Boss Uncaged Podcast Overview

- How Rodell became successful as a venture capitalist with no experience

- What would Rodell change if he could go back in time

- Rodell’s morning routine

- And So Much More!!!

Boss Uncaged Podcast Transcript

S3E2 – powered by Happy Scribe

Boss Uncaged is a weekly podcast that releases the origin stories of business owners and entrepreneurs as they become uncaged trailblazers. In each episode, our host, S.A Grant and guests construct narrative accounts of their collective business journeys and growth strategies, learn key success habits and how to stay motivated through failure, all while developing a Boss Uncaged mindset. Break out of your cage and welcome our host, S.A Grant.

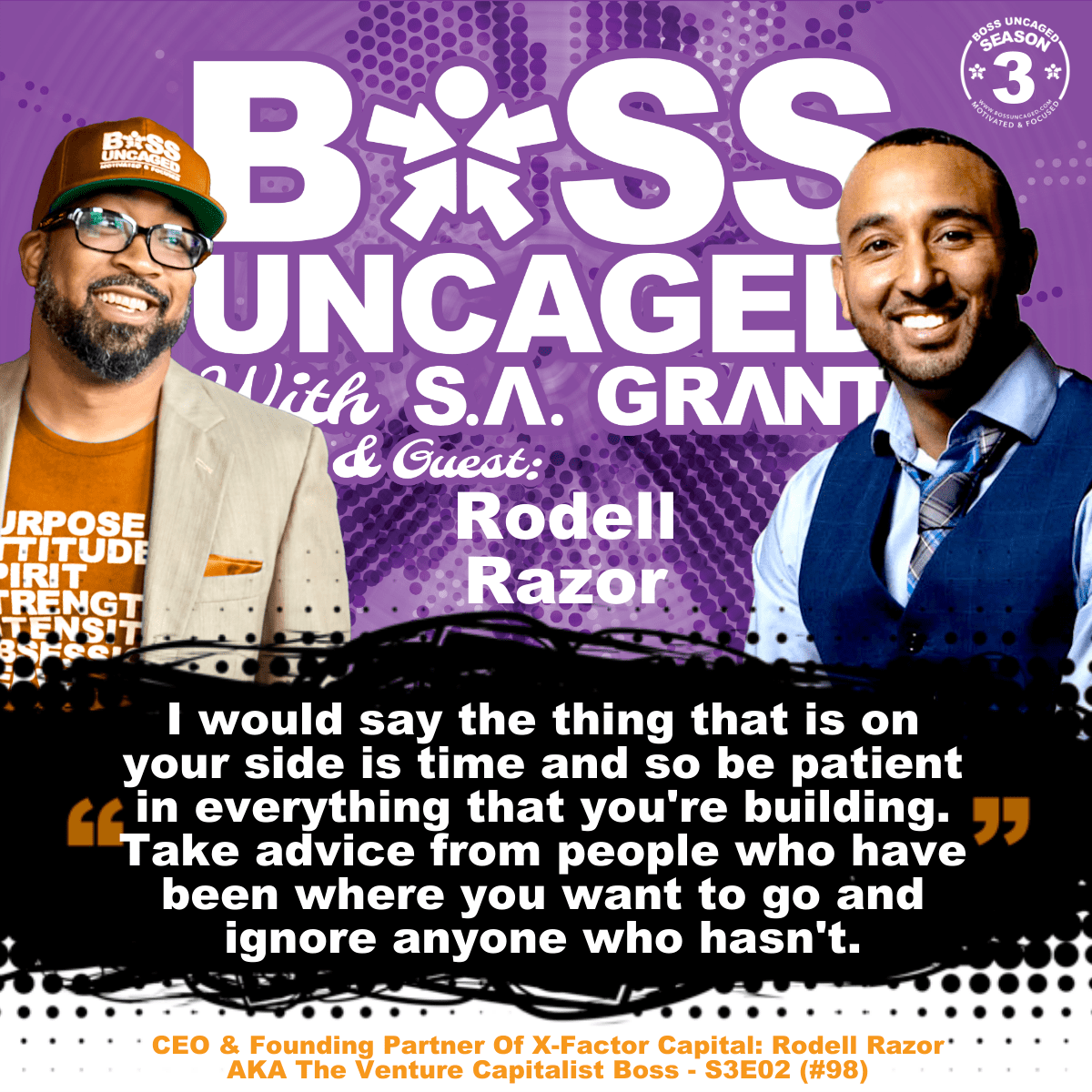

Welcome back to boss Uncaged Podcast. Today’s show. I like to call this guy. He’s definitely a self motivator, a self starter, and to give you a prime example, he literally just reached out to me within 24 hours and he’s on the show the next day. Like most people, they will maybe next week, but I can tell you that just by meeting him in the last few minutes that he’s an action taker. So I always give whoever I’m interviewing a nickname. So in this case, I’m going to name him the Venture Capital Boss, for obvious reason. Rudel. The floor is yours. And give our people a little bit of who you are.

Oh, man, I appreciate it. Thanks for the warm welcome. Definitely excited to chat with you. And yeah, I am a venture capitalist, new venture capitalist. My name is Rodell Razor. I just go by Razor by a nickname since I was a kid, and it’s my last name, so it’s a built in nickname. I live in the Phoenix area. I’m a husband to one, a father to three boys. And yeah, I’m excited to share a little bit about what we do from a business and life standpoint. Decided to chat a little bit more about entrepreneurship and life motivation, self determination and things of that nature.

Nice. I was looking up, like, just doing my due diligence before you got on the show, and I’m looking at your last name and I’m looking at your business partner’s last name, and I’m like the combination between both of these guys.

Right.

You have razor, captain. Like, if you combine them together, that’s like a superhero tag team name if I ever heard one. Right.

I know. It’s definitely divine. We thought about taking that on tour for a while, and we were keynote speakers for a little bit, and we’re both former ball players, so we have fun with it. But it’s definitely unique. Can’t draw it any better. I guess in the Lifetime movie of us, it’ll be fun.

Going to that. Obviously you play football in the earlier days. You’re into a venture, you’re into building, you’re into growing capital and into small businesses and all these different things. Right. But if you had to define yourself in three to five words, what three to five words? Would you choose to define you.

As a phrase or three to five words.

Independently, however you deem it, what if it works for you?

Yeah, I guess as a phrase. I will not quit. I think that really describes just been my journey from the time I was ten years old and became the man of the house. Been working since I was eleven, been running a business and entrepreneurial. I got my first paper route when I was twelve. So yeah, I’ve been grinding and working jungle jobs and played college football, played professional football. And I do love to work. I love my leisure time as well, but I really love to work. I love to see the results of labor. That’s one of my favorite things. And I see I’ve compartmentalize my life that way, whether it’s building my family, building on my children, my marriage, even my recreational life, whatever it may be, I see it as something that I’m building and I get to put blocks on every single day. And so I will not quit. I’ve had plenty of opportunities at the age of 18, I was a convicted felon, lost off the scholarships. And so to get where I am with a master’s degree, running a venture capital fund, playing professional sports, a lot of those things I could have easily been written off and a lot of stats were stacked against me. And ironically, I work in the statistical analysis world, so I know how hard it is to get stats to bend. And so I think that that’s something that God bless me with the ability to just not quit. I think that’s my favorite quality about myself. Nice. I think God puts that in a little bit of everyone in life kind of tries to take that out and I’ve been fortunate to hold on to mine.

Well, just go into this journey, right? So football, you’re talking about being convicted of something and now you’re talking about raising equity raises and selling corporations. That’s a hell of a journey, right? So let’s just kind of like segment this like football. We kind of get this. Let’s start from the football. How does a football player professionally looking to get into an NFL turn into equity, raising capital, funding individual?

So when I was in college, I’m not the biggest guy, so my five 7160. So you would have thought that I would have had more of a backup plan, but I didn’t. I really thought I was going to go to the league and that was my dream and had a couple of try outs and those didn’t pan out. So I played some arena and then I went back and was like, all right, after four years of study in a lifetime of football in sports, what now? And so I went and got back and got my Masters degree. I went and got my MBA for a number of reasons, but the number one reason I went back and got my MBA because I wanted a little bit more of a tangible skill. I wanted something heavier than just football on my resume. And at the time I’m part of the generation where the bachelor’s degree has been getting more and more water down and so I needed something to separate myself. And so that was the motivation behind my master’s degree. Got into sales really early on, but I fell in love with a TV show about 1012 years, probably twelve years ago now called Shark Tank. Most people are familiar with it. I had no idea what those guys actually did. I just knew that I loved watching entrepreneurs dreams come true. I thought that was the coolest thing in the world. And so I saw entrepreneur when they got a deal on Shark Tank, it felt like drafting the draft was this week and that was a dream I always had as a kid. My name called In Draft and so I kind of saw that correlation. I was able to draw that and I was like, man, I don’t really have the aspiration to be one of those entrepreneurs like pitching. I would love to be the person sitting in the chair for whatever reason. I just wanted that was something I thought was really cool. And I had an opportunity to be a part of a startup. I was a co founder of a sports performance facility, the Mouthful, and that became very successful. And the guy who we partnered with in that was venture capitalist. And so I was like, okay, so I got a little bit of more exposure to that. But where I grew up, venture capital is just not a conversation we have normally in a lot of circles. It’s like that. It’s a very esoteric industry by nature and by design. And so that was when I first got the exposure to it, to answer your question directly. But I kind of saw myself as I’m going to climb this ladder of success in life because that’s what I saw. Damon Mark Humid so I was kind of watching them from afar and was like, oh, they’re super successful. And then they turned around and became investors. And so I went after entrepreneurship. High level sales jobs to where I could go climb a ladder of success and then be a contributor back to my community and the things that matter to me. Whether it was nonprofit investing. Community building. And then at the height of the social unrest last year. I was building a consulting company. Me and my business partner. And I just decided I wanted to do something else. So I got about halfway up that ladder of success and I was like, yeah, I’m not going to wait until I get all this on top of things to be a better contributor. That’s when I decided that I was going to venture into venture capitalist. I’m not a venture capitalist by trade. I don’t understand that. I didn’t understand the industry. So I’ve been learning over the last 1112 months, aligned myself with some mentors that can teach me the game and they’ve been kind enough to do that and sit on our board and advise me as I go into this industry that is, again, very esoteric, but also very hard to learn from the outside. I can learn real estate. I can learn how to go start a gym or a restaurant. I can Google those things. I can’t really Google this space. So I’ve had to take multiple courses and put my savings and my life into this thing. But I really wanted to be able to facilitate funding to the underrepresented founders, who I felt had a lot of talent because I’ve been there and I’ve been a part of some pretty special businesses and I’ve seen what people can do when they’re properly funded. And less than 1% of venture and private equity money go to people of color and women. So it’s something that I was incredibly passionate about and knew I was going to pursue at one time. And for lack of a better term, the unrest last year just pushed me into action, maybe before I was fully ready.

That definitely answered the question completely. So let’s talk about your business for a minute. Right? So the name of your company is X Factor. What is that company going to be utilized from a standpoint of, like, a business owner? If I came to you and say, hey, I want to start up whether it’s brick and mortar or I have a concept for an application, or whether I have some kind of new service and I walk into your doors or I come online, like, what’s the next step? What’s your procedures to help me?

Oh, man. The most annoying answer to a question is, it depends, but it definitely does. But I’ll give you some examples. In the space of let’s say it was a brick and mortar, let’s just say you’re going to open a restaurant and you want to open that restaurant and you want to get to three to five locations. You see a big vision for being a local restaurant, maybe being a national or regional restaurant. You have some big plans for what you want to do, but you know that restaurant margins are pretty low. So for you to do that on your own by just profit, it might be a bit tough or you don’t know where to go to start this process or whatever the challenges may be. I partnered X Factor Consulting, which is what we’re doing before, and transform that into X Factor Capital. So we were consultants before, so we bring that advisory role to where it’s like, okay, let’s put together the plan to grow, scale, expand, whatever those plans are, and then let’s make sure that it’s properly capitalized. We right now look for companies that are already existing because startups, there’s so many hurdles to jump just to get those first customers. Right now, we’re not particularly looking for a true start up in the sense of, like, an idea. Right. It’s got to be past idea phase, but let’s just say you have something, you got a food truck or you’re selling meals from your home or something like that, we go, okay, well, you need a building, you need some marketing, you need a team that’s going to cost you $150,000. We can provide that through our fund, which is a group of people who have decided that they want to invest into the things that we’ve committed to. And so we take those funds, we deploy them to you. We support you in the growth and scale your company. And whether we take a level of equity in that restaurant or we have what’s called like a revenue share, a revenue share agreement, it’s kind of like what they talk about on Shark Tank, where it’s kind of like a royalty, where it’s like a percentage of the profit that you generate in that restaurant you pay back as a loan, as opposed to like a bank loan. A bank loan is what they’re going to do is they’re going to want you to put up your house, they’re going to run our credit check. They’re not going to help you build your company. Banks don’t necessarily they’re not going to come alongside you. They’re not going to try to bring your customers or connections or help you with your margins or marketing. A bank is just a financial source. So we try to bring capital and connections in that role. And so those are the practical things that we do for a business.

So, I mean, just hearing, hearing you explain the differences between a bank and what you guys do and to your point, aligning yourself more. So on the Shark Tank side of things, right? So going into like the pros and cons, obviously someone could just get angel investments. They could reach out to the community. They can go online and do like the online investment routes to where, hey, I have a product, you buy into it, I’ll give you the first product off the assembly line. There’s many different options to raise capital in unique ways. So what are the pros and cons of using your service?

So I would say the pros and cons of raising any outside money. The pro is the relationship aspect. You bring in experts, you bring in a lot of founders. Like if you own that restaurant, it’s you by yourself. You don’t have a co founder. You can’t afford the entire team. So it’s really having that like someone you can call really be able to walk through the business planning with because there’s so many nuances and things that you’re going to run into as you’re building a business. You need someone who’s been there before and has experience building a company. So I think that’s the first pro and then obviously the unsecured money. You can give up equity, which doesn’t technically cost you anything upfront. You can pay back a percentage of your revenue. We don’t have to take equity because equity can be very expensive if you turn into the next chickfila, right? So you give us 30% of your company. So there’s some pros there as well. And then some of the cons is, as a founder, you may not need money. You may need a better, more crisp plan or more connections or better distribution. You may not necessarily need money right away. And so some people, they seek money because they want to either quit their job and make sure that they’re funded. And there’s a lot of different reasons why people are seeking funding. But the number one reason I tell people, hey, you just don’t need money. You need more customers. Right now, you go get more customers. You can self fund this thing. You don’t have to give up equity or percentage of your revenue. You can self capitalize. And some businesses are not built. Some businesses are more lifestyle businesses. They’re not built for venture scale. They’re not built to have other hands in the pot because there’s just not enough margins or there’s not enough ambition to really grow it into something big. The reason why when we talk to someone, if they don’t have a vision for something bigger than maybe their neighborhood or their small digital store, then we know that we probably can’t participate in a meaningful way in the value that we could potentially add, or financially, there’s not enough meat on the bone. We would strap the company of resources so that us and our investors can also get paid. So there’s definitely some pros and then there’s some cons. And having people in your business just being straight up, yeah, now we have a board seat, and that can be valuable. And sometimes there’s investors out there that don’t add value. They extract, and they’re looking to take advantage of founders. So you definitely want to be safe when you’re navigating the venture and investing ecosystem. And then as to the crowdfunding, those are some great tools, especially if you’re a good marketer. If you can get people behind you, if you can get people to move, if you can emotionally move people towards your product or service, crossfunding is a great source because it’s easier money and it’s non accredited investors, less red tape around, it, less legal fees and things like that. It’s money that’s easily accessed. But again, it doesn’t come with any connection support advisory in the long run. So if I make an investment today, my goal isn’t to just make a $50,000 investment. If I really believe in the investment, the 50 is not what I’m most concerned about. It’s the 250. After that. It’s the 500 after that. It’s the million that we have a relationship to continue to grow and scale your company. Crowdfunding can’t do that. Banks won’t do that. Only venture or private equity money will participate in that kind of evolutionary growth.

So, I mean, based upon what you said, just do like a small segment and recap part of that, right? So in the way your business is structured, you’re going to scale, right? You’re not just going to be lending money to kind of have a mom and pop stay a mom and pop. You’re trying to scale it and grow it. And part of that scaling and growth, if you’re asking for equity raise, then you’re looking for the opportunity down the road possibly to either franchise or sell that business. So my next question is, when you come in, is your original intent to help someone stage your business more in the selling platform versus as a mom and pop situation to kind of pass down from generation to generation?

So there’s legacy businesses, there’s lifestyle businesses, and then there’s scale and exit style businesses. I think all three should be built as it’s going to sell.

Okay.

I think all three because you just never know, right? If I come to you and you’ve been building this restaurant for ten years and I offer $5 million, you do the math. We’re like, all right, well, I’m netting at the end of the year $200,000. That basically gives me ten years, 15 years of no work, and I get to walk away with the $5 million, whatever. That’s the foundation. Everything should be built as if you’re going to sell. But I also know, especially in the black and brown community, we want to build legacy style businesses, right? We want to either build businesses to get out of jobs that we’re not happy with and go do something for ourselves and or we want to build something that we can pass on to our children. We’re not building something so that there’s a lot of investors for massive scale to go multinational, right? And so even if you’re building a lifestyle business to get out of a job and do for yourself, or you want to build a legacy business, they still be structured legally so that they’re ready for sale at any time. Because you have an asset, just like my home. You don’t want to treat your home terribly because you never know what may happen. You may need to put it on the market. And if you got busted windows and landscape taken care of, there’s a lot of work you’re going to have to do. If you don’t do regular maintenance, upkeep it, the business is the same. There’s no different in that. You want to build it as if you’re going to potentially sell it, even if you have no plans. And then if you take private money, let’s say an X factor comes in and we take a piece of equity, we can sell back our portion because we helped you grow and sell it back to you. And it can still be a lifestyle business or a legacy business that can pass on to your children. You don’t have to have any other people involved in the equation, but outside money allows you to grow faster with more support and mitigate some of your risk. When you’re building by yourself, you’re taking on all the risk. And I think the misconception sometimes that I’m finding just being in this space and just being a founder myself, especially in minority communities, is giving up equity feels like a sellout rather than leveraging and partnering. So you’re mitigating your risk and you’re creating more upside. And so we end up sometimes limiting the lid and we bring it down because we don’t want to take that outside money, which I understand the concept of that. And that’s why you want to find the right partner. Because outside money or venture money, private equity money, it should be a partnership. You want to decide that you want to be in business with that person.

So, I mean, I think what you’re saying is definitely insightful, definitely powerful information. And it goes back to educating, being educated in this particular space. So for our listings, right, I want people to really understand what you’re saying. Let’s say there’s an opportunity, right, for me to sell my brand, my boss brand. And obviously that’s part of branding and getting it to the stage, to where it’s a self sustained business and someone comes knocks on my door and they want to offer me something, right? For me, I’m going to look at it as an opportunity. Not necessarily, no. This is my baby. And I think that is something that people have to separate the emotional side from creating their business. Yes, it’s my brand. Yes, I’m rocking the logo, but I can sell it for a particular price any day, all day, because I know what I built, I could recreate absolutely 100%.

I think there’s a lot of emotion in building a business, and I don’t want to discount that. That emotion is valuable because it helps you wake up every single day and do the hard things. But there is a time and a place for that emotion. And we shouldn’t be as entrepreneurs, we shouldn’t be so emotionally attached to our business because it’s an asset, it’s a stock, it’s a piece of real estate. It’s an asset that you’re building. And you can have that emotional attachment. But if your opportunities for yourself are going to open up a lot more, when you look at it as an asset, you can be emotionally tied to it, but also be able to emotionally separate yourself from it. That it’s not you. Boston cage is not you. At Tractor is not me, right? And I hear a lot of like, hey, this is me, this is my brand, is my everything. And I was like, that’s fine. But if your identity one, there’s a lot of danger. They’re wrapping your identity in an outside entity. That’s a whole other conversation. But your identity isn’t wrapped up in that. And you built it once and you could build it again. And you can leverage time, you can leverage the skills of other people, the networks of other people in the capital of other people. If someone wants to come in and buy a Boston cage, you should take it as a great compliment, not as an insult. You should be like, Man, I’ve already done this. I built this. I kind of want to go pursue something else. I want to go into real estate investing, and I want to go pursue that and go build real estate empire, and I can go sell this and use that capital to leverage that, right. Or stay a part of it and be an active member and still be a part of the brand. There’s so many creative financing ways. When you’re not emotional, that open up. And when you’re emotional, it makes it hard for anyone to work with you, and you end up usually having some type of lid. So if you want to lift the lid, removing some of that emotion will be helpful.

Nice. I think you alluded to something else. I mean, just like business structuring, right? So everyone, whether it’s international or local, there should be at least an LLC, Scorp, or C Corp. And the reality is, if you have multiple businesses, you should have all three and structure them in a particular fashion so you can get the best tax benefits. So with the business that you’re dealing with, just kind of like, I know you’re not an attorney, I know that you’re not a CPA, but if you’re coming into a business, what structures are you looking for? When you’re looking at the back office?

Yes, when I look at the back office, I think the thing that a lot of VCs will say is like, hey, I only want to invest in C or S Corp or whatever. Right. And I don’t want to touch LCS. And really, the LLC is a leverage component that the entrepreneur can use to basically write off a lot of the expenses. But I have no problem with it. I think it makes sense. My family is an LLC. I think that makes sense. So I don’t have a lot of attachment to the type of structure. Personally, I want to make sure that it is structured right. I want to make sure, like, having basic accounting things in place, it makes it easier. But all of those things, if there’s a capable operator and a great idea, like, all of those things can be handled. And even if there’s legal issues or accounting issues or tax issues, the thing about a good enough idea is it can overcome some of that through paying the right lawyer, having them clean up some of the mess, and get back to business. And so my personal experience as an entrepreneur is like, things are not clean, especially when you come from different backgrounds or nontraditional backgrounds, not Stanford or Harvard or something like that. It’s hard to get out of certain places without a few scratches. And I just think that those structures that can sometimes be hold ups if you’re looking to buy yourself or the buyer. For me personally, though, it’s not a hold up in any way, but you want to be structured in some capacity, a minimum LLC. But talk to an accountant or CPA tax specialist to really figure out what makes most sense for you, and then try to spend the money for the entity that makes the most sense. Don’t try to be cheap in those things. Do not be cheap in materials, and do not be cheap in legal and tax. Just don’t be cheap. And if you set it up the right way based on what your financial financial people in your life or whatever they suggest, you set it up the right way, you’ll be set up good.

Okay, so let’s dive back into more like on the personal side. You have a business partnership, right? So you guys the Razor captains, right? In that space, every time I get partnerships, I like to ask this question because it kind of like, obviously one person could be left brain, the other person could be right brain. One person can be A type, the other person could be B type, completely polar opposites or exactly the same in bumping heads. How does that work in your business, being that you guys are co founders?

Man, that’s a great question. Jeremy and I have been in business together off and on for about ten years, and we’ve had some businesses go up, we’ve had some businesses come down. And I think the one thing that is consistent I could tell so many stories about me and Jeremiah, but the one thing that is consistent about what I’ve learned in life is that when bullets start flying, it starts to reveal who people are. And me and Jimmy have been through some fires together, and I know that he would never leave my side. I know that he’s in the box hole. And if I look over at him, there’s a term in the streets. If I look over and your clip is full, like, I know you didn’t care, right? I want you to empty the clip. I want you to really stand for me. Jeremiah, over time and time again, has proven itself to be a great friend. So I think that’s the foundation of our business relationship. I know that’s not everybody’s co founder of Relationship, but our co founder relationship is we are very good friends. He’s actually the godfather to my youngest son. To give you context for how close our relationship has gotten, but it started through business. Our friendship did start through business. I have other friends that I started businesses with that I was friends with for 20 years, and so I’ve done both. But as far as personality, Jeremiah is incredibly creative. He’s a great marketer. He’s great with branding and identity and style, and those are things that. I’m okay. At I’m great with strategy, and we both like to grab on to big visions. Like, if there’s a lid on something that we’re working on, both of us will get uncomfortable. And so I think that’s something that we align in core values personally. Yeah, we align in core values personally. Who we are as family men, who we are in our community, the differences we want to make in the world, we have our different ambitions, but in our business, we use our businesses and always have as a vehicle to express the things that we want to create in the world. We’re both type A, we’re both alphas. And so that’s why we’re co founders. That’s why we’re 50 50, because we don’t want to override one another, and we want to make sure that everything that we do is for the greater good of the company. And if one day anything ever happened to our business or whatever, we would end it in a respectful way to our friendship would even be stronger. Right. We would make sure that the friendship is core. Now, on the other side of it, we are very different, right, where I’m very strategic and I want to, like, hey, I want to look at deadlines. I want to put things in Jeremiah more on the creative side, right. So he can meet and knows everyone that he’s supposed to know. And I’m thinking in my head, like, how do we use this relationship to be functional for us? Right? But if I was thinking that way all the time and he wasn’t out making those connections, our business would have a lid on it and vice versa. So we complement each other’s skills. We share a lot of the same skills. And I think that you want to find people that I don’t think finding your complete opposite is going to be functional in your friendship. Like something that’s so opposite from you. You got to have some aligning values and skill sets so you understand the person. I have a different level of compassion for jarmy’s creativity and understanding and empathy, just like he does for me, because he can be strategic when he needs to, and I can be creative in marketing and branding when I need to. So we understand each other’s value so we don’t step on each other’s toes. Acting like one job is more important than the other.

So basically it seems like both of you kind of have equilibrium, right? There’s balance within it. With some business structures, there’s not that right. They may kind of be a solopreneur that’s looking for partnerships, and it kind of just give me dive into the next question. Like, how would you define an UN estimated founder? What does that mean to you?

Underestimated founder. An underestimated founder. It’s the underdog. It’s the Vincent polys, right? It’s the guy or girl that didn’t have all the right lily pads to jump in. And sometimes they fell in the water, but they found a way to get back up. And so that’s what we define as an underestimated founder. Our company is called X Factor Capital and the X represents a couple of things. The first thing is the X factor in the game is a game changer. Someone who came in and if you think about like Dante Hall back in the day, came in, kicked in, the ball, was going to the house, he just totally changed the game. And so those game changes in their businesses, game changes in their community. And then the X also stands for multiplier. So the X is the multiplier, right? It’s a multiplication sign. And so an underestimated founder is someone that is not only looking for proving that they’re worthy or proving others wrong, that’s a small component of it being an underdog, but also someone that wants to contribute to others. And a lot of the reason is because of what they’ve gone through, they see more opportunity in people where some people aren’t looking underestimated or underrepresented, whatever the category is. It happens to be in America, usually people of color, women and from nontraditional backgrounds, whatever that even means. That’s how maybe the Google would give you that terminology, but really that’s what we look for in an underestimated founder is someone who been through the school of hard knocks and is still finding ways to strive and succeed with that, right?

So we’re going to game time technology, right? So we have a play, right? And we have this underestimated founder. They’ve been running plays, they’ve been getting close within the five yards right from the touchdown on a regular basis, but they never could convert. They always get fourth and short every single time. So what systems do you guys have in place when someone has been running these plays over and over again? How do you guys help them cross over that fourth in inches?

Man, that’s great analogy and great question. And I’ve always thought of myself more as a Phil Jackson than Michael Jordan. And I think that’s been my gifting to the world. I loved coaching and Jeremiah and I both come back from sports backgrounds and I think some of the practical things often are strategic. It can be definitely strategic. But what I’ve found, it’s mostly up here. If you keep getting to 401 and you stop every single time, you get stopped every single time, it’s not the play we drew, right? It’s usually up here, but being willing enough to say, man, I keep getting stopped and working with my coach, I need some help. That’s the only time when a coach or a strategist can come in and really say like, hey, alright, let’s drop the play, let’s put the play up on the whiteboard. OK, that looks good. Now what else could it be? If it’s not the play we blocked the guy, it was you and the opponent, right? Here and men in the hole and you lost, right? Like, what’s there, right? And so we can dive in a little bit more. Jeremiah and I, especially Jeremiah very dense background in emotional intelligence and psychology because I believe that’s 90% of business most underestimated founders have prided themselves on being so mentally tough. But getting over that hump, you just can’t do it. Jordan didn’t win a championship without Phil. And as great as he was, every great entrepreneur should have someone that they can look to and trust to help them get over that hump. Sometimes the strategy in the play that we call, but often it’s someone that’s just believing in you and pushing in you because you’ve gotten so far as an entrepreneur pushing yourself, you’ve gotten so far, you’re already here, right? Like you’ve gotten here now that next level is probably going to be a coach.

Nice. So, I mean, talking about my coaching and talking about teammates, right. The perception, like for Jordan, right. The first time someone sees Jordan win a championship, they may have heard his name, they may have followed him when he was in North Carolina, but the day that he held that damn trophy, everyone was like, who is this guy? Right? He became a household name. And then he stepped and repeated it over and over again. Right. But it wasn’t an overnight thing. He’s been in the game practicing shots since he was four years old. So the perception of him being an overnight success, the reality, it took him 20 something years to get there. How long have you been on your journey to get to where you currently are?

Man, the short answer is 20 years. That’s the short answer. Like I said, my mom was a single mom. So to help her make ends meet at times, my mom worked two, three jobs, so she always make sure that she made ends meet. But there’s times where I needed to help. But if I wanted anything extra, if I wanted to rock anything different than the pay less she was able to provide, it came out of my own pocket. And so I learned how to do herself at a really young age. And like I said, I got my first job when I was eleven years old. And Rick Ross says, you wasn’t with me shooting in the gym. That’s how I look at success. People always look at the home runs and then they forget the strikeouts. They don’t realize how long it took to get to where you are. And there’s a favor that washes over the bold. And I believe that that’s why I got that line in the back, because the fortune and the favor leans toward the bold. And I’ve been at this for 20 years, working 20 plus years, probably 22, 23 years, working since I was eleven years old. And then as an entrepreneur, I’ve been at it for over a decade. And my first role as a co founder, supporting an entrepreneur built his dream. It’s one of the top sports performance facilities in the entire world, and I got to be a part of that. I got to be a little Phil Jackson. My first role, and I was like, man, this is dope. I love doing this. And at that time, he was the one. His name is Tracy. He’s a childhood friend. We’ve known each other for 25 years. At that time, he was like, man, you’re good at this. And I wasn’t the main entrepreneur. I wasn’t the Jordan, right? I might have been considered the Pippin, but I saw myself as more the Phil Jackson. And he was like, man, you’re good at this. And that was really when I got, like, validation. And that was ten years ago, but it was twelve years ago when I saw a shark tank. And I was like, I’m going to do that. I don’t know what it’s going to take. One day I’m going to be a shark on shark tank. So yeah, man, it’s been 20 years to get to where we are today, even get to a conversation where I’m able to share with the world we’re actually doing. We made the decision twelve months ago. When? May 6. When I heard about a motorbike’s murder, that’s when I was like, I got to do something different. It’s been twelve months in a year, just building the infrastructure, building the basic foundation, and we’re still not even done building foundation, so it takes time to build anything special.

I want people to kind of listen to what he said and correct me if any of my math or my dates are going to be wrong. Based on my statement, this man said he’s been doing this for 20 something years, right? And correct me if I’m wrong. Weren’t you in high school in 2005? Right? So think about that, right? Like, this man has been on this plan, on this strategy before college, right? He was in high school. So I want people to really understand it’s never too young to step into the space. And it all comes down to having the grit and having the right mindset, which is exactly what he defined it’s, having the grit. And I think a lot of that grit came from being on the field, but then the mindset came from off the field, and then you put them all together, you completely have a system that can be replicated and could be scaled at the same time. So I definitely commend you to think that my son is in high school right now, and he’s entrepreneur in his own right, but obviously I’m going to make his asset down. Listen, I’m like, dude, he was 18, right? You’re short of 18. Think about think about the distance and time. Time overlaps really quickly because, I mean, 2005 seems like yesterday, but in reality.

20 years ago, it definitely is and I think there’s two sides to that. Like you talked about with your son is never too young. My sister’s in college, and I think Gen Z is the most entrepreneurial. I mean, I think the greatest world ideas are going to come out of Gen Z. They’re so creative and so brilliant. They grew up where YouTube is boring, right? Like they’re like, oh yeah, I want to pay for content because all this free stuff is just a library of free stuff. Right. They see the world way different than we do. So it’s never too young, but it’s also never too late. I was running a successful consulting company, jeremiah and myself, we were making healthy money, and in our mid 30s, we decided to totally change our careers. And so it’s never too early. It’s also never too late. Someone would say, like, man, you were having success. Why are you going to go into something that most 24 year older at your level of expertise and you’re going to be ten years behind them? And those things just never timing is something that social media cares about. Entrepreneurs can’t care about that stuff, and you can’t get caught up in like, oh man, I’m in my late 30s or my 40s or my fifty S. I don’t know that I’m going to pursue this. I think even Gary Vee, who was 34 when he started brand building and look at he’s one of the top personal brands in the world, right? So it’s never too early and it’s never too late. Entrepreneurship is an equal opportunity playing field.

All right, so let’s go into this question, right? If time travel was a reality, right? Considering that this venture of your business structure had just started within the last twelve months, if you could time travel back anywhere in the past 22, 23 years, what’s one thing that you would want to do differently if you could do it all over again?

That’s a great question. One thing professionally that I could do different.

Either it could be the other side of the coin, right. That can affect you on the business side too. Right?

Yeah. No, I think I mentioned that I had to deal with the condition when I was 18 years old, and the pain and the trauma of that circumstance was so hard. But I’m so grateful because of what it developed me to be. So I wouldn’t remove that one. That one is like a scar that I know added value to my life. That was the building work jumping off. The one that I would is when I was in college, I was so focused on the NFL and I wouldn’t have changed my focus from being obsessed about what I was committed to because that obsession is valuable. But I would have been more disciplined in balancing that obsession with networking and being intentional with the people that were around me that I wasn’t like it was like all football or all social, my teachers, the classes I was taking, the people that were sitting around me, I didn’t understand the value of that early on. And so when the NFL didn’t go through, I had to rediscipline myself around my academics. And not that I was ever a terrible student. It was just like I was a student, I was preparing myself to just go to the next stage of college so that I could get to a good job or NFL. And when NFL didn’t work out and good job didn’t sound like good enough for me, I was like, oh man, I need to go back and really focus on what I’m going to go do with the next step. So that would be the one thing I think of others, I’m sure, but that would be the one thing that I wish I’ve learned lessons that were avoidable later in life as we all do. But it was like that was just silly, man. Like I could have had easier network and I made my life harder than it needed to be just because I was so focused on being self made or whatever it is nice.

So this is kind of go into like your personal history a little bit, right? So, I mean, you kind of mentioned your mom earlier. Did anyone else in your early days have any influence as far as being an entrepreneur? Now? Sometimes some people are born into entrepreneurial families. Some people are kind of a way of the rich dad, poor dad model. How did you get influenced by becoming an entrepreneur?

So the loudest voice in my life has always been my mother. My mom came from nothing herself and always worked two or three jobs to make ends meet. Always had a hustle like she would work a job but then be selling Mary Kay or Avon. My mom was always hustling. And so hustle came from my mom. Absolutely, 100%. My mom is super hard worker and the entrepreneurial component. I’m trying to think of what was the moment that I realized I know that when I was in the car industry, that’s where I started my career. That’s where I started the success of my career within the car business. And the general manager there and the part owner of the dealership I worked at, he had one or two dealerships and he just had a different lifestyle. And I just realized that, man, this dude, I’m out here sweating on this payment every day and he’s sitting in my talk. It’s like I want to change spots. And so there was some of that where it was like business owners have always had respect. And where I grew up, we didn’t see a lot of that in the black community or even in my neighborhood. I didn’t know a lot of business owners. It wasn’t so much an exposure thing as it was once I saw it. It was like, oh, that’s what I’m supposed to be entrepreneurial, building something for myself. And I remember the time, and you probably do, too, where the word entrepreneur was kind of an insult. It was like a fancy way of saying, you’re unemployed now. It’s, like, really sexy and cool. And so that’s the generation I came from, where I was like, what is an entrepreneur? It sounds like you don’t got a job right now. It’s hard to think back that far. But I would say one of the gentleman who recruited me into the car business, he’s very entrepreneurial, and I saw the success he had in his life, and I realized that he could impact more people because of his income that he had, because of the influence that he had. And so if I wanted to have a big impact, I needed to increase those categories.

Nice. I mean, you brought up your mom a couple of times, and you talked about your family earlier. So how do you currently juggle, like, your work life with your family life?

Like, someone who’s juggling chainsaws? He’s trying to do your best not to drop one. Yeah, no, I think my family comes first. They’re the reason why I hustled. My mom and my sisters, we were so tight. Me and my dad have a great relationship, and so my family is literally why I grind. And so I think there’s a time when you’re hustling that you get addicted to the hustle and not the reason why you hustle. And so I’ve made a path to myself that unless it’s absolutely necessary, I will not miss a sports game, because my mom didn’t. She raised four kids on her own. My wife, I got three kids, and I have more resources. So if she can make it to every single game, there’s no way I can’t. And so there’s that kind of apple doesn’t fall far from the tree legacy that my mom has left in the way she raised us. But I also have a great partner. My wife is incredible. She’s incredibly supportive. She loves entrepreneurial grind. She’s entrepreneurial herself, and so those things make it easier. But I think the first things first is a lot of people say they grind for their family, but then they never see them, and that’s okay if that’s where you’re at, and that’s what you have to do to make ends meet. But for me, I wanted my grind to allow me to have more with my family, more experiences, more time, more travel, more access, more relationships, more education. I wanted more for all of us, not just I wanted to build something really big so that they were able to have a lot there’s different philosophies, and my philosophy was I wanted to build something that we could enjoy together.

Nice. Obviously, you still got, like, the football training mentality, and it’s very structured. So that leads me to ask you, what is your morning routine? Your morning habits look like every single.

Morning I wake up and I read scripture, I read a chapter or so. Right now, I’m in the Book of John, but that’s the first thing I do when I open my eyes. And then I come into my office and I do a Men’s accountability call. We do a quick call every single morning for about 15 minutes where we just go around the horn. We talk about plans for the day, goals for the week, wins, whatever it is, and it just gets your brain ready to go attack today. And the next thing I do is I go I take my kids, my wife is packing them up, I go jump in the car with them, I drop them off at school, give them a kiss, I hit the gym, and I come back at work. And all of those things, I don’t like to do any of them without the other. Like, I won’t just do the accountability call and then not hit the gym or not take my kids to school. It’s really that perfect balance of I start my day in that first hour. I do all the things that are important to me, my personal, mental, and spiritual health, my accountability and structure, my family, my health, and then I get to business, right? So I set my day, my week, my life up in the ways that my life matters to me. And so I do that every single morning. Every morning from six to 930 looks exactly the same.

That’s nice. I mean, you definitely fall under the category of people that entrepreneurs and business owners that are on a success path that essentially read some form of book. And because of that, I created the Boston Cage Book Club. So this next question kind of stems into, like, the books, right? And you’re saying the Bible is obviously a core book that you read religiously on a day to day basis, but on your journey, right? It’s a three part question. What books helped you on your first part of your journey to get you to where you are? What books are you reading currently right now? And have you authored any books yourself as of yet?

Book that really transformed? There’s two that really rocked me is a book called Sound a Little Bit Weird, but a book called The Secret. And when that book was released before, like mass Internet to what it is now, social media, it’s a whole different machine now where everybody’s talking about the books are reading and all that. It wasn’t like that, but someone gave me that book when I was 24, but I didn’t read it until I was 27. And they said, oh, I think you’ll like this book. And it kind of looks at DaVinci code. I don’t know if you remember what the physical book looks like. It looks a little bit different. You’re kind of like that being of that, right? And so I didn’t touch it for three years. And then I finally read it and they were like, it was validation. That the way I was already living my life, that the magnet that I felt like I was good and bad or good in lessons was it was validated in that book, whether it was you take it from a metaphysical or spiritual, whatever, however you wanted to define that. I thought they did a good job of that. Really articulating the things that you want in your life, like, you bring them closer to you by your work and by your intention. That one really rocked me. It definitely added a ton of value to my life. And the other one is Grant Cardone’s. Ten. X rule. Grant Cardone is insane, and I love dude because he really lives that. And in that book, if you want to go build something, he articulates the foundation of the Ten X Rule is that anything you want in life is going to take ten times the effort that you think. Ten times the money, ten times the resources, ten times. It’s going to take ten times longer. Like, everyone’s like, oh, you’re going to go build a venture capital fund that may take six to twelve months. I was like, yeah, it’s probably going to take me eight years to get what I actually have in my mind. It’s going to take more time. And that book sets you up for the endurance that you need to go run this race and also know that it’s not just a jog. Like even a marathon is timed like you’re still running as fast as you can at what you’re trying to pace yourself, because this is a long journey. So those two books definitely rock me. The second question was, what am I reading right now? And the book I’m reading right now is Blitzcale by the founder of LinkedIn, I think is what he founded. It’s just a book that’s really talking about expanding your vision for the type of business that you want to build and how these big companies that we see, the apples, the Tesla and all that, how they actually did it. It wasn’t hocus pocus magic. There is a level of luck in it, but there’s strategy to it, and I love the strategy part of it. And he breaks it all down, and you can take it to even small style companies. But my favorite book that I’ve most recently read, I’m going to give a bonus. Jeez, I can’t remember the name of it. Now I’ll come back to it. I have not authored a book, though. I have not yet authored a book. I wrote a book over the span of a weekend with my friends, Janine Hernandez, she’s an author coach, and she was like, well, just write the book. And I was like, okay. So I wrote it over the weekend. I haven’t puzzled or pushed it or anything like that, but I wrote it’s about 100 pages that I wrote in about two and a half days.

Nice. Yeah. I’ll say, Get it out, man. Push it out. The books are just nothing more than lead magnets, and they’re the tips of the iceberg. So once you start writing books, it becomes like, when I wrote my first book, it was kind of like, okay, I wrote a book, then I wrote a second one, and like, now I’m about to release my ebook, so it just kind of becomes more of like yeah, but it’s all strategy, right? It comes out of strategy. You hear eight books and you’re like, that’s a lot of writing. But if you strategize everything and you kind of segment it out into particular nuggets, you could write a book every single month if you choose to.

That’s wild, man. I commend you for that, because like you said, whether it’s your morning routine, whether it’s your children or whatever, it takes a level of discipline to accomplish anything meaningful. And so to write eight books, man, have talked to you for that.

Sure. So going into I mean, you’re still a young guy, right? So what do you see yourself in 20 years from now?

I see myself 20 years from now. I pray that I see myself doing a lot of the things that I’m doing today with an increased amount of abundance and wisdom. And I think if between now and then, if I can acquire wisdom, then everything else will be fine. And if I look back 20 years, the only thing that was really missing was wisdom. And wisdom comes to experience. Wisdom comes through a lot of different things. And I think 20 years from now, if I can have wisdom, I’ll have everything that I need because I’ll make the right choices based on my values. But as far as career wise, I believe the X factor in the next 20 years is going to be one of the larger venture private equity lending firms. We’re going to lead the country in investing into underrepresented founders, and that’s our target, that’s our goal, and that’s what we’re going to accomplish. So when we talk in 20 years, we’ll rewind this tape and we’ll say, hey, you said he was going to do it, and you did. I wouldn’t be like, wow, surprised, because there were things I was talking about ten years ago that I’m doing now. And again, go back to the Secret or whether you’re a person of faith or whatever, it’s like you speak things right into existence. And so I know what 20 years from now looks like. Tweeted the other day I said, I don’t always understand the shipping or the tracking information, but the package always seems to come exactly what I need and when I need it. Yeah, I see. In 20 years, we’re going to have a really big firm. My kids will be graduated and gone. By then. So my wife really wants to travel the world. She loves watching the Netflix shows where they’re like, going all over the different parts of the world. So that’s her manifesting, her future right there.

Nice. So with your system that’s set up, and you say you’re building infrastructure, what softwares are you guys currently using that you would not be able to do.

What you do without zoom? Absolutely. 100%. Any Google? I love the Google ecosystem. The docks, the sheets, the slides, even hangout, meetups. Those are somewhat useful. They’re not as good as zoom. And then things like, on a functional basis outside of meetings is things like canvas. I use that a lot because I like to design my own things. Even if I don’t publish it, I like to design it myself and get it to the person who really knows so they can see the idea. Because I don’t articulate as well, but I use canva a lot. I use a lot of social media platforms. So you look at apps like Instagram, Twitter, Facebook. And then the other one that I’ve been using a lot of lately is Fiber. That’s an app function in a marketplace that’s been really valuable for not only us. I see myself using it a lot for the founders that I meet, when they want to send over a pitch deck or they want to design something, they want to change their brand, their logo. And going to these big agencies is very expensive for founders so farr. You can negotiate one, which I like to do, and you can find people with reviews and backgrounds and things like that. You can go find what you’re looking for from all over the world. You contribute to the global economy, which I think is a good thing, and you can get things for what they cost in America. You can get them done at equal quality from someone who 1020, $30 feeding them for two weeks. You can add a lot of value in that way as well.

Nice. So going into final words of wisdom, let’s say I’m a new startup founder, and I don’t even understand what a blind spot is as a founder, right? And let’s say I’m like 25 years old, I just graduated, and I’m starting up. What words of wisdom, insight would you give to me?

I would say the thing that is on your side is time. And so be patient in everything that you’re building. Take advice from people who have been where you want to go and ignore anyone who hasn’t in your journey. There’s a lot of people that want to give you advice that aren’t necessarily qualified to give you that advice. And they’re well meaning people. Friends and family love you a lot. But if you’re an entrepreneur, if they have not built a business, they don’t know. I have no idea what it’s like to give birth to a child. I have no clue I’m not saying that the two are equal. Giving birth is much harder than building a business. But I just couldn’t give anyone real advice on how to go through it that was meaningful to them. There’s more experts out there that have gone through it that could add value. And so if you go to people that have built something that you admire, ask them the questions and then be very patient with yourself. Don’t push yourself to deadlines that are unnecessary just because you want to be the youngest to do something. I think that was a common mistake. I always wanted to be like, the youngest to do this or the youngest to do that. It’s not a race. Yeah, it looks good on Forbes or whatever, but that’s where a lot of people quit it’s because they have these false deadlines that they needed to do before they’re 25, before they were 30, before they were 35, these deadlines. And then they watch social media and people are holding up trophies, and then they stop going to the gym. And you got to be patient with yourself. If you really believe in yourself, then surround yourself by people who have built something significant and have tiers that align with where you’re trying to go. And that may be hard if you’re 25, 28, it may be hard. So maybe lonely for a little bit, but you’ll start to attract the people around you and keep those friends, but your colleagues, as an entrepreneur, become other entrepreneurs.

Nice.

Yeah.

I think to add on to your point, the whole race thing, I think if you’re constantly achieving and striving and going back to the Secret and the rules of attraction, and you’re constantly on that path, look to people like Ray Crock, for example. Ray Croc did not really make any of his money or anything until he was well into his sixty s. And I want people to understand that you could be 20, 30, 40. That’s still a whole lifetime before you even hit that 60, 65 mark. And again, Ray Crock was one of the richest, wealthiest people we had. And if he was still alive to this day, I mean, think about McDonald’s and the Franchising model of owning real estate that they own in today’s world. He did it in the 60s. Right. So I think I definitely commend you for stating that. It’s a clear fact. Right. So how can people get in contact with you? What’s your social media profile? Your website? Do you have any offers for our listeners?

One of the things that I’d love for anyone who’s listening is to reach out if something in this podcast touch you, inspire you, whatever it may be, reach out. I love responding and talking to people. I love hearing Entrepreneurial journeys. Boston Cage is a platform, obviously, where people come and tell their stories. The stories that we get to connect with are so meaningful. So I would love for anyone to listen to this. Reach out to me. Best way to reach out to me is on Instagram, of all places. I’m a millennial, and so that’s where I do a lot of my networking. LinkedIn, I probably check a couple of times a week. Email, I check frequently, but I have to prioritize the most urgent things in that thread. So the threads that are more social like this, definitely social media is a great way to reach out. Follow at rodell razor. R-O-D as in David, e as in elephant. Ll Razor, just like the blade. So at Rod l Razor on Twitter and Instagram. And then for those you guys that do want to reach out via email, you want to submit a pitch or make it open to all your audience, they want to submit a pitch. They want to compete in our next pitch competition, or they want to be evaluated for funding. They can find us on our website, which is XFactor Capital So. Just XFactor Capital so, I mean, you.

Run a pitch, right? So just talk about that for a couple of minutes. What are you guys looking for me? Like, how is a pitch structure? And I’m thinking it from a standpoint of, let’s say you and I, we understand it, right? But somebody is listening that’s brand new into the space. Like what goes into a pitch deck?

A deck and a presentation should not be exactly the same. That’s the first. If it’s on the deck, I’ll read it. And if it’s not on the deck and it’s important, you have to share it. Decks can’t relay emotion in a lot of business and sales as a motion. And so I like to put things on the deck that are analytical stats, your total market, your sales, things like that. And then the storytelling is in the art of you sharing it, whether that be a video you keep uploading on YouTube so you can tell your company story and your background and your vision for the future, and then put the analytics on, because I talk about this a lot in pitching is most people are either right brain or left brain, right? Like one or the other, right? And so a very eccentric individual will just talk about the vision and the goals and everything they went through to get where they are. But they won’t give me the analytics, right? They got to talk to my heart. Like, you got to grab my heart. But I also need to make an investment decision. I need some analytics. So you got to talk to my head as well. And so then there’s some people that will just go through analytics and just sound like it’s an encyclopedia and they won’t bring any emotion. So, yeah, I trust that they know their numbers, but do I feel compelled that they’re going to lead an army towards the charge of the future? Right? So you want to find a balance between the two of those. And so that’s kind of a high level answer. And then as far as practicality, what’s on it, you want to share your team, you want to share your product, your traction, your market, your target market and the available market. And one common thing that I see is people don’t really understand how big or small their actual market is. That takes real market research. And they also don’t know that the market actually wants a product. They haven’t validated that their target market actually wants a product that’s called Product Market Fit. And then the third thing is their go to market strategy. How are you actually going to get to the people, prove that they want it and then continue to sell it to them? Those are some things that I like to hear, that I like to grab out of a deck or out of a presentation. And those things let me go. Because person either knows where they’re going and they understand the challenges ahead of them and they know what they don’t know, or they’re so high on what they have that they think that there’s not going to be any obstacles in a way and they have no context for how hard this journey is going to be. So you want to find that balance between speaking to capturing people with a heart message, but also delivering the analytics to speak to the head so that people can make an investment decision or buying the decision. Because I can’t know Boston Cage could have let’s say you have a hoodie and you can tell me all the background of the hoodie. I can’t actually buy it and take it to the number. I just can’t like I can’t actually finalize the transaction. So you tell me how much it costs. At some point we got to get to the analytics and so just remembering those things.

Nice. And I think you bring up a good point and I think for any business owner that you have to be structured even though if you’re not there intellectually. As far as like, I would be myself 50% analytical, 50% creative just because of my background and I’ve grown into that, right? But so if you’re not 50 50, and if you’re more 75 25, then that other side needs to be at 100%. So you need to find someone comparable to fill in that void. And so based upon what you’re saying that you guys can step into that space, if you have someone that’s more 75 25 analytical, then you guys can kind of step in on the creative side and fill in that void and become a system and unit together to grow at the scale to move forward. So I definitely appreciate you saying that.

Yeah, there’s a lot of people that they do want to, they watch Shark Tank and they think like pitching someone’s against you. And I think that it’s not like it is a venture or an investor’s job to say no. We say no all the time. That’s what we do. But I think the profession should be no. But here’s my feedback. Here’s some things that I have that I think can add value to you. And so you’re very passionate about your product. Want to go study some more of the analytics and go find an investor in this category, right? Like, try to give that nuance of support, because most solo founders, they don’t know what they don’t know. They can’t see their own blind spot.

Nice. So going into, like, a bonus question, right? If you could spend 24 hours with anyone, dead or alive, uninterrupted for that 24 hours period, who would it be and why?

So without this being a religious conversation, it would be Jesus. And outside of my religious beliefs, the reason why I would choose him is as a human, this dude walked to Earth, shared a message, enrolled people in that message, and it’s part of the best selling book in the world. And so I think that he’s the topic of discussion of the number one book selling in the world. And his legacy, believe it or not, his legacy has lived on, whether you’ve decided that he’s yours or not. The legacy of what? The human that was here walk the Earth for miracles was all human and all God. I think that represents what my belief system is, that we are all human, we are all gods. And so I think that spending the time with someone that’s done such incredible things everyone talks about and has created meaning beyond himself. And his message was about purity and contribution and love and peace and things like that. Because my natural would probably want to sit with someone that could leverage all the things that I can get to the next step that’s that my achiever brain wants to do. But to go back to your answer, like, 20 years from now, where do I see myself? It’s like I just want to acquire more wisdom, and I could do that in 24 hours if I stop with the right person.

Yeah, I can definitely see that. And based upon your response, I mean, looking at Jesus, I think anybody that’s an influencer or a marketer is like he is the great great great grandfather of both of those disciplines, hands down, period. Because he’s been doing it the longest. Right.

His message is the original. This will live beyond me. We are all trying to build something that will live beyond ourselves. And his message absolutely does.

Nice. So going into closing, man, every time I have an interview, I like to give the microphone to the person I’m interviewing. So you can ask me any questions that may have come up that you may have thought about during our conversation. So the floor is yours. Do you have any questions for me?

No. I think one of the questions I would ask is what really inspired you to create this platform? Why podcast? Why interview style? Why the name? Like, what made you use this vehicle? Because there’s so many vehicles to get your word and message and purpose out to the world. Why did you choose this vehicle? Because the reason why I asked that I’ll preface it is because I’ve done a lot of interviews and not so many people take the podcast that they do as professionally as you do. And so you brought a lot of valuable Q and A. But even the process before, I kind of knew what I was going to get into, like, I knew I was going to rock with you before I even met you because of the discipline that you showed in setting up not your funnel, but your processes, the video you sent me and things like that. So why did you choose this channel? Because you’re incredibly talented and you could have chosen any channel. What made you choose this one?

Your point? Right. This is not my first channel of communication. Right? I mean, it’s not my first business as well. I originally had a business called Cerebral 360, and I created that coming out of college. And it was my original degrees was graphic design and web design. And I was more of a creator, like, more of that one side of the brain not realizing and not owning up to. I’m also highly analytical, hence why now? I’ve embraced 50 50. So on that journey, I was building this brand in the marketing. I had clients and doing all the stuff and helping people. And then I was growing businesses upon businesses upon businesses. I became a life insurance agent. I got my Series Six and became more in the investment side. I became a travel agent because, like what you said, I was eager for more information. And also I was a single parent at the time, and I wanted to teach my son about all these different disciplines to give him the greatest opportunity. So when he became of age, he had something to look at and say, okay, my dad influenced me here. He showed me this, and this is the one component that I want to utilize. Unfortunately, on that journey over working myself to debt and working on these hours, I had a stroke in 2018. So once I had that stroke and I was in hospital and I woke up and my family and I’m looking around, I’m like, okay, I almost died. And what was my legacy that I was going to leave?

High.

Yeah, I had to go through 16. I had all these different things, but I didn’t leave the step by step procedures and the breadcrumbs on how to execute what I was doing in that business. So after that, I was, okay, I have to kind of reinvent myself. I had to go through recovery and in that process, I was like, okay, I’m going to go into my wife. She was like, It’s time for you to step from in the shadows and step in front of the camera, because I was always the behind the scenes kind of guy behind the man behind the masks, right? So then I decided to step in front of the camera, and I was, okay, I’m going to do everything I’ve been doing for everyone else, for myself. I’m going to create a brand new brand, Boston Cage. What does this brand represent? Well, first of all, it’s an easy name to remember, first and foremost, right? It’s easy for a five year old to spell. Secondly, these are like four principles for design. And then what does it really mean? So, on one hand, being a boss, you could be an entrepreneur, you could be a small business owner. You could be working for someone with your side hustle. All these are linear definitions of being a boss. But the uncage part is that you want to scale. You want to break out. You want to leave corporate America, you want to leave your nine to five. You want to be a free. So you breaking out the cage of becoming a boss on Cage. So that’s the definition of that. And then the interview style was more so how do I maximize and scale this business structure? There’s only one way for me to do that is to talk to business owners like yourself. Again, I’m 50 50, so I have multiple different disciplines, and I can speak and hold my own. Anyone but you’re the profession in your area of expertise. So what does that look like 20 years from now? This podcast leaves behind a legacy that goes back to my original brand of giving my family and other business owners the breadcrumbs to connect the dots between the service and the stories to get them from point A to point B.

That’s really powerful. Again, I think every beautiful story has that moment, and it sounds like that stroke was definitely something that kind of brought you to, right? Of like, hey, there’s something I could be doing different here. You mentioned something that resonated with me. I was a single father when I first started my entrepreneurial journey as well. And the challenges of that that only we could know. Right. I would love to hear your feedback on that because that’s not a common story, especially single father. We do hear the single mother hero stories, but I’d love to hear a little bit about what you learned in that process of building a business and trying to juggle being you had to be a present father because of your role in their life.

Yeah. In my son’s early days, man, like, through elementary school, it was crazy because I was a PTA president, which was, like, unheard of. I was male and black PTA president. Think about that dynamic right so I was PTA president and then also he was a Boy Scout and then I was like an assistant den leader at the same time as well. And at the same time it was kind of like the real dawn of my entrepreneurial side because I had to go through a custody battle, went through divorce, and then I was faced with the reality that I had primary full custody of my son. So I was like, well, shit, this is the opportunity for me to say to hell with a corporate America. So I left my full time job and I had strategies in place, but I went 100% remote and that was like ten or twelve years ago and I haven’t heard back since. So that gave me an opportunity to kind of just jump and just commit to it. And then I had to raise a kid at the same time. So everywhere I went, if I was going to a meeting, if I was going to a conference in North Carolina, if I was going to New York, that dude was right there with me the entire step, every single step.

So he saw all these different opportunities and to the point now, like I said, I’ve kind of built it to the weird. Now he’s reached out to me and said, hey, now I want to get into stocks, I want to learn futures, I want to learn forex. So I’m committed to kind of putting him in that space and put them in that environment because of all the things that I’ve done, that’s the one thing that he reached out to. So it’s been working. I’ve been on that right journey, and I won’t be able to see the results of it until later on. But to your point, it’s honing and nurturing and building it, much like we see mothers do. Dads can do it as well too, if you’re 100% committed in the end result.

No, that’s beautiful, man. And I love that you’re raising a young black man to be entrepreneurial, so hats off to you for that. It’s beautiful to hear the story and the journey. My kids are still pretty young, age six and two, and to know to hear you kind of articulate like, hey, they see the hustle. They don’t know what it is yet, but they will come to respect it and desire it for themselves. That gives me hope, man. I appreciate you sharing that.

Yeah, definitely, man. Well, I appreciate you taking time about your schedule again, going back to the credit of who you are. I mean, like literally you reached out less than 24 hours ago and it’s like now we have this unsound brotherhood. Because to your point, I think there’s some synergy definitely between us, and I think this relationship and the business that we have can definitely grow and move forward. And that’s what this whole thing about communication and about building community is really about. So I appreciate you being on the.

Show today, and I appreciate you having me. This has been a real treat. And as much as you’re commending me for reaching out within 24 hours, you responded very quickly and you made the time available. This is something that I committed to. My wife said, hey, because I’m trying to think of ways I can be more of a contributor in my own world. And I was like she’s like, well, you need to do some free coaching calls because you don’t consult anymore. You need to jump on a coup podcast and share your knowledge. Whenever I hear a great idea, I try to take proceeding action. And so I reached out right away. I think it was like midnight, probably. I lay in bed and I said, you know what, this is what I’m going to do. And I set up some appointments. I got a few consulting calls I’ll be doing over the weekend because it’s something I committed to to be a greater contributor. So I appreciate that you have me and you making the time so quickly.

Right. I definitely appreciate it. And to your point, having a significant other makes all the change in the world, too. I mean, being a strong individual is great, but when you find the other half and you guys come together as a whole and you have that support team, it’s a game changer.

Game changer, a spouse, that’s down for you, man, because it can be both ways. And if you want to build, you got to build either way. But having someone that sees the vision the way you see it is very rare.

Again, I appreciate you coming on the show, man. S.A Grant, over and out.

Thanks.

Thanks for tuning into another episode of Boss on Cage. I hope you got some helpful, insight and clarity to the diverse approach on your journey to becoming an uncaged place. Don’t forget to subscribe, rate, review and share the podcast. If this podcast has helped you or you have any additional questions, reach out and let me know. Email me at ask@sagrant.com or drop me your thoughts via call or text at 762-233-2677. I would love to hear from you. Remember, to become a Boss Uncaged you have to release your Inner Beast S.A Grant signing off.

Listeners of Boss Uncaged are invited to download a free copy of our host S.A Grant insightful ebook, Become an Uncaged Trailblazer. Learn how to release your primal success in 15 minutes a day. Download now at www.bossuncaged.com/freebook.

Leave A Comment