know, about the man where he really had no talent.

He wasn’t an artist, you know what I mean? He didn’t have he did not make beats. You know, his talent was to be a businessman. And and and I admire that a lot. And I think that in twenty four hours, you know, I will learn.

Something I mean, so much that’s off the top of the head. I would go with. I mean, it’s I mean, when you talk about the hip hop game, I mean, there’s only like maybe four guys you can really look at. Right. Is definitely one of them. Dre is another one. Jay-Z is another one. And in case number four, I could all of them are like close to that billion year mark to have crossed over to a really close.

Yes. So I’m looking at like, you know, obviously you’re a family man, but you’re a businessman as well. Right. So if money wasn’t a factor, would you still be doing what you’re doing right now? Absolutely.

But once again, it comes from education, right? Like, you know, that’s probably why I’m in management, too, because, you know, I like to sit here and see people drive the depinto. Right.

To work in India, barely works and then obviously help them, you know, strategize and get to a place where they are able to buy a car where now rapacity beating on you to say hi, you know, getting into the first apartment, you know, getting the first house, sending the kids through school, like these are the things that I enjoy. These are the things that I personally benefit off of. And I just like to see people when, you know, one of the things that my wife says, you know, God bless her soul, man, because I’m rough, right.

You know, full of energies. I’m like this waking up. She’s totally out of Mynabirds. And so any time she knows if someone asks me a real estate question, she just goes back and sit down because she knows the other forty five minutes. And that’s why I said, God bless us. So I can’t I have to thank God for that because she allows me to be me.

And you know, when like it’s late at night she’s like, all right, it’s time to go. So I said, hey, you know, what about if you pour me another drink or so? You know, I appreciate her for that. But yes, and I will be doing this without a doubt.

You know, I just love that I got you. Got you. I mean, I think you brought up a hell of a point man. Anybody that’s in business that’s married to a significant other, whether it’s male or female, that other counterpart that may not be in the limelight, that may not be on the microphone, you better trust and believe that if they are together that a support team is real and that person wouldn’t be where they are without that other person.

Absolutely.

After I give so much. He deals a lot, a lot, and that’s the reason I get back, like, you know, we go on vacations and, you know, I hold no expense, you know, and and we do other things. And it’s just a wonderful thing. Great, great, great.

So, I mean, this is a time where, you know, the mic is yours.

The only question for me, no matter you know, I think you’re super cool guy, man.

I appreciate you having me even invite me on to this podcast.

And I don’t take that lightly. And I just want to express a thousand one hundred thousand. Thanks for that. But there’s one thing I can mention, if you don’t mind.

Do go for one of the two reasons that, you know, my wife’s right is, one, the real estate allows me to understand business, allows me to speak to attorneys. It allows me to understand how to work with accountants, how to read it and how, you know, how to actually run a business. And also teaches me a skill on how to acquire a real estate to build generational wealth. And having that is allow me to be able to teach my son something when he gets ready.

That school, you know, will not allow him to teach. And it also is going to put him in the state where he’s going to be ahead of the game. So depending on what you want to do in life, you know, he’s going to have this real estate empire behind him. The second thing is that my wife, she was having a challenging time at her employment and my wife is making pretty good money where she was working. And, you know, we making really good money in real estate.

And how God works is, you know, you don’t know what’s going to come down in the future. But my wife just was coming home super miserable. And it was it was really impacting the household. And she just wanted to stop the work. And honestly, I look at the finances.

I said, Dad, you know, and God put us in position to have enough real estate income where is supplemented what she was making and more so it was a no brainer. And she opened up her own business. Now that she’s a business owner, she’s getting that off the ground and I’m thankful for her. So, you know, profits over wages any day of the week, you know. And so those are the two major things that real estate is allowing for me.

And with those two things like I can’t be I don’t take it lightly, you know, and I’m out here, you know, I was in California looking at of these, you know, and also that’s a write off because it’s all real estate related. So so that’s another thing.

Maybe another conversation to have you back on. But that’s that’s the two major things I’d like to drop my great, great, great.

Well, as always, I definitely appreciate you keep doing what you’re doing on Facebook. Like I said, it’s great when I wake up in the morning and I’m just through to do my stuff on Facebook, checking my pulse. And then I see Lenny pop up with the like the animation. It’s crazy every single time, guaranteed to kind of put a smile on your face. And I definitely appreciate you, appreciate you and your family, appreciate what you guys are doing.

And I look forward to continuing to follow you and see what else you got coming up your sleeves in the near future.

Absolutely. Man. Thank you again. I really appreciate it. Great. Great.

Leave A Comment