Boss Uncaged Podcast Overview

- What is Lake Growth do for you

- What is Mark’s morning routine

- What tools is Mark using in his business

- And So Much More!!!

Boss Uncaged Podcast Transcript

S3E21 Mark Willis.m4a – powered by Happy Scribe

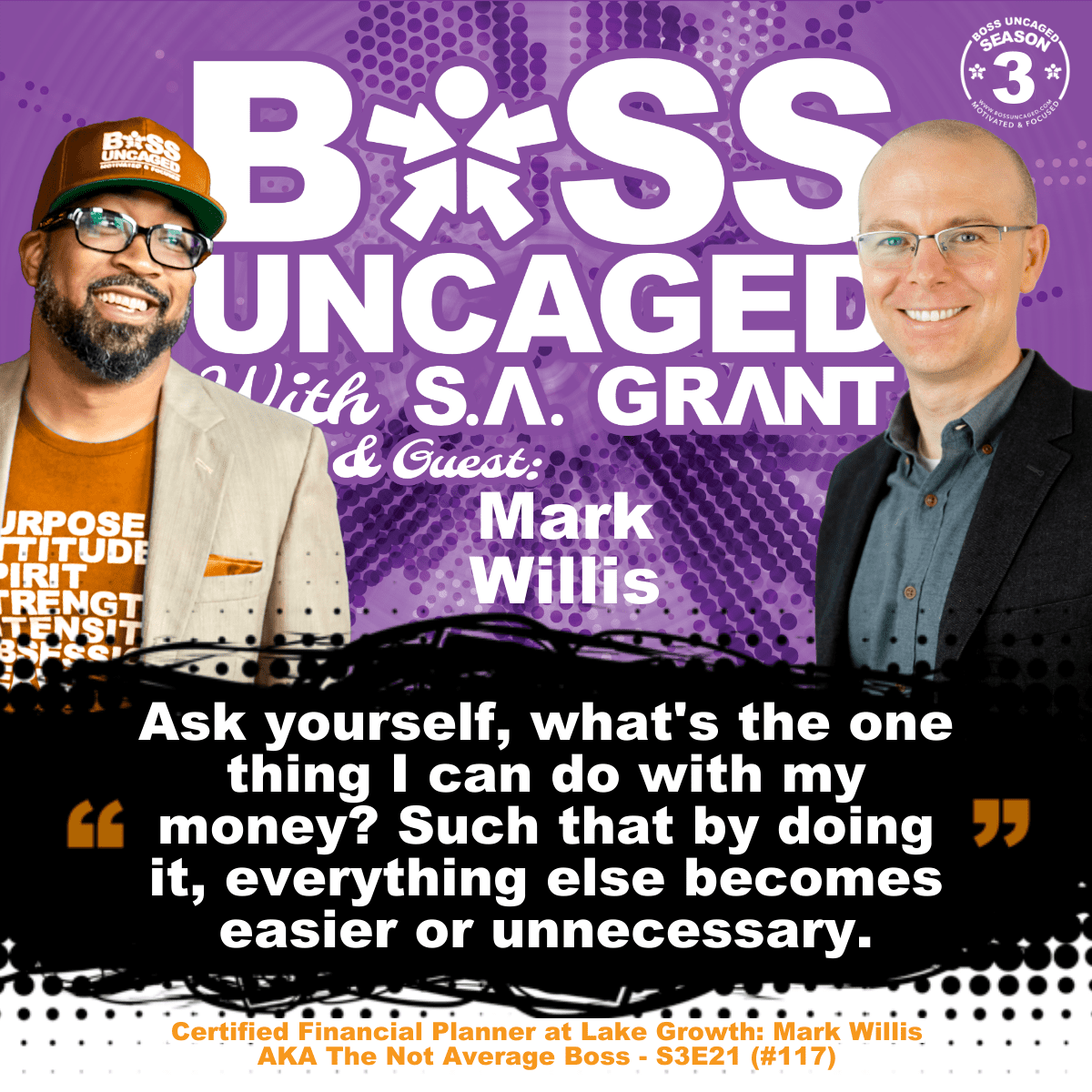

All right, three, two, one. Welcome back to Boss and Cage podcast. You guys know, like, when I have someone on the show that I think is unique in different ways, I always going to give them a nickname. So in today’s episode, I’m going to nickname our guest, the not average boss, and he’ll be able to tell you a little bit more about that. So before we dive into that again, I think this episode is going to give you a lot of jewels, a lot of Nuggets, a lot of takeaways. So we want to hear about it. Okay. Mark is our guest and he wants to hear some information from you guys. So again, we want you to go to bossuncaged.com/fbgroup and leave some comments, share some information. What is your greatest takeaway from this episode? So without any other distractions, Mark, the floor is yours. Tell the audience a little bit more about who you are.

Hey, I love the idea not average boss. I like it, man. And I know our podcast is not your average financial podcast. And so I guess the theme aligns well. And it’s true. I think our background, my wife and I, when we graduated from College, we woke up and found that I had accidentally married two women in College whoops one was my beautiful wife, one was Sally May, if you know who she is. We had $120,000 of student loan debt. She wasn’t leaving until we paid her every last cent. So it’s sort of my alimony to Sally May, I guess. But we had a massive amount of student loan debt. It was in the midst of 2008. No awareness of our finances, no ability to pay off the debt because we had no jobs, three private school degrees between us. None of it was really marketable in 2008. So what are you going to do? I found myself walking up and down Chicago’s Michigan Avenue trying to find a barista job or something and coming up empty. I even remember I sat down at a Chase Bank to be a teller, and I don’t think I got that job either.

Maybe it was my bald head. I don’t know what they were having a problem with, but the best thing I can say about our background and journey is that it lit a fire under our butts to, like, get really honed in and focused and for real about our money. Because those monthly payments weren’t just going to stop every month. We had to find a way to wipe out that nut there and also cover our groceries and gas and all that fun stuff. So it got us ready in a hurry to think about our money. And we had to think different because we weren’t just being handed a 401K at some job. We had to think different about how we were going to handle our money. Our own personal private economy. In the midst of the world’s economy crashing, which it seems to do now every ten years or so or more or less. But we’ve got a massive undertaking on our hands now as we’ve got a wonderful business with folks over 1000 clients all around the country, in all 50 States and a few around the world, too, which I really love. And it’s been a real privilege and honor to get to help other clients now take back control of their financial future in a way that makes sense for them, is sane, predictable, and helps them become their own source of financing.

Yeah.I think it’s definitely humorous that you kind of brought up indirectly polygamy. Right. Being married essentially to two wives, you’re mine, right. Just talk about that a little bit. I think that’s a really good analogy to think about. You’re coming out of College, you have a degree, you’re trying to figure things out, you’re getting married, but you’re already married to someone else and you’re already making payments over there. What does that look like? How do you transition from that? What does that ecosystem look like as far as the conversion factor?

Man, that is a great question. Let’s go even deeper into this thing because contracts are really the basis of everything that I can find in human civilization. Right. Whether it’s a contract between me and my bride, that’s kind of a contract. A little bit love till death view apart. It sounds kind of like a contract even signed something. I think I signed something. There was a lot of drinking going on there, chocolate milk. But we had a great time at the wedding. We did make some promises to our future. Isn’t that kind of what I do when all of us do? When we get that credit card or that car loan or that student loan, we’re making a contract with our future, and it’s partnered up with somebody who may or may not have your best interest at heart. Unlike our wonderful spouses, Sallie May and Capital One and all these bozos, they’re in the interest of making profits for their future. They’re getting ready for their retirement. They’re not exactly going to be helping you with yours. So if we have a contract with every Tom, Dick and Harry, whether it’s our business line of credit or our mortgage or our student loans, debt comes with it, some commitments, some promises.Till death?Do we part? Till debt? Do we part?

Wow. This is definitely interesting. That kind of gives the listener a little insight to who you are. So let’s dive into that a little bit more. Right. If you can define yourself in three to five words, what three to five words would you choose?

Well, the next couple of words are going to be pretty important, man. Wow. I’d say counterintuitive parodies and playful.

Nice.

Those are a couple of words we could keep going. But counterintuitive parodies and playful. I think the general notion of a tennis ball floating down the gutter of life is not a life I want to live. I want to move upstream financially, not just being counter to culture for just the sake of being different, but saying to myself, all right, if average is being in debt up to my eyeballs with a subpar 401K I can’t touch for 30 years if that’s the average. I don’t want to be average. I want to be awesome. I want to be not your average. And so yeah, counterintuitive. And maybe even by parody, I’m saying not just going different for different sake, but how do we use the mainstream concepts and play with them? Some be a little playful with it, like weird Al playful on some of these parodies. Right. So how do we use what’s coming at us and use it to our advantage, not just get away from it, but actually make us stronger as a result? Quick, case in point, if anybody has done any martial arts, sometimes the opponent coming at you, you can sometimes use their weight against them if you figure out how to leverage it.So leverage, in my opinion, is a key part of the parity in the financial life and in most of life, too. Your business. We all had to get around this word called pivot last year. In 2020, I’d say that you can pivot in your financial life to help you not only just handle that debt and take care of it and pay off your old debts. Whatever. Don’t just pay off the debt. Be the bank. If banks are the problem, then you can become the bank. You can become a bank like the ones you know about and actually profit from the debt rather than just paying it off. That’s kind of what I mean by parody and then playful. What else are we doing here but playing? I mean, all us adults, we’re really just in a sandbox together, playing with new toys, call the podcast and Zoom and all that. And I’d much rather this than punching some check at some teller spot at some Chase Bank down the street.

Nice. So I’m thinking, like, obviously being playful and this is the first time I’m thinking I’m like, maybe I should rebrand you and call you the analogy boss, because, I mean, you’re spinning off analogies left and right, and you’re playing with words. So is that something that you utilize when you’re helping educate someone about finances? Are you using analogies and you’re playing with wordplay to help them understand the theories and philosophies a lot easier?

Yeah. If you can understand something really well, you can hopefully do it in a picture. And if you don’t understand something really well, you’re going to end up getting all bogged down into the technicals. And that’s okay. Both are probably important. But yeah, if you can like this idea of pictures, if you want to talk more about the debt, most business owners are trying to fly their airplane and they’re trying to take off. And maybe your airplane can fly 100 miles an hour, let’s say. All right. And so you take your airplane, you drive it down the runway, you lift off, you’re going as hard as you can. 100 miles an hour is hard as that engine can push. Unfortunately, you got a 300 miles an hour headwind coming right at you. Now, essay, I don’t know about you, but I can do a little bit of math in my head. And 300 is more than 100 most of the time anyway. So no matter how hard I’m pushing, I’m not moving toward my destination. I’m going the opposite direction at 200 miles an hour. And that’s how most businesses live. According to the US Commerce Bureau, the average business owner spends about a third of their revenue servicing debt, a third of your revenue servicing debt.So if you’re 100 miles an hour is 100% of your revenue, but you’re getting that kind of push against you, you’re not going to be making much headway with your head wind. It’s going to be pushing you in the opposite direction. Best thing we could probably do with that airplane is just land that silly thing, wait for the wind to die down or change direction. And the powerful thing here is you can refuel your tank while you’re waiting and then wait for that wind to stop. Now, most people think that no wind is as good as it gets, as fast as I can fly this little plane is 100 miles an hour and that’s as good as it gets. Most people think paying cash is the answer. No longer just paying credit cards, finances, lines of credit, mortgages on my business properties or my personal home or my student loans. They think, hey, if I could just pay cash for everything, I’d be King. But I’m here to say no. Again, parody right. Let’s do something a little bit better than just paying cash. How can we use banking to our advantage? How can we get that tailwind behind us?

What if you had 100 miles an hour airplane and you had 300 miles pushing at your back of wind? Now you’re doing 400 miles an hour getting towards your destination. Okay, so that’s a difference of what is that 700 miles an hour or something like that between the head and the tail? That’s an incredible arbitrage if you can get that wind behind you, if you can use debt to your advantage. And I don’t just mean borrowing from somebody else’s Bank, I literally mean find a way to become your own source of financing because it will change how your airplane flies and it’ll get you to your destination with a lot more certainty and confidence. So yeah, analogies, it paints a picture more so than rates of return or we got to get technical, we got to get into the weeds at some point. But yeah, the picture of a thing, I think speaks to the heart.

So I think my next question still stemming off of that analogy about the airplane and the tailwinds. Right. So let’s say your plane is going down the runway, it’s 100 miles, and let’s say you’re going with the actual wind and you’re maximizing creeping up on 400, but the tires blow out. Right. Let’s say the landing gear falls off this plane and spark start flying. So my question is, obviously, you’ve worked with thousands of people. Has there ever been like that type of plane wreck or that train wreck on a runway that you’re helping someone, you’re pushing them, you’re motivating them. What was that experience like? And what was the example that you would like to fill in to void with that?

Well, yeah, life throws us curve balls, sometimes two or three at a time. In fact, most of the time that’s the case. So I found anecdotally anyway. And yeah. Having some repair attempts and having some spare tires and having a tool kit, you can repair that landing gear on the fly. Forgive the pun there, but you can fix that up if you packed provisions, if you’ve done the work of packing that plane, not with a bunch of junk. I don’t need a bunch of like San Pellegrino bottles and other cement and quick energy bars. What I need in that airplane are all the provisions I’m going to need to survive if something goes haywire. And it almost always does eventually. So, yeah. Great way to extend the analogy. I guess we could take any analogy to its limit, I suppose. But since you brought it up. Yeah. Most people have very little in the way of an emergency fund, have very little in the way of an opportunity fund. And I count those as two separate items. Most people might have a week or two of savings. There’s an old quote by Gloria Steinem. She says “Rich people plan for three generations and poor people plan for Saturday night”.And I found that’s the case, if all you have is enough money to make it through Saturday night and the tire blows, literally the tire on your car blows, or this airplane metaphor. If life’s tire blows or your landing gear starts sparking a fire, man, you got to have some ready to go capital. And I’d mentioned, too, not just for emergencies, but opportunities. What could you do? What could you take advantage of if you had a big pile of contingency cash for any purpose, take you in any direction? I mean, if you had half a million Bucks just sitting around waiting to be told what to do, how might that impact your business?

I think definitely as a listener. Right. And if anyone has $500,000 sitting around and they’re not actively engaging with that $500,000 or making investments or buying non liabilities, obviously they need to get some counseling. They need to get some help for sure.

Yeah. And by the way, if you guys do have $500,000, call S.A right away, he can tell you how to put that money to work.

Or obviously, I would then say recommend. You probably need to talk to Mark kind of talk strategies behind the scenes. I can help you with your marketing, your growth strategy. But obviously, if you got $500,000, how could you really leverage that? Going back to your analogy earlier about becoming a bank. So let’s dive into that. Let’s unpack that question a little bit. So someone’s hearing you saying become your own bank. And it’s an analogy, but it’s also real, right? So with banks, you have to pay back loans, you have to pay back interest. So are you talking about maybe someone having capital and they’re paying themselves back interest? Like, how would they stage that self banking?

. Let that sink in for a minute. The first 5000 years. So that’s going to be around for a while. Banks are about as old as artwork or music or cave paintings. They’re as old as it gets when it comes to human civilization. So the question really is whose side of the bankers desk are you sitting on? Because we’re already in the banking business, we’re just sitting on the wrong side of the banker’s desk.So how could we become a bank like the ones we know about? How can we become the bank again? Judo, martial arts. How can we not just avoid the banking business? But how can we actually use the banking function to become a banker for ourselves? And of all things in the financial universe? A tool that I’ve kind of stumbled across, of all things was a modernized form of whole life insurance. Strangely enough, if it’s designed properly, not for the death benefit as much as the cash value, the living benefit, the money you can spend on this side of the grass. If you built that thing correctly with an adviser who did it right for you, it does some really interesting things that really builds cash and can be used like a bank. If you want, I can do a quick tour of what that tool can do, but how it’s helped me and help some of my clients.

Well, I’m thinking about it because obviously I’ve had active insurance licenses in multiple different States and I understand the philosophy between whole life and term life. Right. So in one side of that spectrum, people always uniquely taught to buy what you need, pay the extra and invest the difference. So on the other side of the coin, you’re talking about merging those two worlds together. You’re talking about get what you need and also use that capital that’s being invested on a monthly basis as extra capital to utilize for something else. So to answer your question, I’m like, definitely just unpack that a little bit because again, there’s two sides, two different philosophies in the financial world.

As a Dave Ramsey fanboy from a long time ago, that’s what I got drilled into me every day. Primarca Al Williams, the whole bit. That’s where by term insurance and invest the rest came from. No one knows what the rest is. They just know they’re supposed to invest the rest. What ends up happening is you buy term insurance and then you use the rest at the grocery store or at the restaurants. That’s typically how that ends up, right? Most people. But what we’re doing is we’re flipping it on its head. We’re not using life insurance for the life insurance, although that’s certainly there. What we’re doing is we’re cutting the expenses of the life insurance down by about 70%, cutting the commissions down by about 70%, and we’re flooding that policy with liquid equity money, wealth, money you get to spend rather than your heirs get to spend. So it’s building up a cash value, which is cash value is sort of like equity in a house. So back to term insurance and whole life insurance. And then how does this fit into banking? Term insurance is like renting for a while and you can rent an apartment and there’s nothing wrong with renting.And everyone should probably have a season in their life where they do rent, but the landlord will start to raise the rent on you. The longer you stay there, the stuff gets less and less valuable. The water heater starts breaking, whatever, and you have no equity that you’re building up in that term insurance policy. And in fact, 99% of term insurance never pays out. It expires. So on the other side of the equation is whole life insurance, which is more like owning a house where the house payment never goes up, it stays flat, so it gets easier to pay with inflation. You’re building up wealth inside your house called equity. And unlike a house, however, whole life insurance grows guaranteed. Nothing guaranteed about a house. So I’ll say this in four quick little statements, TGIF, just to keep it real simple for folks, whole life insurance, if it’s designed the bank on yourself way, can do four things. T stands for tax free access to the cash. If we design this thing correctly, it’s going to have massive cash value and you have access to it. With no taxes due, the tax law says you can get the money out of the policy.

Both principal and gains can be accessed totally tax free. So it’s like a Roth IRA without any restrictions. Like Roth IRAs have no income, phase out, no contribution limit. You don’t have to wait until you’re 59 and a half. You could put the money in this month and have access to the cash value next month. That’s pretty cool right there. The G and TGIF stands for guarantees. It’s built on a system of guarantees. Unlike the stock market, real estate market, whatever else, it grows on a guaranteed basis every single year. The cash value is more this year than you had last year. Guaranteed. It’s not my guarantee, thank goodness. Who am I right? It’s the insurance company’s guarantee. They’ve been around for over 100 years. They’ve never missed a guarantee on their promises. That’s why they’re still in business for over a century. So I just, like, mind blown when I say that because they’ve been through multiple pandemics at this point. That’s how old these companies are. So third option or the third piece on the TGIF. I. Stands for insurance. And it’s insurance. So we’ve got access to that money for my family if I do pass away, which is awesome.And then financing guys were already in the banking business, as mentioned. But when you borrow from one of these policies, you’re able to borrow the cash against the policy. But when I do, that magically, it continues to grow and compound as if I had not borrowed the money. So let’s say I got a hundred grand in cash value, and let’s say I want to go buy a car. Well, I got a couple of options. I can use a regular banker down the street and pay him some interest don’t like that. Or I can pay cash for the car. I don’t like that either, because now I’ve lost whatever interest I would have earned on that money if I just withdraw from my savings account. It earns me nothing once I withdraw it. Or I can borrow from my policy. And again, I’ve got 100 grand in there. I borrow against that 100 grand to pay cash for the car. But my policy still continues to pay me a full guaranteed interest and dividend on the entire $100,000, as if I had not touched the money. So to me, that solves the biggest problem in our financial life, which is we keep breaking compound growth.We either pay cash, which is a big problem, because we keep breaking compound growth, or we’re paying compound growth for the bank down the street. Neither of those essay helps us grow our future. It’s helping somebody else’s bank. So again, headwind tailwind. Let’s go from the headwind coming right at us, paying interest to banks, not just wait until the wind dies down. That’s paying cash for things, but let’s get the banks function at our back. And now we can really make some real progress. We can pay ourselves the interest we would have paid the bank down the street.

Got you. So anyone that’s listening to this episode right now, I think Mark single handedly just made insurance sexy again. Right?

Sorry, I’m already married guys.

I just want to kind of like if you listen to what he was saying in comparison to term and comparison to the whole in comparison to the bank. Essentially, in the simplest way of transforming what he said is utilizing a whole policy as a banking system to leverage the capital that’s already sitting there taking that money out to make your purchases and still having that whole policy grow using compound interest. It’s like the best of both worlds. I’m surprised it’s not illegal, but by defining it that way again, I think he definitely makes it very sexy. And it’s kind of one of those things you kind of have to stop and think about it. You have to really recap and relisted to what he said. And then the next part is like, questions, take action on that. Like dive into it. Just don’t listen to this podcast and then don’t go do anything about it.

Amen, man. Yeah.

So going to the next question, obviously, you’re a wealth of knowledge. Like you have all this information and someone listening to this podcast, and it’s like, who’s this guy, Mark? Where did he come from? He’s just overnight success. But in reality, how long does it take you to get to where you are currently right now?

Well, every breath I’m taking, I guess I’m a little bit older. As they say, life is like a roll of toilet paper. The more you use it, the faster it goes. And you’re right, it’s one of those overnight success stories that happened over 30 plus years, I guess. But no, I’m still growing. We’re all still growing. You know, never feel like you’ve arrived. It’s just you find right mentors. You know this very well. You find people who can blow your mind, people who can give you a new way of thinking and a new way of living, even more importantly. And then you just keep working one step at a time. Yes.

So if you had to put, like a date on it, are you more of the 20 year conversion? Ten years. How long have you been in this space to get to where you are?

Sure. Okay. So I was definitely a Dave Ramsey fanboy when we graduated College. That was in 2008. And then I remember it was kind of an AHA moment when a mentor of mine, he’s just a College Professor. He didn’t have any skin in the game. But I think he saw that we were so stressed about our student loan debt, and he came to me and he said, well, Mark, is it possible Dave Ramsey could be wrong about something? And I never let that even cross my mind. For me, Dave Ramsey was sort of akin to writing the Fifth Gospel. It was just clear to me that everything he said was like speaking from Mount Sinai. But no, honestly, we had to come to terms with the fact that we had not thought critically, hadn’t done critical thinking with the voices on the radio and sometimes the voice on the radio doesn’t always know you personally. And I’ll mention this too, guys don’t just go start a whole life policy just because you heard it on even this episode. I would say very clearly there’s over 4000 life insurance agents in the United States. That’s one for every 800 Americans.

So not all of those insurance agents know what we’re even talking about right now by a long shot, right? Maybe 90% of them have no clue. They’re still thinking about life insurance as death insurance, as some people call it. So again, if you want to do this right, you’ve got to make sure you’re listening and acting with mentors that understand and know who you are and what your needs are, what you’re trying to accomplish. Because again, it’s not a perfect fit for everybody. Even this cool strategy is not something I just recommend everybody run out and go do. But you want to sit down, talk with the right experts and know who influences you and make sure, of course, that they’ve got your best interests at heart.

Yes, I think in addition to that, I think the numbers are probably even more extreme than that. You’re talking about 90%. But even within that margin of insurance agents, majority of them don’t even have access to whole policy. Some of them are term only. So that number even becomes even more extreme. And then it’s part of what kind of whole positive, like universal is it? So you kind of want to look at that number as even a more smaller percentage, probably like a 1% of 5% of insurance agents that even know what the hell you’re talking about right now.

Yeah, exactly. Well, and I’ll tell you, I’d be happy to chat with folks if they just want to jump to me. But if you want to do some research on this, there’s a classification and a certification known as bank on Yourself Professionals. And that’s a financial credential. There are hundreds of credentials out there. Certified Financial Planner is one that I went through. It took me a few years, but I’d say along with the CFP designation, nothing was as hard for me to attain as the bank on Yourself Professionals designation. There’s about 200 of us in the United States and Canada, and it’s sort of like the USDA organic label. You know, you may not know all of the 30 Hoops your organic food had to jump through to get that label, but you just see the label and you know, okay, that’s got all the things I want in my food, whatever. And the same is true with bank on Yourself. You may not know the 30 things that we need your policy to be engineered in what company to use, make sure it’s mutually owned, make sure there’s nondirected loans on the policy. All you might really need to look for is in their email signature to the insurance or financial adviser.Does he have the work? He or she have the words bank on yourself in their email signature. So that’s just a simple way you can look to see if this thing’s being done right for you. Wow.

So dropping even more insight and information. So let’s just go back to your analogy of flying a plane. Right. And let’s say we’re taking up the speed numbers. Right. We’re going past the speed of light, which allows us to essentially travel back in time. If you can go back and I’m not going to say you’re going to go back and change everything. But if you can go back and whisper in your ears at a younger age, what would you tell yourself to do differently?

Man, don’t listen to the man on the street arithmetic. And I’ll say person on the Street, I guess, but don’t listen to the average advice. So case in point, I really bought the fact that you could just fall off a horse and get 12% a year in the stock market. I bought that. I bought it, you know, hook, line and syncer. If I could go back and just give I’ll share this with your audience. Maybe it’ll be a kind of a wake up call to them. Let’s say, for example, that you invest $10,000 into my special magical mutual fund. $10,000. You give me $10,000 and I do a wonderful job. And here it is. The first year I make, I double your money. So your ten grand went up all the way to $20,000. Still with me on all this so far. All right, then year two, we started with 20 grand, but, Oops, I lost you half of your money. Yeah, 20 grand goes back down to ten. Now we’re two years later. Do you feel any wealthier?

Technically, you’re not.

Yes. Technically, no. You started with ten grand. You ended with ten grand. But we just gave you a 25% average rate of return. You went up 100. You came down 50. You divide that by two years. That’s 25%. Guess what? I get to advertise that. I get to tell the world that I just got you. I can’t say your name, but I can say, hey, my clients got 25% over the last two years. Mutual funds are allowed to advertise average rates of return. It’s a myth. The real return was 0%, right? So one of the things I’d go back in time and try to convince myself of is do the math. You know, don’t just take their word for it. Learn and ask yourself. And maybe this is me talking to my former self here, too. Figure out what you want your money doing for you, because where you put your money makes it act different. And if it’s in a 401K or if it’s in a hedge fund, or if it’s in a non fungible token, or if it’s in Bitcoin, or if it’s in an annuity, it’s all going to act different. And that’s okay.Real estate whatever. It’s all different. And there’s no right or wrong. Every financial vehicle has a purpose. But ask yourself, does where my money lives right now align with my values? And is it helping me accomplish my goals? If I’ve got a business I’m trying to start, I’m selling widgets or cupcakes or something, but all my money is tied up into an ETF fund over here that doesn’t mature until 2040 or something. Then I’ve got conflicting interests. I’m acting against my beliefs. I don’t really believe my business is going to thrive if all my wealth is over here in this exchange traded fund or an annuity or something else that doesn’t align with my values. So point being, figure out what you want your money doing for you, and let that money leverage that money to move closer toward your goal. Starting your business, sending your kid to College, paying off your debt, whatever your goal is. So let that money align with your values. Too many of us don’t do that, which is okay. I mean, I want a six pack, but I also really love ice cream. I work against my beliefs all the time, but realizing that and then making steps toward figuring out what you want your money doing for you might be a 25 minutes brainstorming.I’d be happy to do that with folks, but it might be 1520 minutes on a Journal and you save yourself a world of hurt. Either you’re going to tell your money what to do, or other people are going to tell you what you need to do with your money, and then that puts them in the driver’s seat, not you.

It also gives them advantage to make wealth on top of your wealth that you didn’t even know existed.

That’s it, man. Yeah.

So going on to another question. Obviously, your entrepreneurial side is very business savvy. You went through the training, but it kind of makes me want to ask you the question. Did that come from a predecessor or a family member? Are there any entrepreneurs in your family while you were growing up?

Oh, man, I love thinking back over some of this, and I think all of us can look back and figure out where the entrepreneurial bug first bit us. And yeah, I guess if we dug into other family members, there were some other family members that tried it out. Try and fail sometimes, but try again. I don’t know if this would be the case with most business owners, but one parent of mine was kind of the day job, nine to fiver. The other was the serial entrepreneur. But I remember I really remember the moment when the bug really hit me or bit me. It was walking down Michigan Avenue, debt on my back, trying to figure out how we were going to pay the bills that month. Income was dwindling after College. They weren’t exactly hiring folks with my degree or my wife’s degree at the time in 2008 and I was walking into getting denied from Chase Bank and other bank teller jobs and whatever. And I just really remember thinking do I want one boss or do I want 1000 bosses, all of which I could fire one or two of and not feel a thing.And it was my wife really that kind of pulled on my ear lobe and said let’s do this thing, we can do this. So she really gave me the nitrous oxide to let that plane start running down the runway to make that metaphor even more complete. Airplanes are not efficient in the first mile or two or even half the journey. Really. If you think about it, starting a business is one of the most risky and inefficient things you can do with your finances. And just like that, I wouldn’t recommend flying your airplane to the grocery store today. It’s just not efficient. Get in your car or take a bike or whatever, but don’t fly your airplane to the grocery store. However, if you want to go long distance, if you want to go long range, the airplane will fly in a perfect straight line directly to your destination. But a car, it’s got to go up and down and left and right and north and south and stop at this red light and pull over for this gas station. That’s a very inefficient way to get across the country. And just like that, the business and the entrepreneurial spirit takes some time to get going.But if you’ve packed your provisions, you got your back stop, you got your spare tire, etc. And you’ve got the cash on hand for any emergency that might come up. Then you start running really start becoming more and more efficient. An airplane gets more efficient every mile it flies because it’s burning fuel behind it and it’s overcoming inertia. So again, if you can find ways to become your own boss and to become your own banker and to take back the functions that have been outsourced by too many of us into your life or your business, one step at a time, you figure out, hey, I can do this thing. I can become a little bit better at this money thing or I’m not afraid of this money thing anymore and it becomes fun. And yeah, I’ll use your word, man, sexy.

Definitely. So I think that’s definitely solid information. And I think in this episode you brought up your wife a couple of times and it seems like you guys had a joint journey and you guys got graduated at the same time and she’s in your left ear saying okay, we can do it. So my next question is based upon that, how do you currently juggle like your work life with your family life?

Well, sometimes the balls fall down. I’ll just be clear about that. But I’ll say one thing that I’ve really found for me, it’s a personality thing. But this book that I use, some people might also know about it. It’s called The Full Focus Planner. It’s a really cool little Journal, a little different than your typical reflect on your feelings, although I try to write some of that down in here as well. But what I really like about this Journal is that it’s got these different domains in your life and you can set a goal. I’m kind of a goal geek, so forgive me if that’s not your cup of tea, but every domain in your life I’ve got here spiritual, parent, intellectual, social, emotional, business, physical, marital, financial. So maybe put yourself down for a goal on at least half a dozen of those every quarter, every year at least. So you’ve got a marriage goal. There’s no revenue in your marriage. Hopefully once it’s that kind of marriage, hopefully not. But put yourself in the mindset that this is a goal that you are just going to be as passionate about as you are with your business, which has very acute feedback.Your business, you know, every week, every month, every phone call if you’re winning or losing, but it’s a lot more of a slow burn with your children or your friends or your marriage. And I’m certainly not an expert on this. Still learning, failing, but find a little way for you to know the mile markers, figure out if you’re moving in the right direction or the wrong direction.

Got you definitely insightful and just playing off what you said. Obviously, if you’re giving money back to a marriage and we’re talking going back to the Sally Mane and you’re giving her alimony, you’re going to have to figure out how to make that. Cut those ties as fast as possible. You’re very structured, you’re very analytical, but you’re also very creative. So what does your morning routine, your morning regimen look like?

Well, you got to keep asking, is this still working for me? So don’t take my stuff as just some sort of cut and paste recipe. But I love my mornings right now. It’s been a lot of fun. I get a lot of joy out of the time I spend. I’m kind of an early morning dude. And so fireworks. We’re recording this right after the 4 July here, guys. So fireworks last night, I was like, okay, I’ll see you guys in the morning. So, yeah, I have a great morning routine. I get up, read some scripture, do some journaling, pour myself some coffee, try to get done more before the sun comes up. And what most people can do in a day if I can help it. And then I try to work out six days out of the week and spend some time with my daughter, my wife have a little time with them, and it works right now until it stops working, then be ready to change and pivot like most things in life.

Wow. So going into that right the next question that I have. And I’ve been looking at this bookcase. And for those that are listening, he has this bookcase behind them. And it’s showcasing books. And you guys know, as much as I love books is the reason why I created the Boss Uncaged Book Club. So this next question is a three part question, right? And you can turn around and reach to that bookshelf whenever you’re ready. First part is what books helped you on your journey to get you to where you are. The second question is what books are you actively reading right now? And the third part is, have you had an opportunity to write any books?

Okay, so the first book I’ll mention and maybe relevant to our topic today, there are tons of books that influence you over your lifetime with field quote. Creativity is just for getting your sources. So I’ll try to remember at least a few sources here. But there’s a great book out there. It’s right behind me, actually. “The Bank On Yourself Revolution”. Great book for a mindset shift on how money flows and how it really works, how the wealthy are using the banking function in their life. So check out “”The Bank On Yourself Revolution” by “Pamela Yellen”. Book I’m reading right now that’s been absolutely blown my mind is “The Road Less Stupid” by Keith Cunningham. Great book on business consulting and just not being stupid, which I have seemingly a warrant to do too often in my business. And then a book I’m really thankful I got to co author is a book called “How to Be an Amazon Legend and Fire Your Banker”. It was a book on this topic of firing your banker and becoming your own source of financing through the lens of ecommerce business owners. So a lot of folks who are just blown it up online right now in a good way.How can you run your inventory through your bank rather than somebody else’s? How could you run your taxes through your bank rather than somebody else’s? How can you set up a golden parachute out of your business someday so that you’ve got a large pool of contingency cash or when you sell your business or when it finally is time to retire the business so you don’t just have all your net worth tied up in the business? So there’s a book about that, how to Be an Amazon Legend and Fire Your Banker. I got the privilege to write that with Danny Stock about a year or two ago. And by the way, I’d be happy to give that book for free to anybody who reaches out if they’re of interest and want to learn more about that topic.

Well, you got your first contestant standing up to the show right here. So obviously, I love reading books. And the list of books that you just lift off, including your book, is definitely something that I would definitely like to recommend for the book club. And having access to your book would definitely be fruitful.

Thank you. I’d be happy, too.

So with that, I mean, you’re talking about legacy, you’re talking about building wealth. You’re talking about not only building what, you’re talking about managing the wealth. So ideally, you have a strategy for yourself and for your family. So where do you see yourself 20 years from today, man?

Well, you’re right. I got to say this not your average financial planner means that because I have had the opportunity or privilege, it’s a humble honor to get to meet with people all over the world and look into their finances, to ask humbly about what concerns them, how’s their retirement account coming? I will tell you, the investment advisors, because I meet with investment advisers and financial planners to look at their stuff, too, to look at their retirement plans. And I can’t tell you, I can’t think of a single example where they were eating their own cooking, where they had their money in the same stuff that they were advising their clients to put their money into. So that’s maybe a side note or a little extra goodie here for your audience. When you’re interviewing a financial planner or investment adviser or whatever they call themselves, ask them what’s in your portfolio. Just ask them that question, see what they say. And may I see your account sheets? I’m showing you mine. You show me yours. So that’s just a side note or an extra credit to answer your question 20 years from now. Again, thank God my wife and I sat down about 1012 years ago and we said, we want to write a contract with our future.So we set up a number of these whole life policies for ourselves, on ourselves, on our other family members. We built this portfolio that grow on a guaranteed basis. And just over the weekend, I was looking at that. I don’t do it too often, maybe two or three times a year. I was looking at the portfolio, how it’s coming along? And I can see when my daughter is going to be 18 years old here’s exactly what our net worth is going to be inside those accounts, guaranteed. How cool is that? Right. And so in 20 years, we’re going to be empty nesters, likely, Lord willing. And we’ll have the chance to be doing some pretty cool stuff, hopefully for the betterment of our little circle of concern and the larger human project that we’re all on here. So it’s small or large. I think the best thing I can say is that I want to be further along on this journey of being able to communicate well with other people, to help them think different about their money, their own private personal economy and their future. I think, yes, we can vote, yes, we can influence things at that scale.But, man, the real change happens at the you and me level. And I’d love to be a part of that solution. In fact, wouldn’t it be cool? And this is written on one of my mission boards is not through my efforts alone, but what if we as a collective could change 10% of America? What if 10% of America had their own personal financial system, their own bank? What if they were doing this banking thing I’ve been describing? If just 10% of America became their own source of financing, what would happen to credit cards? What would happen to the Federal Reserve? What would happen to banks? What would happen to Sally May and her cronies? How many more marriages might we save? How many more kids could go to College if we were our own banker? The whole world would change if just 10% of America did it. So that’s me in 20 years, it’s still working on that project, still beating that drum. Yeah.

I mean, even with that, I think with that plan of strategy, I think that some of the equity that you’re saving are you going to have to buy security? Because I think the government may be looking for you at that point in time, because you’re talking about essentially upsetting the current status quo of the economy in today’s world. And that’s what bankers and the government are utilizing to self perpetuate the money that they have in the system right now. So with that, that opens a whole another Pandora’s box. Right? Is that something that you really want to go down that road and kind of see what happens, or do you have a strategy to support that fallout as well?

Well, the word that I absolutely don’t want on my gravestone is the word potential. Potential is a great word. It sounds so cool. You know, he has such potential. But a rocket on a launch pad has potential. A rocket on the launch pad has tons of rocket fuel potential take you off into space. But if 30 years later, that rocket is still just sitting there, that’s regret right there, that’s regret embodied. And so the worst word on my gravestone is the word potential. So if I can spend it, if I can spend it, I don’t mean to pick a fight with the largest military operation in human history or anything, but, hey, why not give it a shot? If nothing else, at least we fail and we get 9% of America to become their own banker. So that’s okay, too. And yes, you’re right. It’s definitely something that has unintended consequences. But better to be a part of that revolution than to be a tennis ball floating down live Scutter and ending up where somebody else wants me to be, as opposed to where I’d love to be, if possible.

Nice. So, I mean, with that, I’m still talking about legacy. And this is one of the reasons why I created my podcast was to leave behind, like, my voice and my reasoning and my thoughts for my family and for other business owners. And I wanted to commend because Breadcrumbs right. You’re doing the same thing. You just released your 200 episode. Right. Obviously, kind of like I’m in that tracking stage of my podcast and we’ve been blessed to be in the top 1.5% of podcasting. So I looked yours up and there it is. You’re right there with us as well. But you have 200 episodes. So I just want to talk about, like, why did you get into the journey of podcasting, being that you’re so influential with numbers and you understand numbers so well, what made you go into the communication space?

Yeah. How easy is it? We’ve been doing a little math on this show. How fun is it to try to do math and numbers over a podcast? It’s not exactly. Maybe it’s a secret way for me to avoid having to do a bunch of complicated spreadsheets. But if you’ll go to our show, we’ve got about two or three dozen of our episodes jam-packed full of spreadsheets in the show notes. So I actually love spreadsheets as a default. But anyway, I’d say, yeah, just commitment. I mean, you know this better than me, that it’s long persistence in the same direction, long persistence in the same direction and deciding, hey, podcasting seems like it’s a cool medium and I have a face for radio, so let’s give this thing a try. For me, it’s been a lot of fun. And as you know, it can be a great deal of fun. And unfortunately, folks are recording these on video, putting them on YouTube. So forgive me, but, yeah, it’s been a lot of fun, man. How has it been for you? I mean, you’ve made this decision podcasting as a medium and as a business model. What’s it been like for you?

It’s one of those life changing events that I wish I would have got on the bandwagon earlier, especially since I was always into media. But I was in the global media. So niching down to podcasting. It kind of it fulfilled all my requirements ten times easier, ten times faster with a lot of dedication to support it.

Yeah. Well, keep up the great work. I love what you’re doing, and I love that you’re leaving Breadcrumbs. I mean, aren’t we just living in the future where we can even have this conversation, not only with each other over the internet like this, but to be able to have this conversation with so many others listening and also for our families, posterity and more. It’s a great gift, and I hope we don’t squander it. It’s an opportunity to change our family tree for generations.

Yeah, definitely. So going into I’m just trying to think of so many different questions I could ask you. Right. And I mean, time is limited, but tools. Right. Software. What tools do you use on a day to day basis that you would not be able to do what you’re doing without?

Well, let’s just go ahead and put Excel aside, because basically that runs all the time on my computer. I’ve been really a big fan of some of these web automation tools. I’m a big fan of Zapier. You probably know Zapier. It’s a fun little tool. And I like Text Expander. That’s been a fun one, too. I read the other day. It saved me 10 hours of typing time last month. So that’s a full day and a half almost of my work. I got that time back. So Text Expander is a great tool, too. What about yourself? Tell me something. I love this stuff, too. So what do you find?

Yeah, what I’ve been really falling in love with lately is the headliner tool. And it’s a headliner, right? And in addition to the headliner is Copy Smith. And Copysmith is kind of like a new underdog on the market that uses AI to kind of artificially write content. But I love it because I could write content and I could run it through Copysmith and it could rewrite my content for me in a different parade, in a different phrasing. So I ended up with two types of copy that I could utilize two different market sectors.

Wow. Now you got my attention, man. That’s awesome.

So thinking about it, right? Let’s say I’m in my early 30s, or let’s say I’m in my late 50s and I’m listening to this podcast and I’m hearing all this insight I’m hearing about whole life. I can use my whole life as a bank. I got to figure this thing out. What words of wisdom would you give to an individual that’s eating up everything that you’re seeing on this podcast? How would you influence them to move forward to the next steps?

Well, again, ask yourself, what’s the one thing I can do with my money? Such that by doing it, everything else becomes easier or unnecessary? I’ll say that again. What’s the one thing I can do with my money such that by doing it, everything else becomes easier or unnecessary? Let that sink in for a minute. Where your money lives will either improve your answer to that question or will make it harder. Again, I can’t get past most people have their money tied up in their house, in their 401K. Why? Because they’ve been told to. Because that’s what they were handed when they got their day job. Here’s your 401K binder. Sign here. Sign here. Go sit in a cubicle. We’ll see in 40 years. That’s not the life I want you guys to live. What’s the one thing you can do with your money right now? Today, this moment, such that by doing it, everything else becomes either easier or unnecessary. If your money is in a whole life insurance policy designed the bank on yourself way, that’s crucial. If it’s designed the bank on yourself way, it’s unnecessary to have to worry about what the stock market is doing.I don’t even know what the stock market is doing today. Maybe it’s off today with the holiday. Who knows? It doesn’t matter. My money is locked in and guaranteed to grow for me every single year. Do I have to worry about calling up a bank and getting approved for a loan? No, I don’t. It’s unnecessary. Retirement is easier and saving or investing in the stock market is unnecessary. Do I still do it? Sure, I’ve got a little money here and there. Have a little fun. But by putting your money in something that makes the rest of your life easier, it’s just going to make for a better outcome. It makes for a more sane life. Think about it. If you’re stressing over the stock market now, what’s it going to be like when you’re 55 and you’re stressing what’s it going to be like when you’re 65? You’re no longer working and the market crashes because you still got to pull money out of that IRA for grocery using the grandkids and the markets crashing. We call that double pain, right? So if you want to think about easier or unnecessary, decide now where you want your money to live.And whether you’re 35 or 55 or any age, it’s not too late. These whole life policies are not designed with the death benefit as the primary focus, although that’s there again, you can be 70 years old and still start one of these policies. You just had someone do that last week. They’re in their mid 70s just starting a brand new policy, and they don’t have a ton of time to waste. So they just dumped it all in as one lump sum 300 boom. It’s all in the policy rate of rock and roll, and it instantly creates a legacy for their family. It instantly creates multiple hundreds of thousands of dollars that they’re going to use for real estate investing and of course, takes care of them in their older age as well. Just decide for yourself what you can do with your money so that the rest of your life is financially more solvent, easier or unnecessary.

So all that insight that you just developed and dropped on the listener, how can they get in contact with you? How do they find you on the wide web?

Well, you guys can definitely check out our podcast, Not Your Average Financial Podcast. It’s been a lot of fun and love to date you first there if you’d like. If you want to find us or meet with me. Happy to chat. I offer a 15 minutes consultation and I’d be honored to send you the book “How to Be an Amazon Legend and Fire Your Banker” as a Result of that. So you can go to bitly/quickboy, stands for bank on Yourself. So the link is bitly/ Quickboy, and that’ll get you to everything you need.

Right? So going into the bonus round, right. And I always like these questions because I know that your answers are going to be uniquely different to anyone else’s. Right. So first question is, outside of your family, outside of your direct and immediate family, what is your greatest achievement to date?

Oh, wow. The greatest achievement. I really do feel like the moments when you can say to yourself, all right, I actually had an actual thought and decided to act on that thought. That’s where I feel like achievement really happens. There’s an old quote, 20% of people think, another 20% of us think that we think, and the rest of us would rather die than think. And most of my life, I probably was in that last pool there. But it’s in those moments where I was actually thinking and crucially took action when I realized Dave Ramsey might be wrong about this whole life thing. And I took action to set up some policies and pay off my debt. That’s where I’m most proud of achievements, whatever small they might be.

Interesting. Definitely. Very interesting. So going to the next question, and again, you said Dave Ramsey a couple of times, but I have a feeling it’s not going to be him. So if you could spend 24 hours with anyone, dead or alive, uninterrupted for that 24 hours mono Amano, who would it be?

And why man Rockefeller, can I say John.D? He is still adjusted for inflation, by far the wealthiest person in America anyway, that’s ever lived by far. So what did he do? Well, he took all the sludge that the rest of the kerosene industry wasn’t able to use and coal and so forth and turn it into kerosene, which lit America before electricity. He then took the sludge from that and turned it into Vaseline and 15 other different inventions that we all take for granted today. He made the world much more efficient, whatever, beautiful, whatever, clean, whatever. And yeah, he’s got his faults. But one thing I feel like you really got right was he didn’t just do that. He lived well beneath his means. And he set up a family foundation for his whole family. And by the way, not to harp on this, but he started a whole life policy on all of his kids, grandkids, everybody. And even to this day, the Rockefellers are still some of the wealthiest in the world, and they still start policies on each one of their kids and grandkids as they’re born. But what I just would love to do is sit down with him and understand how he got that kind of mindset.He didn’t come from wealth, but he took what other people were willing to throw away and turn it into something that was extremely valuable. And that intrigues me.

Yeah, definitely. He’s one of my alltime favorites as well. So I think one of his philosophies about understanding that you can execute things by yourself or you could have your efforts executed by hundreds of people. Right. So the 1% of 100 people equals 100% of your own efforts. If you have to really rewind it and listen to it, really take that apart. And he lived by that philosophy, and hence why he is as wealthy as he is until this day, like you said, because he’s executed that philosophy.

Can you say that philosophy one more time?

So it’s essentially instead of doing 100% of the work on your own efforts, it’s to utilize 100 people’s efforts at 1%.

Yeah.

So that equals the same equal 100%. But you’re diversifying it across 100 people’s efforts.

Love that, man. Yes, I heard somebody once say, if you don’t know how to start the lawn mower, you don’t have to cut the grass. So find somebody who can do it 80% as well as you can, and then let go. Great stuff, man. I love it.

So going to the closing, man, I think this was a hell of an interview. A lot of insight, a lot of humor as well. But this is the time. You’re a fellow podcaster, so the microphone is yours, the floor is yours. Any questions that you would like to ask me?

Well, what do you see as the future of podcasting? It’s going through changes as 2021 rolls on. Where do you think we’re headed?

It’s funny that you ask that question, because I always kind of want to look at history, right? History repeats itself. So I always tell people that are listening to podcasts and they’re like, oh, this is so great. It’s so new. It really isn’t right. I mean, radio is really the granddaddy of podcasting. So look at the history of that industry and then look at XM. What happened with XM? And now podcasting is essentially taking segmentation of both these principles. And the only unique factor that’s a difference is now the general public has access to creating radio stations, creating XM radios. So the next is like, how do we scale it? Right? And I think Clubhouse attempted to do that. Now we have Facebook and we have Twitter all going backwards, considering that they all had video before they had audio. Right. So understanding how do you monetize this? And I think that’s the next phase is like looking at how was radio really monetized? And we kind of have some of that going on podcasting where we have affiliate offers and we have commercial spots. But what does that really look like at scale when you’re talking about millions of people creating all this content?How are we going to really monetize this to the bigger goal? And that’s what I’m trying to figure out. Like, what’s the next step of monetization in advertising and podcasting?

Yeah. I think money follows value. So just as you’re doing so well, just keep adding such great value to your listeners, your audience, and money follows. I heard somebody once say, if you want advice, ask for money. And if you want money, ask for advice. Keep just asking people for advice and money. I think follows you’ll give them such value, they can’t help but want to support you.

Yeah, definitely. Well, I mean, I definitely appreciate your time. I think there’s a holiday weekend technically but we both had the opportunity to have a really insightful conversation and all the Nuggets and jewels and the humor that’s you deliver is definitely well appreciated.

Let’s go for some financial independence, man. It’s Independence Day weekend. Let’s make this thing real. Let’s make it legit. Let’s make it official.

As they grant over and out.

Leave A Comment