Boss Uncaged Podcast Overview

Boss Uncaged Podcast Transcript

S3E15 Jenny Vaz.m4a – powered by Happy Scribe

Alright. Welcome back to Boss Uncaged Podcast. So this is going to be like a uniquely different format. I’m not doing an interview right now. I’m not interviewing a particular person. What we’re going to do is do like a live discussion. It’s going to be like a topic talk and it’s going to be with Jenny. And to give you a little background who Jenny is. I mean, Jenny is one of these people. Like, once she dives into something, she dies head over heels. And when I first met her was just like literally a couple of weeks ago through a networking group. And it was through a common person that we knew and kind of hit it off. And then the first thing she said to me was like, NFT, NFT. And I was just like, oh my God, I love this woman. Where has she been? And then come to find out she’s on the other side of the world. So right now it’s 05:00 a.m. Her time, 04:00 p.m. Our time. So she’s definitely a trooper to get up this early, crack ass morning, early to get on this podcast. And earlier this week I did the same thing. She had a webinar and I think the webinar was something like 03:00. I woke up at 03:00 in the morning to get on her webinar and she was just delivering so many Nuggets. I was like, okay, let’s join these forces together and let’s just do a live discussion and just talk about NFT’s. But before we dive into that, I just want you to kind of tell people a little bit more about who you are so they can kind of get that synergy, get that vibe that I got from you that first time we spoke and just dive right into it.

Sure. Thanks. First S.A, big shout out to everyone who’s watching. And thank you for bringing me on the show. I’m so excited. I can’t believe how much has happened in the last two weeks since you and I spoke for the background on me. I’ve been in tech for 20 years, so 24. It depends the number of years we serve at University. And I’ve tried to leave it, but it’s one of those really great relationships that pulls you back. The beauty about tech is that it’s constantly evolving. And I always found myself in a position where I was helping people to understand it or helping people to translate what they needed to someone who is in the tech world as a business analyst, as a consultant. And even when I was working at Garden, I was there for nine years and working with the best minds in the world. The best minds in the world understood the tech, but it was them trying to get the rest of their business on board, saying this is a new direction. We’ve seen how tech has changed the world in the last two years. Look at all of us working from home. Who would have thought, right? We all be jumping on Zoom just to even speak to our family members. It’s now completely permeated every inch of our lives. It’s undeniable what it’s done. And now in this NFT space, which is this whole Webpoint 3.0 blockchain crypto, I’m hearing the usual words I hear whenever there’s a new tech rolling out. It’s a scam. It’s a Pond Day scheme. And I was like, come on, if people are making money, how is it possible? And I know that some really good people are making money, how is it possible they can be upscale or Ponzi scheme? So that’s why I decided to dive right into it and figure it out for myself. I made that decision in October of last year. Oh, my gosh. And I’ve told this to the people that I met on Monday in that session that I had. I don’t have enough time to get on top of everything. So it’s just completely being thrown at you. There’s so many meetings on Twitter, space on clubhouse, people doing sessions on eventwide and other rooms as well. Just really, because this is coming, this is happening. And then the third wave, and what else can we do? And so for me, this is where I find that this is the best opportunity for someone like me who’s done this before, being the translator to go. Let’s take this mainstream. Let’s make this easy enough for us to consume. And at the same time, we now know what the gaps are, where the risks are, and how can we better inform anyone else. It’s not part of the tech world. Most of us are not. But we want to catch this wave. So if you’re into catching this wave, this is where Esther and I decided we’re going to start spitballing some ideas potential of what we can do with the space and really just take you through. I wouldn’t say the tech, but really decomplex the tech, correct?

Yeah, I think definitely. I mean, just listening to your content on Monday and hearing the things that you were talking about, and then it dawned me. I was like, you had some pretty successful people in the room, but it was kind of like half of them had dare and headlights, kind of like this NFT thing. They keep hearing about it, and they keep thinking crypto. And then once they get crypto, then they get scared. But in reality, NFT, I always say NFT’s are essentially multiple different things. But starting with the premise of collecting, and if anyone has done any collecting of any single kind of any time in their life, then start with that. Start with something that you understand. So I want you to kind of talk about it a little bit. Like, I mean, you started collecting entities as well.

Yes, I did. And one of the first things I spoke about in my session on Friday and on Monday was, what’s your risk profile? Let’s start there. My risk profile. Whenever I’ve met with an investment consultant, my risk profile has always been medium. I’m not someone who jumps really head on. I’m not willing to take high risk in projects that are unfamiliar. I want to see how the project has been doing for a few years. I want to see what the stats are. And then I want to understand a bit more. Where are they investing? Where’s the money going? What’s one of the reasons you’re doing so well of doing poorly? And that’s me putting on a business hat in a way, from working with understanding why people want to do what they want to do with tech. That helped me to also clarify how I make decisions on investment. So I came out saying, all right, I just want to know what it looks like to buy my first NFT. And I went into Reddit. I was just sniff out the Reddit boards to find out what’s happening, what’s not, what to look out for. Loads of people who tell you what to spam, what to avoid. So I thought, okay, ready to be a good source? Went in there, and I saw someone they were sharing about their NFTs. I’m selling this looking for bias. Is this the first time I flaunt my art? I’m like, Cool, let me go check you out. So saw them on Reddit, and it was the same user ID that I saw on Opensea Marketplace. For those of us who don’t know that, it’s kind of like your Amazon for NFTs, one of the many Amazons out there for NFTs. So I went into Opensea and I thought, oh, I went through they had maybe eight pieces, this artist, Ocean Life, two or seven big shout out to them. I said, oh, very cool. They created this art. There is no game or anything behind it. And I was really attracted to the one particular piece, and that allowed me to just make the decision of, all right, let’s see how to what happens when you buy a piece of energy and then you learn there’s something called gas prices everywhere. As such, no one talked about gas prices. And suddenly he was like, why am I paying $200 for something that costs five? And that’s when you start researching. Oh, so there was something else I didn’t know. And that was how I taught myself how to buy an entity. And then what else is there behind these entities?

I think it’s definitely interesting. First, I want to commend you because most people, they’ll hear about something, and then by default, they’ll stop. And then the fact that you got hit with the gas fees, and then you’re like, I never even heard of this thing. And this thing costs more than the product that I’m buying. And then they stopped. But for you again, you’re not an early adopter, but you’re kind of like you’re more vigilant to say, I want to dive into that space and to purchase this to kind of see what the process is so that I can help other people. And I think once people understand what gas prices are and it’s not associated to a gas pump, it’s not associated to, like, renting something and getting a late fee. Essentially, a gas fee is just a pretty way of saying it’s a processing fee. They’re charging you a fee to process your transaction, much like what banks and ATMs do. Every time you go to ATM, you put your card in the ATM, you type out, and if it’s not your ATM, you have to spend a $2 fee to get that money out. That’s a processing fee. Gas fees are essentially processing fees as well. So to continue with that story, I mean, you’ve went to Open Sea, you’ve purchased an NFT, so you started collecting NFT. So now that you have the NFT, what’s the value of it? What can you do with it?

So with this particular NFT, I realized I’m actually a collector. I never knew that about myself. I don’t own a piece of art. There’s nothing on my walls that’s mine. I know some artists I started looking at who’s out there doing stuff about, Darley, can I buy a Dali? That’s an NFT. I love Salvador Dali. What about Monet? What of Monet? And when I started looking at, okay, maybe not so much, because the prices were really up there not going to go down that road. And then I started looking at other forms of artwork, and there was some really creative artists, people who were relative unknowns in the art world because their art pieces were hanging in some obscure Gallery that you and Irobably would not have been into in the last two years. And now they’re selling it rapidly. They’re selling a piece of digital art that’s a replica of the real art that they’ve created. And they’ve created this beautiful process where when you buy this digital art, I will send you a picture of the art, not the actual art itself, but a picture of the art that you can frame and hang on your walls. And a few months down the road, when I release my next art collection, you will be one of the first pieces to actually get the real art, actual art in that next collection and say, wow, what a great way to grow your following. What a great way to just spread the word out there. And there’s so much to give as artists to create, artists create, and there’s so much to give. And now to just receive. Be in a position where you can receive. I thought that was a beautiful flex in the ecosystem of energies.

Yeah. I think you make a really solid point to comprehend what NFTs are. And again, there’s so many different aspects. Right now, we’re just talking about the collection aspect of it. But whether you were raised in the 50s or the 60s or the 80s, 90s or 2000s, at one time, the other, there was some collection of something, whether there was baseball cards, basketball cards, Pokemon cards, and all of these are essentially you’re collecting them and you get into like a rare card, like someone that collects Pokemon. They want to collect the rarest Pokemon of all time that has all the powers, all the glitz and glamour, and there’s only three of them in existence. Versus someone wanting to get the first rookie card of Bay bruth or a Michael Jordan rookie card, then you can start to see, like having ownership of a car that’s so rare, then the value goes up, taking that definition and transferring it into the digital space. It’s exactly the same thing. And correct me if I’m wrong, what’s your thoughts on that?

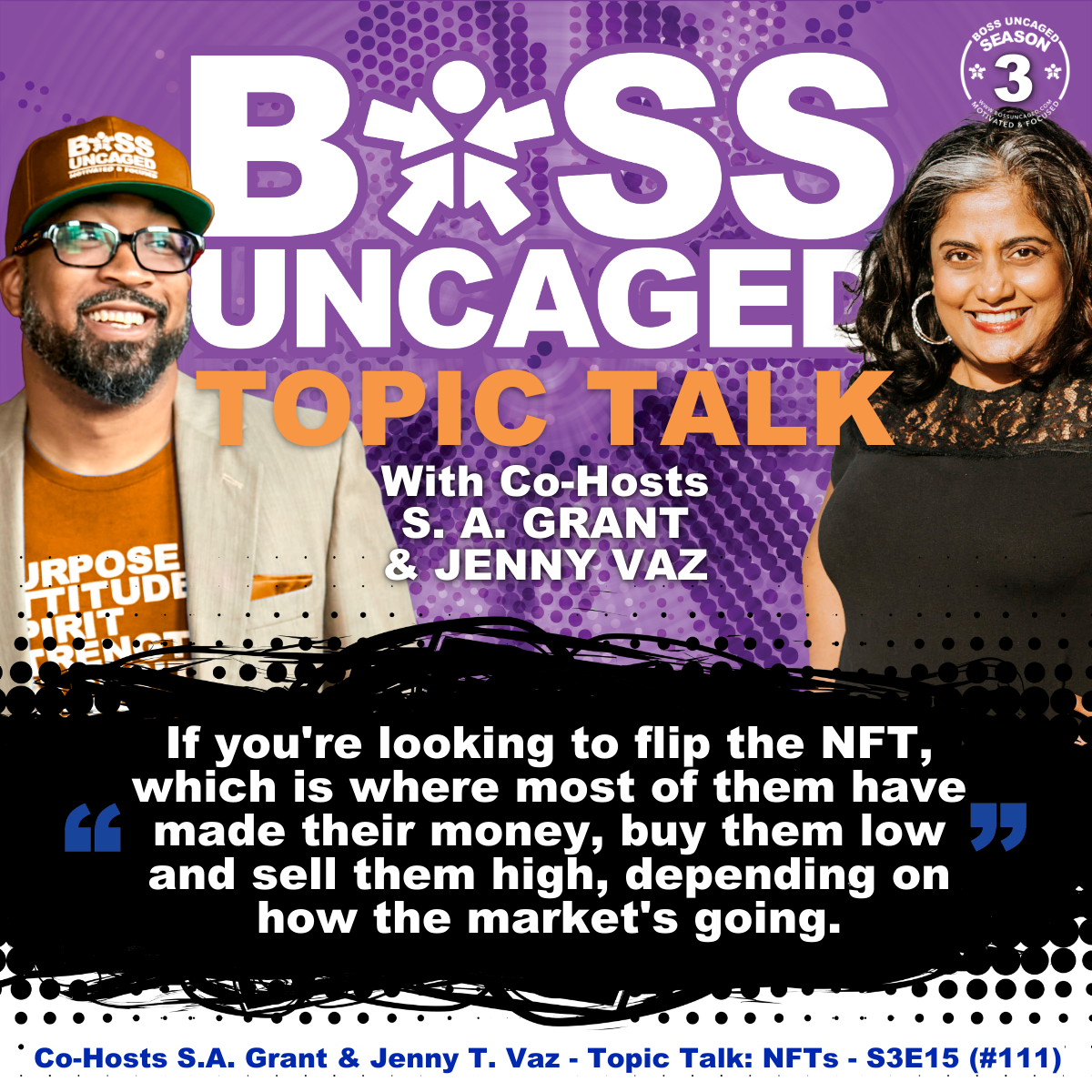

Totally. So one of the key features, if you’re out there and you’re looking to, you’ve got some crypto, you want to get some crypto and spend it. If you’re looking to flip the NFT, which is where most of them have made their money in the first and the second wage is by flipping NFTs, buying them low, selling them high, depending on how the market’s gone. You’re looking for these rarity, right? The one of a kind, because my second purchase on NFT was something that had like 5000 copies of it. So not very clever in terms of an investment, but I wanted to see again, I was testing out the ecosystem. It was a low price. I wanted to see what it was about, what’s the height? But when you buy something that’s right, you know, the value gets higher. Now you could be a collector who just doesn’t want to do any trade. You just want this cool it’s for your own satisfaction, for your own pleasure. Fantastic. At the same time, if you’re looking to trade, you’re looking to exchange, you’re looking to promote this piece of artwork or this collectible. Awesome. There’s also an opportunity for you to get on board. There are other platforms that do that. And one is Veve, and they showcase like your Warner Brothers, your, what do you call that? Your estimate from the Bond world. And so there are different types of Black Panther. They have different even the magazine covers. Remember your DC comics? They were so rare. And even then, even now, finding the most various copies from back when, even now, you can do that. And in the digital world. So if you ask me with NFTs, it’s art imitating life. And one of the best questions I got is why not just get the real painting instead of buying a digital that’s it. But how many copies of that are there? How often are you going to come across the clock Monet hanging on your wall? I’m not, not in this lifetime. But if I get, I can probably do a jigsaw puzzle. Sure, that will give me the satisfaction. But I know something about having a digital piece of taught money gives me satisfaction. And it’s not your boat. That’s totally okay. Find what works for you, find your flavor as a collector and see if there’s a market for you, or else go create one.

Yeah. And I think you brought up a solid point. It’s not about necessarily following the trends of just collecting. To collect, like, you have to, first of all, collect something that you would like that if you see value in it, then there must be another target audience that sees value in it as well. And then you can kind of follow and it kind of goes into, like, roadmaps. And those that don’t know what a roadmap is. The roadmap for NFTs essentially is like telling the story of what the NFTY could be used for, telling the story of where the entity could be down the road or how is the value going to be increased in the next year or six years or even ten years down the road. So actually understanding the roadmap and understanding collecting, then you can start to see kind of how the value. And again, we’re only still talking about the collecting side of entities. We haven’t talked about a real estate. We haven’t talked about, like keys. And we’re going to talk about these things as we progress. But I just want you to kind of understand, like, if I say I have a new product and my new product is Boss Uncaged podcast. When I first started this podcast, I was talking about my roadmap. I was saying, okay, in year one, we’re planning to interview a couple of people. Year two, we’re going to grow and scale. Year three is the same exact philosophy, but you’re applying it to a digital asset to say, hey, this piece of art, I’m going to be able to sell it now for this price. But in the next five years, I’m going to do X, Y, and Z to make the value of this particular art go up to this price. So then you can see your room to make more money a lot quicker.

Yeah, totally. And we talked about the road map. We talked about it being a collectible. Truly, the real value of entities is what else can I do with it? You’ve got a community who are Raving fans. When I was young, I love Elvis, grew up on Elvis. And if you told me today that if I bought an NFT for Elvis, and that gave me something about something that he did or maybe a piece of furniture from Graceland, Whoa, I’ll sign up, I will sell whatever I have. People like me. I know I’m not alone. I’m happy to say that we do have that. And so I know that I’m not alone. There are others who are like me. We are Raving fans. Even if the artist has passed. We do have these collectibles that are already in the market. You get them on ebay, they get traded on special domains. You have already community and they want to know, what else can we do? Is there an Elvis concert? Is there an Elvis movie that will get a screening to front row seat? Maybe you put me up in a hotel in Vegas or Greeceland. I’ll show up. Why not? I live in Singapore. It’s short flight. We will do it because we’re waving fans. So if you’ve got a strong community, a strong base, NFT has a strong potential for you. If you’re watching, keep watching.

Yeah. And I think it’s something that you brought up that’s a key factor. If you are a collector and you have imagined. Right. We have so many artists that have lived and created content art that have passed away. And the art has grown to where they never could imagine it being that valuable. Basquiat is one of those people, you know, Boschia was a millionaire in his day, but now his pieces of art sells for tens of millions of dollars. But imagine having royalties. Right. And that’s the thing that art never really had associated to it forever. You would pay for it, you would own it. You could do whatever you want with it, but the original artists would not get royalties from that. And then we had the creation of the music industry, and the music industry was like the real industry to kind of figure out how to give royalty payments to artists because again, they’re creating art, music, and then you have royalties. But now in today’s world, the NFT gives us you can be an artist to create art, and then you can eat off the royalties of your art as that art sells and sells and sells and sells again. And for me, as an artist, generally speaking, if you don’t understand entities, that statement alone should have raised your eyebrow. That statement alone should have made you like your heartbeat should have changed the rhythm of your heart. You should almost have like a heart attack in that moment to be like, wait, say that again. And I want you to talk about that a little bit about the royalties.

Yeah. So imagine this. And this is a particular topic that’s of interest to me as well, because we hear about this. Right. Arthur has missed out on their royalty checks. Some of them have died for. They didn’t even know that there was this massive fortune that somehow in that whole chain sequence of them producing the music, releasing and performing and putting it on a single, they didn’t get the check. How is that possible? But because of the way blockchain is organized, because the way it’s created and it records transactions, everything is permanent. It’s a permanent ledger. How many of us if you’re watching this, I use this example. You’ve used Excel. You created an entry in excel, and it’s a shared file. The next thing you come in, that entry is gone because someone else has come in and edited it and you can’t find it freaks you out, doesn’t it? Because, you know, it’s like a bit of a mindfulness. Like, I thought I put this in. What the heck is it? But with blockchain, the way it’s designed, it’s permanent. It’s not editable. It’s not editable. So you can see. So I’m an artist and I load up my NFTs. You know, right from the start, I’m the creator. I own it in a way, it protects my it. And so in using that as a basis, and I can start earning the royalties from it. So as it sells, I still earn. And that process is called minting, right? As it sells, I continue to earn. Why shouldn’t I? Why shouldn’t it be traced back to me? It takes out the middleman, it takes out the confusion. There was an artist who four years ago, I can’t remember her name. Now she loaded her music onto the blockchain. She was one of the first. So it’s possible. And with these marketplaces, you can load videos, you can load images, you can load music, MP3 files, all sorts. And we’re just at 2% of what’s really possible with entities. This one. What about USA? Have you bought NFT?

Yeah. So I started buying visual entities because, again, I’m trying to recreate my own 10,000 collection. So I got some entities in that space, and then I started following particular people to see how they do their launches. And then I also started buying there’s another whole aspect of entities called like, the domains. So I started buying, like, the Boss Uncaged domain NFT as well, because it only makes sense. Like, if I have Boss Uncaged, I should have the NFT domain. So looking into that space of owning URLs, and I want people to kind of go back and think about it as the 90s, early 2000s when people were jumping and buying all these domains, and now 20 years go by and they’re making thousands of dollars because they had the ownership of these domains, they’ve been sitting on them for like $510 per year or whatever. But now when you want to buy that particular name because it was a short name, they’re selling it for $20,000. So now in this whole new space, it’s a whole new area of expertise and monetization just on URLs, using enemies as well.

Yeah. And I’ve not gone into domain space yet because that was like another job or not to crack. I wasn’t ready for that yet. But that’s fascinating. That’s what’s possible with what we’ve all experienced, where even with the smartest phone device that we have is what the business in the tech world, they call Web 2.0. So in fact, you and I using Zoom as part of Web 2.0. Everything that’s running on the blockchain is called Web 3.0. Anything related to the Metaverse. I would say a Metaverse, not the Metaverse. Metaverse, NFT, cryptocurrency and blockchain. It’s all part of that web. Three point. So with Web three point, think of it like we got a Kickstart to Web 2.0, and now we’re creating a virtual and real map. So you’re starting at the beginning, you get a second break. So it’s not a one for one. I’ve spoken to quite a few business owners in their minds is, oh, I have this in my real world. I just want to create something equivalent. And I think that would be selling yourself short, to be honest. What you want to do is bust out that cage of realism and really get into the creative space, which is the reason you started your own business. And think about what’s possible, because in this new world, what if you could offer your clients a virtual Tesla as part of the NFT? Because they bought the NFT from you? That down the road. In that roadmap that SA was talking about, they could get a Tesla and drive that in a metaphorse. How cool would that be? Anything is possible. This is where we get to really stretch the imagination.

There’s so many different avenues of NFTs, and I think this will be a good time to kind of segue into it. Like, you talk about monetization, we talked about the art, we talked about the collections, right? We talked about the road maps. But I think it is another part of it. It’s like a hybrid between the real estate and the gaming. And you’re talking about Metaverse. And there’s one game out there that I think it’s called Athlete Earth, and it was kind of like not necessarily one of the first platforms, but what it’s done, it gives you an opportunity to buy real estate in Metaverse or whichever reality you want to call it. But at the same time, they added a real business model to it. Like, if I buy land in the real world and I put a house on top of that land, and then I get somebody to live in that house, I could rent out that space, too. So think about that in the digital space. If I have an opportunity to buy the land underneath the Eiffel Tower and the Eiffel Tower is in the virtual world, then I could pretty much have additional items and charge rent for that. And that’s what this game is starting to get people to think a little bit differently. Like, well, it’s virtual. What can I do with virtual? Well, imagine in a virtual world if you wanted to become a farmer, and then that farm is going to grow a product, and that product is going to be sold on a shelf, but then you’ll be able to access that shelf in the real world. But the only way to get there is to build that story, to build that timeline and build it in the VR space to get that VR person to realize, wow, I want access to this. And then the only way they can get access to it is they have to be part of that world. So you have the exclusivity of someone being more like, okay, well, I’m the only person to have access to it. Then you start getting into bragging rights and everything else. So have you dimpled in the real estate space at all in NFT yet?

No, not yet. I’ve been watching it with much interest. I know that the house in Florida went up on sale through the NFT process, and that was just beginning of this year. It was pretty awesome to even think about a real estate actual real estate in the real world. It’s now permanently recorded in the NFL world that the transactions happened. And it went for a pretty Penny as well. I think it was something like $600,000, if I remember correctly. When you think about in the real world, yes, we know how these transactions happen. And in the virtual space, you can buy land, you can do whatever you want with the land. You can, Man City, It’s the football club in Premier League. They’re building the equivalents of the Etihad Stadium, their home turf in the Marvelous. So what does it mean for their fans? Right. They have thousands, not millions of fans globally. What would it mean for their fans to catch their games virtually? You get to bring your people together. You get to bring your community together. But it’s not just your fans. It’s everyone that’s part of your ecosystem all under one roof. And then you get to channel them back into your real world, give them that real world experience so people don’t get left out. Most of your buyers, they’re like, what’s in it for me? What’s in it for me? What else can you do for me? And this is the next possibility. As a business owner, I’ve heard this. Why do I need to do it? I already have a thriving business in the real world. I don’t need the virtual world. Awesome. Totally get that. Fair point. What I want to ask is how many of your clients are in the virtual world? Because if they’re starting to look at the virtual world, they’re starting to pay attention to it. Chances are you may need to. And that’s really like the opening question. It’s not about our preferences. It’s never been about our preferences as entrepreneurs. It’s what your clients want.

Totally agree with you. I think I always compare NFT’s kind of like if you think of AOL messenger. When you first heard it, it was like, why would I need that? I could just pick up the phone. And then people started using messenger and it was like, okay, well, that’s great. But then messaging became social media. To a certain point, it became a communication device that in today’s world, we cannot see ourselves without having access to it. Linkedin is a platform that uses messenger. Twitter is messenger. Facebook is messenger. Instagram is Messenger, TikTok is messenger. So think about back in the late 90s or mid 90s, that was the dawn of the messaging service that people couldn’t understand then. And then within 20 years, it became a way of life. And so what we’re trying to kind of communicate is like, look at NFTs the same way right now. You may not understand it. You keep hearing about it the same way you heard about messaging services, and then eventually it’s going to be ingrained in your life. And an example of this is my family and I, we went to a basketball game in the last 30 days, 45 days. And to your point about real estate, the Stadium, if you’re used to Pokemon Go, where you have an app and the app is kind of virtual reality and you’re looking for something in this space, in this environment, I could find a Pokemon if I use my phone. Well, the basketball arena that we went to had the same exact thing set up. So we’re watching the Hawks play. And while you’re in the Stadium, if you go to get something to drink, you go to the bathroom. There’s an app that allows you to walk around in the Stadium and find Hawkbucks or whatever they’re called. And then those Hawkbucks allow you to then buy game shots or headshots of the basketball players or game cards in the NFT world. So you can kind of see someone that created that was thinking outside the box. It was, okay, let’s map out the real estate. Let’s put random gold Nuggets in this real estate. Let people stay in the environment and interact with them. And then at the same time, they can actually get images or video clips that nobody else may not have access to. And then those video clips could then have value, and then they could either sell it for monetary gains or like you said before, they could print it out and put it on the wall or use it on their iPhone or whatever else they want. But it’s about thinking differently.

Totally. One of the things that I share with my clients is gamify. You want to gamify the experience. People want to go on an adventure. They love that. Why not? You know, it takes them out of the real world and takes them in whatever great reasons we have for stepping out of the real world and into that virtual space. And while they’re in your arena, let them play. They’re there to watch a game, let them play. And they’ve got us all. We’ve seen how powerful Pokemon Go was. There were people who got into accidents, unfortunately, because of that, because they were so focused on acquiring that and all these geocaching games, they were so effective. And now in this new phase, it’s something similar. Whether they’re in the arena with you, or they’re in a virtual space with you. They could be your online community on Facebook. They could be a Twitter poll. That’s part of the game that you’re creating. What’s your opinion? How many of you are doing this? We might be sidetracking Hills One of the things that I saw today was overnight was there’s this bought from the UK government. It’s been searching for every company that’s hashtag IWD International Women’s Day 2022 and made a tweet about it. And then it goes on to say, Well, here’s what your gender gap is in terms of pay. Here’s what this business is doing. And so it’s calling people out. Now, I’m not saying you call your clients out, but what if you could make this real time, like, let them get the real value from your business of what you can do? And this is a major flex in so many ways, if you think about it, one of the things that I look at is when they come to my door, I want them to start using the service. And if they’re not using the service, it’s going to take me an even longer time to get them all warmed up. So the first thing I do is book a call, get some actions together, get a plan together. There’s a sequence of things that my clients are going to do when they work with me in the first month. It’s heavy hitting. Let’s make this happen. Let’s lock down the strategy. Let’s test your content, let’s see what your community health is like, and start assessing and reviewing that. And then let’s start talking about what can you do in terms of entities, and then map that out how that launch is going to look, build that roadmap so that first month is full on. Let’s roll up sleeves and make it happen. And then we test. It not very similar to how you’re going to roll out your NFTs for your clients to get them to use the service. When they get into that habit of using playing the game, they don’t even realize they’re playing the game. They just know, Damn, I’m hooked.

Yes, I totally agree with you. It goes back to the rewards. We’ve seen the rewards a million times, whether if I get a hole punched in because I bought five dozen Donuts in the past three weeks or whatever, then I get a free box of Donuts. It’s the same exact principle. The only difference is you don’t have that tangible object of that card. Now you’re in the virtual space. So instead of doing a hole punch for it, maybe in proximity of your store every time someone drives by, if they collect a floating donut outside the door and they can collect one donut per day, and as they get 20 Donuts, then they can come in and get a discount for that donut. And that’s the way to look at it. It’s kind of like, you’re keeping them around your location, you’re including the gamification, and then you’re rewarding them for doing it over a period of time. And by default, what are they going to do? That’s when you get into, like, the social media aspect of marketing to say, hey, check this out, check this game out. I got a free donut today. How did you get a free donut today? Well, I just drove by on my way to work every single day. And every time I drove by, I just stopped and picked up a random virtual donut. And I did that for five days. And at the end of the week, I got a free donut. It’s as simple as that. If you look at it from that aspect.

Exactly. So you don’t need to be on your premises to do this. The item is there, it’s digitized, it communicates into your systems. So you know how many virtual Donuts have been picked up by your customers? And by the end of the week, you know how many Donuts you’re going to give up for free or at a discounted price?

Yes.

Freaking awesome business model right there. Why not? And marketing is paid for. You’ve got your customers saying, hey, you can put it into the game, post it on social media and Tigers that you got your donut for the day. Because that’s how we measure it.

Yes.

And this is what creates a natural marketing sequence for you not having to pay for anything.

And I think this is on topic. Right. But looking at it from that standpoint, right now in the world, people are paying Amazon and paying YouTube and paying LinkedIn for the ad campaigns to strategize and figure out who’s nearby. But I guess once you have those people, you may not have their email addresses, but they may come in, scan a QR code, download the app. And then once they download the app, then by default, you’re going to require them to give you an email address. And that’s what you’re really paying Facebook and all these other platforms for, is to get direct access to that user so you could own that user. So not only do you own the user, but if you created a platform that can track the users, how frequently are they coming by your store, that’s golden. Facebook can’t tell you that Facebook would only target them. But imagine you can say, you know what, these ten people, they pass by our Store 03:00 every single day on queue and they pick up Donuts on a regular basis. That is inside information. That way you can target them directly and communicate with them and maybe even set up to do larger parties or larger giveaways for those individual people. And you’re building the lifetime value of that customer so much more ingrained by telling them their story through their actions of them playing on this NFT based game.

Exactly. And I’ll put my hand up for Donuts. What about USA?

If it has bacon on it, sign me up.

All right. I won’t fight you for that one.

If you haven’t had it, you got to try it, man. Maple bacon.

All right.

This is a recap. So we talked about the general NFTs, we talked about road maps. We talked about real estate a little bit. I think the only thing we haven’t really Dove into would be, like accessing keys. And this is kind of something like that’s, really close to people like us, like a digital marketers. And we have clients, or we may have potential clients that want to get access to our time or access to our information. Using NFTs as the model to do that is very successful. I’ve seen a couple of bigger names that have done it well. And think about it, a lot of times we’ll pay for a course, we’ll pay for our Academy, and we’ll get that Academy. We will get that course. We may or may not even access the Academy. We may not even access the course. But now attaching an NFT to it, something that’s visual, something that’s on your blockchain, something that essentially has value. And if you don’t use it, this is where the money is. If you don’t use that course, you don’t use that Academy. It still has value. Now you could resell it. You could resell that access key. And that changes the dynamics of course development and course strategies completely. Because before you couldn’t resell access, you bought the access and you stuck with it.

Yeah. And I know, like, GaryVee rolled out his NFTs. I’m sorry, Gary Vee’s NFTs are his hand drawings. I was like, man, I could have done way better than that. And he released. I can’t remember how many of them and what he gave us free pass to his annual event in the US. Right. And it’s certain entities, if I remember correctly, gave one on one sessions with him. Quick meeting with Gary, all of this, you can create a lot more exclusivity as long as you create a different tiers with your NFTs. And so now you can start spreading them out. Like, if you’re going to roll out, you won’t roll out 10,000 at one time. You roll out 301st test. What the market appeal is to see what people are saying. Is there something of value? Is the price increasing? Are they trading frequently? You’re monitoring the stats. And then in the second phase, you might have a different collection of NFTs that come out that offers different privileges or access to you, whether you’re an influencer or your business owner or even you’re a coach. I’ve seen coaches now start putting NFTs together with their programs and you don’t have to run your coaching communities on discord. I don’t like discord. Personally, you could keep to Facebook. That’s totally fine. You got the opportunity to create that exclusivity. If you have raving fans, they want to go all the way with you. And when you’re releasing your NFT and it’s at the lowest price to Mint, they will come on board and they’ll be the ones hyping it up. So to me, like I said earlier, we’ve just barely cracked this. We’ve just barely cracked this. So far I’ve seen sports community. The most recent one was where they raised funds in 30 seconds, a million dollars for Ukraine relief. They brought together 37 artists across the world to raise these funds. So it’s not only limited to business. If your business has a not for profit that you support, you can say 10% of these proceeds are going my royalties are going to this not for profit. Why not attach charity calls to your programs, to your offerings? And I think that’s where this ecosystem gets really beautiful and rich as a result.

Yeah. I mean, that kind of goes back to the royalty model. And just to kind of dive into that just a little bit. I mean, imagine you created an NFT and NFT is $10. Right. And you set your royalty at 10% so that NFT sells, you Mint it $10, you get a dollar of those royalties. Now, let’s say a year goes by or five months go by. And going back to the definition of a roadmap, let’s say that NFT is going to be included in a movie or in a video game or in some like you’re saying access to an event. Well, let’s say you can’t attend that event, and those tickets for the event are now worth $5,000. You bought the NFT for ten. Now, essentially, you can sell it for 5000. When that NFT sells for 5000, the original owner, which would be me, who created the NFT, then I’ll get 10% of the 5000, not 10% of the original ten. And then let’s say if it’s an annual pass, you get access to life. Let’s say next year, that same event is now going for 10,000. So I sold it for 5000 and I made the 10%. And then that same NFT gets sold again for 10,000. Then the original owner, I get another. So you can kind of see, imagine you create 10,000 NFT, and they’re all selling every single day. They’re selling and they’re trading like cards. They’re trading like stock. The value goes up, the value goes down. It stays level as Bull is beer, whatever it is. But at the end, all be all you as the creator for the first time in history, you’re getting royalties on all of it.

Yes. And this is what I call perpetual income. This is a perpetual income stream. Coming up to this point of why some NFT projects fail is because the roadmap is not sustainable and they got to pull the rug on them because they can’t create there are some that were spams or scams, rather. And therefore there was a rug pool that came along with it. Unfortunately, but you want to check whether you’re investing in one or when you’re creating one. What’s your roadmap and is it sustainable? Is it possible? Are you promising you don’t want to get into a situation where you’re over promising and under delivering. That’s going to devalue your energy. And you want to create a community that really understands and rallies around you as you’re building out this roadmap, creating that in the real virtual world. And as a result, the price of energy will go up. Whether you use the parts of the token or not, whether you’re able to use the entitlements, the price of that energy will go up, will go up. And each year you can update that contract. All right. You’ve been with us for three years. You’ve held onto this energy. You’re the original owner. Great. We’re going to upgrade the contract and give you something else for the next three years. Damn. This is how in the coaching world we call this Client for life. These are clients for Life. They’re going to talk about you, and it’s just spitballing some ideas here.

Yeah, I want people to really dive into that again. Some people in today’s world, NFTs, are really big with investors. And here’s the reason why. Right. Because investors understand market. They understand market cap, they understand market values, they understand buy and hold. They understand buying at wholesale. And that’s the point of the matter. We haven’t talked about whitelisting yet, and this would be a good opportunity to talk about whitelisting. Whitelisting essentially is nothing more than giving a user access to presales. Okay. So it’s kind of like if I’m buying a house and I can say, okay, I can go up to the bank and be like, okay, I know you have a list of foreclosures. May I see your foreclosure list before you take that foreclosure list to public? By seeing the foreclosure list before it goes to public, there’s no bidding wars. There’s no $5 here, $10 here. None of that goes out the window. Then I could look at the banker and say, hey, I’ll give you 100,000 for this house. This house is worth 300,000. It’s a foreclosure. Let me get it off your books. It’s the same thing with NFT’s. So if you get on a white list, it will give you access to getting the NFTs at the cheapest value they will ever be. Right? As a creator, I can set my price. So I’m saying this is the value I think it is right now. And my road map is then going to delegate where it’s going to be if you buy it. Now, as the roadmap continues, the value increases and investors, they understand, wow, if I buy for ten, sell for 20%. Yeah, it’s easy money. So that’s why investors are diving into this space, because they could buy and flip, buy and flip all day, all night. So if you understand buy and hold, then you could understand NFT as far as a business revenue making model, do you have anything to add on that?

No, I know that’s a great way of explaining it for me. I do see the height that comes as a result of that. So some projects, they got overly inflated and now they’ve come down in value. One of the projects that came out in wave two was this chap in Indonesia who posted 990 something pictures of himself over a period of five years and he made a million dollars. He made a million dollars out of them. And so they went up as high, I think 0.3 went up as high as one each. It’s about, I want to say 3000 us. I could get it wrong. And now he has about 300 of them left that he can’t sell. And as an investor, that’s a piece of NFT. Bless him. I love what he did. He took a chance and he made his money. Bless him. Right? Great. He took the risk as an investor. If I bought into that project, I can’t do anything else with it. So if you’re new to this, get really picky. Get really picky. Which is why we keep going back to the road map. You want to see what else can I do with it? Is it a game? I’m not a fan of games. I don’t enjoy online games. But if it’s a game and they give me something else, I might be tempted to buy it because I have nephews and nieces I could pass it on to. Why not?

Yeah, I think we could do a whole course workshop on the variables of that. Like if Kanye drops an NF tomorrow, would it be a million dollars? Probably. Right. Because that’s more the influencer route. Right. If you have an NFT with this guy, the random guy that created those, and he was kind of like the anomaly. And to your point, he sold maybe two thirds, he made a million dollars, and the rest he can’t really sell because he didn’t have a roadmap to support it. But if he then took the notoriety of what he was doing and became an influencer, then that could be the transitional point to where now he has clout, he has people following him and his NFTs is kind of like Gary Vee. Garyvee could come out and say whatever he wants about any NFT and it’s going to sell out because he has that notoriety in the industry to talk about things that people like, I want to be part of it no matter what it is. So that’s the variable to it. Like, are you famous? If you’re not famous, then build a road map. The road map is going to assure the investors that, okay, this person has business background. They at least understand the value of it. Right? Or are you doing kick ass art that someone looks at it and like, oh my God, I want to own it. I don’t want to sell it. I want to own it. I want to own it and hold onto it. And that’s the way to think about it. If you’re good at art, then create that. If you’re not good at art and you’re good at business, then create a strategy. Create a roadmap, and then you could do the other guy thing and create something random and wish for the sky. But I’m not going to advise you to do that because again, nine out of ten is going to fail at that strategy.

Oh, yeah, you’ve got to be really unique now because that play has already been made a few times. So if you’re coming into the energy space, talk in terms of utility, what’s the purpose behind your NFT? It must have a purpose. And that purpose creates the roadmap. Ultimately, where are you taking people on this journey, this adventure where you’re taking them to? What are they going to get to do with you as a result of having this access through the NFT and the roadmap tells them what it’s about. Now to an investor, that’s what they’re going to look at. If you go to Shark Tank, they ask you, how many people do you have already in your client base? What’s the plan and what’s your ask for, how much of equity? And that’s pretty much what an investor is going to do. So whether you buy, you get people coming who want to invest and flip it, or real hardcore fans are going to go with you all the way. Either way, your roadmap is going to take care of either of them.

Go ahead.

I appreciate what you said about the chat in Indonesia. He could have used that opportunity to flip it, to really change the course on where he wanted to take it. And if someone had given him this, I should say, if only my hindsight was my foresight. If someone had given him that piece of information like, you can tip it, you’ve got the cloud, you’ve got the rise, you’ve got the following. You can pivot. Make that pivot. So wherever you are, it doesn’t matter how big or small your client base or your following is get cracking. Start building that hype. One question I get from people who want to launch energy projects is, you know, I’ll wait till I build everything and then I’ll start building the community. And I’m like, that’s the worst thing you can do. That is the worst thing you can do. Get your community started. Start with five friends who are absolutely mad for anything that you would say. Start there, and then start adding people to this chat group, to this Telegram group, to a Facebook group. I don’t care where you put them, put them together somewhere because they’re not just going to start pumping you up when you need it. They’re also going to follow you through that journey and they’re going to start bringing people in and help you build that community. Build a community first before you start building anything. Really have that community upfront. And they are already buyers.

Yeah, totally agree. As far as, like, media. I mean, going back to Gary Vee, Gary built up his community from wine. Right? He was a wine connoisseur to his dad. And he brought that million dollar business. It’s a multi million dollar business. And that was his claim to Fame. And he took that claim to Fame and built it into a monster following, like everyone. Gary Bee the only person I know that can come on poppy national TV and curse and probably not get beat every five minutes. They’ll be like, okay, it’s Gary. Right. And he has that enough clout. But you have to understand the power of media. And that’s what we’re really talking about. Oprah could do the same thing. Tony Robbins could do the same thing. Kanye west can do the same thing. And they’re all in separate, different media. But again, collectively, the definition of it is just their media moguls. All of them are. And they understand that they have their core niches and their niches in those space, but they’re using them all exactly the same. And I want you to stop and think about them, compare them, and look at what they’ve done and look how they’ve expanded into multiple other avenues through their media outlet that they started in originally.

Yeah. You know, what I love about what you said is really there’s not just one person or one industry. It’s not just the artists who are going to get to benefit from this new web. Three point it’s every one of us and how we strike the matches. What’s going to matter to us if you’re an author? Turn your book cover into an NFT and create the community around it, especially if you’re a prolific author. People know about your work. You mentioned JK Rowling. She’s going to put up the next book. She issues an NFT. We will buy it because it’s going to get us into a Zoom call with JK. We get to get see her do a live reading. Who wouldn’t want to be there. She’s got that ready. Fan base who want to do this. They want to go on a journey with her or maybe even offer a first peek at the manuscript that’s any publisher’s dream. The first peek at the manuscript. And because you have an entity and there’s only maybe seven pieces of this energy available from JK Rowling, why wouldn’t you why wouldn’t you make a bid for it? That’s where this game gets a bit more fun. It’s really a game. It’s a game.

I totally agree. Looking at it from the marketing strategy, the marketing aspect of it, I think Gary has done this as well, too. It’s kind of like there’s two ways of doing it. Hey, if you want to get access to my NFTs. I need you to purchase this many books, right? To get access. You need to purchase 20 books, and you keep one, you give away the other 19. That’s a hell of marketing strategy right there. And the books and the NFTs are both paying for each other. And the other one is like, if you want access to my new book before it gets released to the general public, then buy this NFT at this level and you’ll get my book 30 days before a public release. So not only do you have notoriety, but you have bragging rights, and obviously people will. What if someone shares it? Well, I mean, you already own it. So again, if they share it, all they’re doing is marketing for you. There’s no real negative marketing in that space. Someone in the music industry, it works the same way. Think about it. For the past 20 years, when Napster came out, it was like, oh, my God, we’re not making any royalties off of music. And then what did Apple do? Apple. Okay, this is how you make royalties off of music through digital space. You charge them a dollar per song, and some people got it. Some people didn’t. But it’s at the point now, I think revenue wise, over the past 20 years, Apple has made at least probably close to half a billion dollars worth of revenue from selling music online. It’s adapting to the situation and understanding the business model and seeing the opportunities. Don’t knock the opportunity. And I’m saying don’t knock MPs because you don’t understand it. Figure out how to understand it or figure out someone that can understand it for you. Bring them into your circle. Let them educate you enough so you can kind of figure out what, am I, a collector? Do I want to collect? Am I more of a stockperson? Do I want to buy and hold? Am I more of a real estate person? Do I want to buy it and build, like, figure out where you fit? Because NFTs are not just one thing. They’re profound in multiple different attributes.

Yeah. And it all depends on the community that you’re attracting into your world and where they want to go with you. It’s not about where they are right now. It’s where they want to go with you. And if you think about that, I think that’s a great place to start. You can go anywhere. It’s up to you to decide, because right now we are still at the early stages of the energy space. So you can design and decide. Take advantage of the fact that we’re not fully baked yet and take them on that journey with you. Check them. All right. Maybe they get a piece of land in the virtual world. Why not? Because they signed up with you and then you’ve given them different tiers of NFTs to bid at. That’s a possibility. One of my favorite things to say is if at most youth helped her grandma create legacy for her grandchildren to say, all right, this is something I’m leaving with you. As part of the inheritance. You get my entities, and I want you to work with this creator. I want you to work with this business person, with this marketing guru, with this author, with this coach, because they’re good. And I’ve vetted them. I’ve had someone vet them, and I know and I understand I’ve made the investment for you, and she minted it. And now that’s part of her estate inheritance. Why not? There are so many ways to play this.

Yeah, I think a couple of things just to round it out, I think we mentioned ether a couple of different times, and I think somebody probably would have heard that word and it probably would have been like, ether. Is that like something from Marvel Universe? What is ether, exactly? And just to kind of everyone is so familiar with cryptocurrency blockchain as terminologies that they comprehend, but they don’t realize that inside of those are like the general statements. So inside the blockchain, there’s many other blockchains. Bitcoin is one of many cryptocurrencies. So when we say ether, ether is essentially the cryptocurrency that’s associated with NFT, it’s kind of like if I go to Chuck E. Cheese, I’m going to take my real money and I’m going to give them that money, and then they’re going to give me the Chuck E. Cheese coins. That’s the ether. I’m transitioning US currency into this ether, and that ether is what I use to then purchase the NFTs. So I think for you, we want to talk about maybe wallets a little bit because I think that’s something that people just understand. Like, well, okay, I have money. I want to get into the space. Where do I get these coins and what do I hold them in? What do I do with them?

Yeah, cool. So if you’re starting out in the crypto space, you need crypto. Or you could use US dollars to buy NFTs. If you’re looking to invest, you do need crypto to list your first NFT for sale. So you ultimately end up buying crypto. And we talked about gas prices earlier. Whenever you transact on the blockchain, you pay. So have enough crypto to cover that. Typically in the NSA space, where the biggest marketplace is opensea.io, there are now others that have come along and open Sea trades on the Ethereum blockchain. So they use east currency. And so you’re going to buy east directly from the marketplace. You can get them on Coinbase. That’s where I bought them from. Coinbase has its own virtual wallet that you can store on your phone. And I transferred them to my Coinbase wallet, moved them onto the opesea platform, and then transacted using that. It connects. I won’t say I moved them, but it connected to my Coinbase wallet, virtual wallet. And that’s why I made the transactions when I was purchasing it. You also need a hot wallet. And because for security reasons, and I’m so glad that I got mine. I got mine from Nano. I think it’s the Nano s. I can’t find the brick at the moment. It’s actually a physical wallet that got shipped to me. And the way I get to move my coins from my soft wallet to my heart wallet pretty much like how you backup your data to an external hard disk. It’s the same way it’s a USB plug in, and it’s encrypted. It requires you to remember twelve different keywords. Anything on the blockchain seems to require that you have twelve different keywords. And that’s how if you need to unlock because you got hacked or you forgot your password, you get to access that. And that’s how you set yourself up to be safe, to protect your investments on your Coinbase wallet. I also can see my purchases of my NFT, so you’ve got the full listing there. I also have another wallet called MetaMask that seems to work a bit better, but I found the integration a little more clunky. And you can use these wallets on almost any other platform. That’s the Solana Marketplace. There’s one that I found, which is the NFT Stadium, and they’re talking about filling up seats. They deal with fans. They’re based for fans. So what you’re doing with your enterprise is you’re connecting the marketplace with the wallet, and you can do this online or on your phone, but you do want to have a hot wallet just to protect your points.

And I like to like, I love your definition. And again, I just want to take pieces of the definition and even make it even more layman for someone that’s like, the first time hearing about this, right? A wallet essentially is the definition of what it is. It’s a container that holds your currency in it, but in the crypto space, it’s a virtual wallet. And when she’s talking about soft versus hard, well, the hard wallet is like taking your money and putting it in the bank. But you have access to go to your lockbox in the bank. But keep in mind, if you lose your key to your lockbox, then you don’t have access to that anymore. And that’s the drawback between the soft and the hard. The hards are very secure because they’re on you. They’re with you. Nobody else has access to it. And it’s going to be hard for them to break that encryption or hack into it if it’s a physical device on you versus being in a remote space like the Internet. But the issue is if you do lose that, or if it falls in a microwave by accident or falls in a cup of water, then you pretty much have to go through a lot of different scenarios to try to figure out how to get access again. And another thing, too, that I wanted to kind of bring up with the wallets. You brought up metamass, right? So Metamass is the name of a wallet. Coinbase is the name of a wallet. Rainbow is another name of a wallet. So there’s so many different wallets out there, you could easily just go to Google and type in NFT wallets, crypto, wallets, ether, wallets. And in addition to ether, another thing that they have so crypto is at the top. Ether is secondary. And even under ether there’s another one called Poly. And I’m not saying this to confuse you, but I’m just saying there’s a hierarchy. Crypto is probably the most secure because it’s the granddaddy. Ether is a little bit newer and Polly is on top of ether. And the reasons that they all exist, it really comes down to the gas fees, right? And so Poly essentially does not really have gas fees associated to it. Ether has gas fees because everyone and their mom is using the system to Mint the NFTs. So supply and demand, the more people all go to a website and try to Mint something at the same time. The way minting works is that on a global scale, let’s say there’s a million computers. All these million computers are going to get this data to say, hey, someone is purchasing this NFT. We want you to verify this purchase. All the million computers will hit and then one of those out of those million computers will verify and add it to the blockchain. And every time something added to the blockchain, it becomes indisputable because it’s on the blockchain and all the computers are verifying it at the same time. So that’s the beautiful aspect of the blockchain. But unfortunately people have to get paid. And this is what you saw that you hear people about farming or crypto, farms and all this stuff, the mining side of it. So just understanding, you don’t have to understand how that works. But I’m just defining it. So if you hear this terminology again, you could kind of like, okay, I think I got a gist. I kind of understand that. And just a little tip as far as minting, what I’ve learned is between. 03:00 A.m. To. 05:00 a.m. US time, Eastern Standard time. Drastic difference when it comes to minting NFTs

I haven’t found a software that tells me actual gas prices on Opesea yet in real time. The soonest I got was I think 1 hour before. So as soon as I see something that’s of value that I know can help you to make real time decisions, I’ll shoot that to your followers, to you making sure that they get followers. Because I think it’s important to know that you can get lost. I won’t deny it. You can feel overwhelming even just listening to us, probably on this podcast. It’s a bit overwhelming. What I would say is, for starters, before you even decide to buy or create your own, go buy an NFT. Just for the kicks. Kick a few tires, see how this thing runs.

Sure.

And when you take it for a spin, okay. You get into the ecosystem. You know what you’re doing. You can make decisions, sound decisions. And if there are gaps, you can come back to Boss Uncaged, probably have another session like this. Like, what’s the next step? And that’s where you get to grow the muscle as well. So kick those tires, go out there, get a soft wallet that we talked about. Get some crypto going to open Sea or any other where you find, oh, there’s a collectible that I want. Cool. Make your purchase, and just watch out for gas prices. Those are the ones that are going to catch you.

Yeah, I definitely could cover her. First thing is just get a wallet. Just do like she said, do a Google search, find a wallet, and then all you have to do is connect that wallet. You can connect it to PayPal if you want to, to transfer currency in it. And then once you have that money and go to opensea, it’s a search engine like anything else. So type in a word. If you like dogs, type in dog, and then it’s like any other search engine, there’s highs and lows and values. So you can say, hey, I want to sort this by the lowest price, and you’d be surprised. You may see something. And this is where you’re going to have to kind of train your mind. You’re going to see zero dot one sometimes. And you’re like, is this thing less than a Penny? No, that’s ether. And we’re saying ether is generally one. Ether is about $3,000. So that .0 maybe that’s $2 transitionally. But the thing is, once you click on it, it will tell you how much it is in your currency. And then if you have enough ether or enough currency to make that purchase, if you don’t, the good thing is the system will tell you, hey, you need to transfer some more ethers. And this is where there’s a great space, because as you’re transferring money, like she was saying before, there’s fees, there’s fees going and there’s fees coming. It’s just like stock. Every time you buy a stock, they’re going to charge you a transaction fee. Every time you sell a stock, they’re going to charge you a transaction fee. So always keep that in mind. It’s like you’re buying and selling stock. So there’s going to be fees on both ends.

Yeah, totally. And let us know how you go your wallet, what you buy in the marketplace. I can see that. That’s visible to me. If I go into your profile, I can see what’s in your collection, what I call your NFT wallet on Opesea. But I can’t see what’s in your virtual wallet on Coinbase, for instance. That Coinbase. I won’t be able to see that unless you share that. And you do not share that with anyone. I feel like we’ve done a pretty good show of just walking through all the various examples. I’m curious if people have questions, what they think about the show. Drop them in the comments. Would love to hear from anyone who’s watching this while I take a sip of my cafe.

Yeah, I’m just checking because, like all these damn monitors, I’m trying to see if anyone is watching on a particular platform anywhere.

We were talking about the one button, I just need one button.

One big red button to do it all. It would be nice. The good thing about this is that now we can kind of share it and reuse this content. It’s good to talk about the stuff and bounce these ideas off of it. And I think the more we do this, the more and more people somebody is eventually going to raise their hand, as it may be a minute, 15 minutes, 65, and they’d probably be like, you said something and I need more information about that. And that’s what we’re really talking about. Ask the question so you can get the answer, so you can comprehend it. Because the last thing you want to do is be essentially left behind in the world that’s essentially going to be 100% digital. Like the whole digital age thing. Well, it’s here. It’s now.

Yeah, we are in it. And if you found great value in this, please share that with at least three friends of yours or anyone in your network. Share this with them. Spread the word. The NFTs are happening. And we hope that these ideas have triggered other creative ideas within you. Give us a shout. Let us know where you are at. If you make your first purchase of NFTs, you realize that you’re a collector. You realize that you actually have medium risk like me. I’m looking for people. I’m always looking for people. Just like S.A.

Yeah. One of my key takeaways from this talk that we were just kind of throwing ideas out there. But the whole donut thing, it was like a real world example of something that could work for us. When somebody asks you, I’m a small business owner. I have a location. How the hell among use NFT’s. That is a case right there that we can turn those Donuts into massaging oils. We can change those Donuts into marijuana. We can change those Donuts into anything you want and just have people drive by your store pretty frequently to pick them up and build their reward points. Really?

Yeah. Every Friday and Friday, let them pick up a bacon filled donut. An S.A donut.

Maple bacon, to be exact.

Maple bacon. I’m sorry I missed that.

Well, it’s cool. I mean, anything you want to close out with, any last comments or questions or anything that you want to put on the table before we close out.

Yeah, sure. The way I look at this is I have an 83 year old mother. How would I help her to get on board with NFT? How would I explain this world to her when my mom was able to make decisions on her own? This is how I would describe the world to her. I would show her the world, and it would be mind blowing to her because she’s a person who had to travel on a ship to get from India to Singapore. And when she went back to India to see her parents, she flew on a plane for the first time. She saw the dawn of the escalators, the moving stairs. Right. So this is a woman who has seen the change in history, technologically, in engineering. She gets to Marvel and everything. So what I would say is, through this process, you’re going to feel the fear, but get through it anyway. And I would say Marvel through what you’re experiencing. Wow, look at how cool is this? I figured it out. This is so fun. I want you to take those moments with you, really appreciate them and anchor them, because as you make stepping your way through new technology, it can get overwhelming. It can get like, what is this? Can someone just explain this to me and know that you’ve already made breakthroughs? You’ve already had those moments where, check me out and keep doing that and keep doing that. I hope that helped.

I would love to see my mom pull up her iPhone and show me NFT that she’s purchased. Now she’s so antiquated to her world and her bubble, but if she ever came to me with an NFT on her phone and she made that purchase herself, I would probably shit on myself in that moment and be like, Holy, what the hell is the world?

Mom needs to be on your show, boss. That’s DoD. Yeah.

You’re probably listening. If you are listening to the episode, go and figure out how to buy NFT. I would like to see you buy an NFT.

Yeah, totally. I want to watch that show.

Well, that’s a solid way to close out, man. I definitely appreciate you coming on the show today. I think doing these talks like this where we have two like minded people on a particular topic and we’re just going back and forth again. For people that are new to this space, you have two people that are knee deep in this space. So reach out, communicate. Let us help you, guide you in the right direction, point you in anything that we said that resonates with you, raise your hand, talk to us, communicate with us. And the beautiful part is we’re on the opposite end of the world. We’re like a twelve hour difference. So when I’m sleeping, she’s awake. And when she’s awake, it’s vice versa. So definitely get this thing rolling. And I would love to see what NFT’s people are creating or purchasing.

Yeah, tag is on your project. I would love to see that tag me on Twitter anywhere else in the social media so I want to see what you guys are getting up to.

Drop your website in your handle so people know how to get in contact with you.

Cool. Right now in the chat, you’ve got the deep all right? So follow me on Linktree. Linktr.ee/jennyvaz and you’ll get all my deeds on where I’m at and that’s how you find all my social media handles, so that’s the best place to get to https://linktr.ee/jennyvaz.

Yeah, and she’s pretty active on TikTok, too. Some of your TikTok videos TikTok is where is that to kind of get the new fast kind of TikTok is like the new visual Twitter. So by all means get up, sign up and we love to see what you’re doing. S.A. Grant over and out.

Leave A Comment