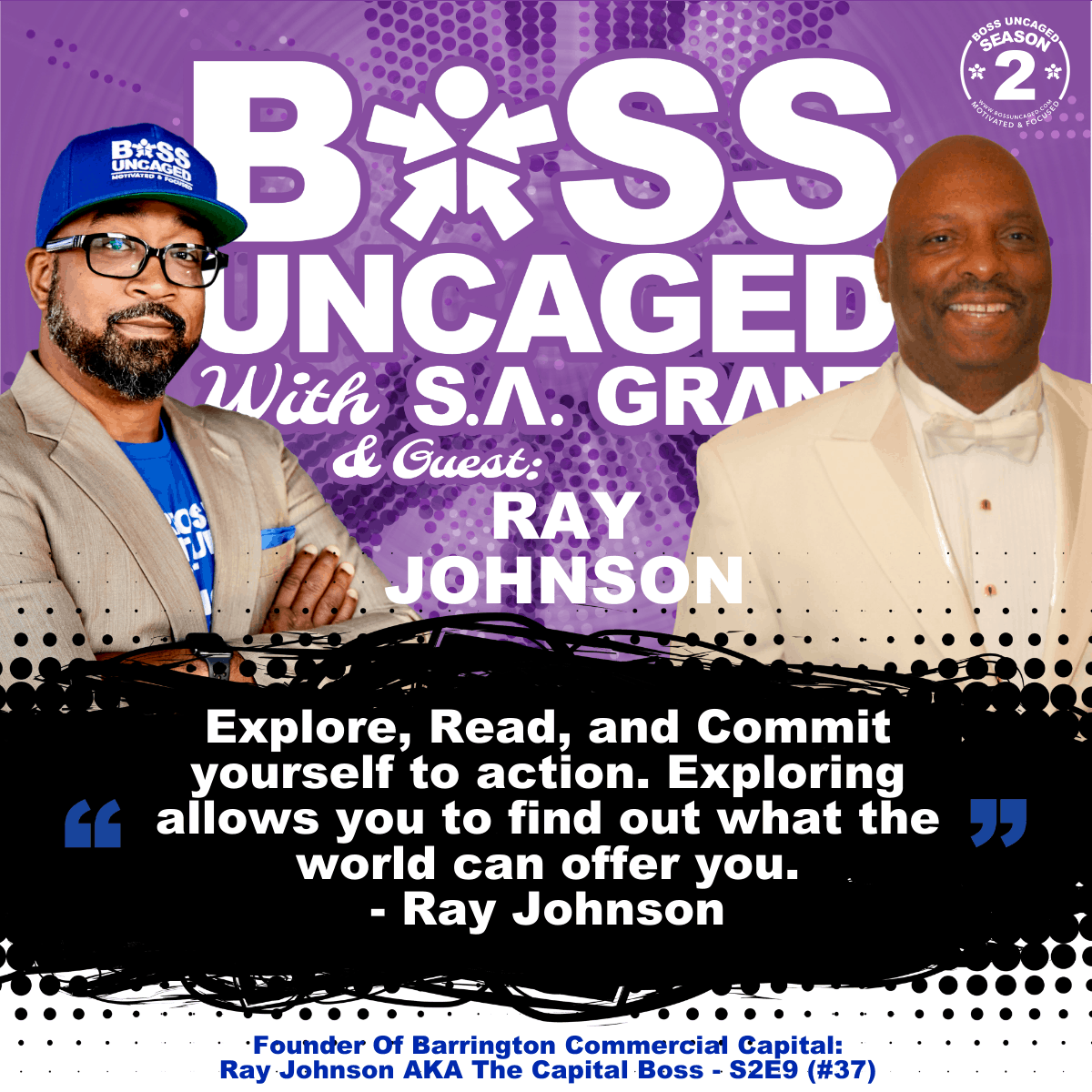

Boss Uncaged Podcast Overview

“Explore, Read, and Commit yourself to action. Exploring allows you to find out what the world can offer you. That’s what it does. And, you know, despite what’s going on in terms of politics and what have you, it’s a big world out there with a lot of different ways that people can make money.”

In Season 2, Episode 9 of the Boss Uncaged Podcast, S.A. Grant closes his real estate month with an information-filled interview. Ray Johnson is the Founder of Barrington Commercial Capital which provides alternative structured finance solutions tailored for business owners.

Each episode of Real Estate month has focused on the property, but in this episode, they discuss ways to get financing for the purchase. With an education in Finance and Accounting, Ray began his career in the world of corporate America. Frustrated by his day-to-day job and armed with a wealth of experience, Ray decided to step out on his own and start a company that focused on providing financing options for business owners that were not receiving funding from the traditional banks.

“We evaluate you differently than the banks do. We are very holistic in our approach to evaluating a credit, which means that it doesn’t matter what you’re doing. If you’re a business or you have a commercial property, we look at you, your income, your debt to income ratios, and then also default to what the business is doing. In many of the products that we have, we are going to take a look at you from a credit score perspective. But beyond that, we don’t really care about what your income is because none of our products are personal consumer products. They’re all commercial products. So, therefore we can look at what the commercial building is doing in terms of income and expenses and determine can it support a loan and then make that loan on that building based off of the financials of that project versus you personally? We don’t have to look at what your income is. We don’t have to look at what your debt to income ratio is; none of that matters in the evaluation. And because of that, we can do more loans than sometimes banks do because our lenders have more flexibility in how they can evaluate the project. A lot more is dependent upon how the business is doing versus how the individuals perform.”

This episode is so good; you need to listen to it twice. Additional topics that are covered:

- The benefits of career pivots

- How alternative bank financing works

- The highs and lows of lending

- A deep dive into Accounts Receivables

- The difference between Lines of Credit vs. Factoring and which one works best for your business

- And so much more!

Want more details on how to contact Ray? Check out the links below!

Ray Johnson

Website https://www.barringtoncommercialcapital.com/

LinkedIn https://www.linkedin.com/in/ray-johnson/

Twitter https://twitter.com/barringtoncomme

Facebook https://www.facebook.com/Barrington-Commercial-Capital-LLC-1778527939039570/

THANK YOU FOR LISTENING!

Just speak to your Alexa-enabled device and say, ”Alexa Open Boss Uncaged.”

Also available on Apple Podcast, Spotify, iHeart Radio, Amazon, Google podcast, and many other popular podcast apps.

#SAGrant #inspirationalquotes #motivationalquotes #Quote #Success #BossUp #BossUncaged #Marketing #Design #podcast #Business #talkradio #hustle #selfemployed #smallbusiness #entrepreneurs #successmindset #bookclub

Remember to hit subscribe so you will get instant updates. Leave us a review, we would love to get your input on the show.

PRE ORDER The NEW Podcast Book: Boss Uncaged: Learn How-To Become An UNCAGED TRAILBLAZER Through 25 Inspiring Stories From Successful Entrepreneurs: Season 1

http://go.sagrant.com/links/bossbookv1

Follow S.A. GRANT on IG: @sagrant360

Are we Facebook friends yet? Check out facebook.com/SAGrant360 for the latest Boss Uncaged updates.

Looking for the latest books by S.A. Grant? Visit sagrant.com/books

Also join The Boss Uncaged Book Club, It’s a book club for entrepreneurs. bookclub.bossuncaged.com

Dress like a BOSS!! Visit store.bossuncaged.com to grab the latest in Boss Uncage Gear & Accessories!

Because we want to hear from you and would love your feedback, leave us a message 762.233.BOSS

Boss Uncaged Podcast Transcript

S2E09 – Ray Johnson – powered by Happy Scribe

Over here, right, the levels are looking good. All right, three, two, one, welcome. Welcome back to Boss Uncaged podcast on today’s show. Well, let me stop before I introduce who Ray actually is and make me take you down a short little story. Ray was originally supposed to be my Season one, episode two. We were sitting at a cafe. We recorded the episode and honestly, the audio quality became crap. And no matter what I did behind the scenes to clean it up, it just couldn’t work. But, you know, in the past year, we’ve kind of developed our equipment to raise a point that he just made earlier. He like I got better equipment and I was like, yes, yes, I do. So I originally met Ray at a networking group and he came into the networking group. And the network is always a lawyer. There’s always an insurance person. And Ray came in and he was like the capital guy. So everybody was like, who are you? What do you do? So in this show, I’m going to give him the capital boss, Ray Johnson. Without further ado, man, who are you?

Hey, everybody. I’m Ray Johnson, founder of Barrington Commercial Capital. What we do is primarily land money. We lend money to business owners and to investors, real estate investors. We’ve been in business now for seven years, doing extremely well during the covid last year. Have our best year looking forward to twenty twenty-one. It’s off to a great start and business is booming over in our house.

So, so take the story back. So I mean, obviously you deliver capital and we’re going to dive into the definition of what that really means and how could someone qualify and all that. But before that, like how do you as a child just wake up one day and say, OK, I want to be a secondary lender, I want to be the hell with the banks. I want to give money versus taking money from a bank. Like how old were you when you realized that? And what does that journey look like for you?

Well, the the one I didn’t wake up and think that way. I think my career sort of moved me in that direction. I’ve been my background is finance and accounting. And throughout my career, obviously, I’ve done a lot of finance and accounting type roles with organizations in corporate America. And I spend a ton of time in corporate America, but grew increasingly frustrated with one of my roles was as a consultant. And I help people borrow a lot of money through that role. And when I left that that organization, I continue to do this, helping people borrow money on the side. So because I really enjoyed it, I really enjoyed the process of putting together the plans, put me in the forecast showing them how to approach lenders to receive monies from them depending on what their needs were. As I became frustrated with corporate America, I decided to go into business for myself and leaned on the things that I knew extremely well and really enjoyed. I felt like the time was right to actually pursue something that I wanted to do rather than where your career sort of takes you. Even though I was in my field and pursued opportunities to basically become a lender and move on the side of being the actual person who provided financing opportunities for business owners. And when I went into it, I really thought the only thing I’d be doing was business loans. Loan and behold, I believe 30 days after I open my door, as I did my first real estate loan and real estate has continued to be the biggest thing that I do. We do a lot of real estate, all types. Our money brings money from the finance and cash out reifies, whole thing. But we also do a lot of business loans. I just felt like because I have been in business, I would I would attract more business owners and operators and be able to do a lot more of those types of loans. And it’s worked out where I’ve had a really unique balance. Real estate, real estate investors, business owners that actually we help with their financing needs in all types.

But I mean, that’s a really interesting philosophy. So just going back and it’s funny because I usually talk about this on topic, off-topic versus education versus real-life principles or getting a coach. So do you think that your college education was essentially fruitful to where you are currently right now? What did you learn more as you got into the actual workspace that you’re at?

It’s a combination of both, because everything I do currently is a direct result of what my training was in college and also throughout my career. I studied accounting, finance and undergrad and also got my degree in finance and from my MBA is in finance. So I, I was prepared academically. Of course, my experiences and my professional career cemented those types of things that I have learned and allowed me to actually use that every day, every day. I’m looking at financial statements every day determining where the opportunity is for finding financing a business, financing a commercial property financing, for example. But I’m looking at financial information and my money training and career certainly has helped me in. What I do now is just I use it in a different way than what it was. I was doing it as I was working for a company.

I remember going back to the first day when when you stepped into Powercore and everybody was like biting at the chops to get in front of you because in that space, right, we’ve dealt with banks and a lot of people get rejected from banks because they don’t understand what the banks are really looking for. So you came into the room and you told us exactly why banks are rejecting why what banks are looking for and what you’re looking for. So this is going to say that this is Friday morning at seven o’clock. What’s your one minute spiel that you can kind of give us some insight to what your business really helps people do?

Well, we evaluate you differently than the banks do a very what we call holistic in their approach to evaluating a credit, which means that doesn’t matter what you’re doing. If you’re a business or you have a commercial property, they look at you, your income, your debt to income ratios and then also default to what the business is doing. Those two have to line up for them in order to even determine that they can take the next step to consider your loan. In many of the products that we have, we we are going to take a look at you from a credit credit score perspective. But beyond that, we don’t really care about what your income is because none of our products are personal consumer products. They’re all commercial products. So, therefore we can look at what the commercial building is doing in terms of income and expenses and determine can it support a loan and then make that loan on that building based off of the financials of that project versus you personally? We don’t have to look at what your income is. We don’t have to look at what your debt to income ratio is, or none of that matters in the evaluation. And because of that, we can do more loans than sometimes banks do because our lenders have more flexibility in how they can evaluate the project. And that happens almost all the things that we do, including equipment, are just just a number of the products that we have. A lot more is dependent upon how the business is doing versus how the individuals perform.

So, I mean, you just touched on on AR and you also touched on real estate. So I’m going to pick these two apart, let us dive into and AR kind of define what is and what does it usually use for.

Sure. Accounts receivable is what they are actually means. And in accounts receivable, you create accounts receivable in your business when you invoice your customer and that customer now is giving terms to pay you back. So what we have is doesn’t matter what type of businesses and can be a construction company, a marketing firm, a distributor, a manufacturer, you invoice your customer because you perform the service. So you’ve actually done something for that customer, either delivered a product or delivered a service. And now you’ve given him your invoice to say now you owe me. Once you do that, you create an asset for your business. That asset is an asset that is actually a little devil asset to most lenders. Some banks won’t do it, but there are tons of other lenders around the country that will consider that that invoice for advance of a loan. Basically, man, they’re evaluating who that customer is. Some of your customers are Fortune 500 or Fortune 1000 type of entities or even not that large, but have great credit ratings and that can be verified. You basically are created for yourself, an opportunity for a lending opportunity once you buy an invoice, your customer. Now, the way the process works is the lender evaluates that invoice then advances your money against that invoice. That could be anywhere from 80 to 90 per cent of what that invoice totals. Your invoices, one hundred thousand dollars and the advance rate is ninety-five point ninety-five per cent. You basically, once they approve that invoice, you can get ninety-five thousand dollars on that one hundred thousand dollar invoice. So and if we step back under normal circumstances, you invoice your customer. Now you’re waiting for whatever the terms are. Thirty days or forty five days or what have you that they have to pay you. You can turn and sometimes your customers take longer than that. Well your your lender can advance you that money within twenty-four hours after you issued that, that an invoice. So now instead of waiting that thirty or forty-five days you now have that money in your company within twenty-four hours after you issued it helps companies with cash flow, meeting their normal obligations of payroll, utilities, suppliers. And so it really helps them operate in a way where they’re not necessarily sitting on the invoices, waiting on their customer. And there are tons of organizations that use that process. Daily staffing companies. I don’t know if I mentioned those, but they’re big in that. Space manufacturers are big in that space and service organizations. That that do we do a lot with our government contractors, so those are the types of organizations that really take advantage of that and construction people. Also, there are some lenders that specialize in nothing but construction and are sort of.

So, I mean, so in a nutshell, just to summarize that and kind of like, you know, obviously I know you’re talking Bampton bank terminology and I completely understand that. But I want to kind of just simplify it a little bit. But what you’re saying is that if I have an invoice and my invoices net 90, meaning that I have a ten thousand dollar invoice that I’ve submitted for services or rendering or whatever it may be, the person that I delivered that invoice to has 90 days to paid in full.

Right.

I may need that cash now to pay my team. I may need that cash now to get the supplies to complete other jobs. So I’m going to essentially liquidate that invoice, cash it out within 24 to 48 hours to make sure my company can continue to run. And then eventually I’m going to get that payment within the 90 days to kind of washout that loan.

Absolutely. That’s a perfect explanation. Perfect, because that’s what it does. You you’re not creating a separate bill for yourself. You just get an advance on that invoice that allows you to continue to operate it. Source cash flow issues that companies have because many companies can’t operate on that float that you have when your customers to actually pay you. They enjoyed that. You might need your money fast with it to your point, to make payroll to suppliers, to supply for your other customers that you’re trying to service and so on and so on to create a marketing program. Just just a number of uses for those funds in your business. But you’re able to get them a lot faster by utilizing a financing program tied to your accounts receivable. And the companies, even though they’ve been in business for a long time, still might not know about it or understand that it’s something that they can actually access and use for themselves.

So I to give my viewers a next question, is probably going to be, OK, so I have ten thousand dollars. I know I’m going to get paid in full in 90 days. I’m going to liquidate in twenty-four. Well, obviously that’s not free. So what kind of percentages are you looking at and understanding those margins to make it worth it. Like what numbers are we talking about as far as making that payment to cash that out within 90 days. Well less than 90 days.

A lot depends on what type of what type of industry you mean. Obviously, the things the lender is going to look at is what your margins look like. And nobody can determine those but you. But the type they are, the less likely you can afford financing. And the way that we’re describing the rates could be single digits. You know, the 10 per cent up to, what, double digits? So and the rates are monthly because you actually use the money for only the period of time that you have it outstanding is what it is. You’re not you’re not. For instance, even if a lender said, OK, you got a 12 per cent line of credit on your AR, it’s really a monthly number that you’re going to be paying maybe one per cent a month that you’re actually responsible for. And that can be sometimes up to three per cent. But keep in mind that in some cases you have to Furlong’s that you can do in these types of financing, one of which is where you actually are selling your invoice to your lender. That’s one. The second is where you actually have a lending arrangement, line of credit that’s directly tied to your accounts receivable and balances. The line of credit is actually a cheaper form. But because sometimes where you are in your growth cycle as a company, you might not qualify for the line of credit. So they have what they call the line of credit where you’re actually selling and it’s called factoring. Well, factoring allows the lender to buy it. But the process of how they both work is the same. The factoring is a little bit more expensive than the line of credit, but they they work identical to each other. You’re getting an advance against your invoice on either form. And the the lender is taking the risk that the customer is going to pay. And based on that, they’re going to charge you an interest rate that allows them to reap some benefits for actually lending you that money.

is definitely a win-win. So taking that in and going back maybe 10, 15 minutes, the other part that you were talking about was essentially I’m going to kind of. Iterate this right to say, if I’m buying property and I think you and I had this conversation about, let’s say, buying mobile park homes, so if I want to come into the mobile park home business and I’m going through a bank bank is going to look at me personally and look at my credit score and look at how much cash that I have now. So what’s your point? What you said, the way you guys do your capital investments and your lending is that you’re going to look at the the mobile park home and look at how many lots we have. What’s the rent do on each lot? What’s the magnitude of those Lotte’s per month times year. And that’s going to be the number to say, OK, if I lend his guy 100000, how quick can he repay me the 100000 based upon how many lots are being sold? Is that correct?

FALSE they will look at typically the income that’s coming off of their mobile home park, and that’s determined by the number of loss that you have that you have to use part on. That income becomes your monthly income and that is netted against whatever the monthly expenses are associated with that mobile home park. You know, they take into consideration things like repair and maintenance, insurance, taxes. Those monthly expenses are reduced from that income and that net income. It’s called net operating income actually determines what your what what kind of financing you can’t support out of that project in commercial lending, that net income, net operating income also determines value, you know, on or many or many projects. And I just did this with the mobile home park. He came to me because the bank would refinances is his mobile home park. And what we did was it was it was Freidrich that was vacant. That was commercial property. And then he had the mobile home park. But it was what he kept talking about selling the Frontalot right subdermal. So what we did and the bank wasn’t going to do that, even if they had refinanced, what we did was told them to get a survey that separates the front. Right. So now you have a separate lot. And also the economics of the mobile home park determine the value of just the mobile home park, which was more than enough to make the loan work for him. When we finished, he had his mobile home park refinance and he had a free and clear lot on the front that he could sell any time he one didn’t know what dad wanted. So he actually came out better by coming to us to help him with his refinance. And he’s overjoyed with the what the final outcome was, because, as I said, he was able to get his refinance taken care of, but he also got his property separated out so that, you know, to the day after the closing, if he wanted to sell that lot, he could sell it. And there will be no repercussions to his lender the way he was doing it with the bank. If he wanted to sell that lot, he had to go to the bank to get their approval to repay collateral and we alleviate it all. So he didn’t talk to the bank at all about what he wants to do, but that’s that’s how it’s done. Yes. That income determines what you can afford in finance. And that’s that’s how the evaluation happens. That income will either support the loan for the purchase or not. And sometimes, depending on what those numbers are, you might have to come in and actually makes them a much stronger down payment to make the numbers.

Well, I mean, yes. So, I mean, just what you just said and again, if you didn’t listen to what he said, I would say stop, rewind and listen to what he said again. I mean, he’s saying that there was a plot of land, right? And on that land, there’s a mobile park and let’s say an easement, but there’s an adjacent part of that land that could be used and sold for something else. So by going through a company, they were able to separate the land, put everything underneath the one lump-sum of money. But now this other piece of land is completely free. So now you can sell this land and pretty much pay for everything in full if you wanted to, by selling this new piece of land that’s completely separate from the other land is making rent income on a reoccurring basis, which is great.

Yeah, I guess so. And the reason you want to do that was the the front of the land to face the commercial rental that made expection valuable. Then even more so, he knew that at some point somebody would come in there and want to buy the put something in a strip shopping center, air station or what have you. And that that part of the city where he had the mobile home park, that role was being commercialized. So more and more development was coming down there. So he knew. He was sitting on a goldmine, and all we did was to be able to capitalize on that at whatever point he wanted to, and he doesn’t have to now think about, oh, I got to talk to my lender to get their approval to sell my land. You don’t have to do that.

Well, yeah, definitely a beautiful thing. So, I mean, just going like that was a good story. I mean, that was a good, positive story. I mean, what’s your worst experience dealing in this business that you ever dealt with before?

Not able to help people. And the way that they need to be help, I think is the worst. Or because sometimes sometimes it just doesn’t work out for a number of reasons. Typically typically, it’s either the credit score is way lower than what it needs to be. A person doesn’t have the down payment or, you know, those are those are common things that keep popping up that speaks to why a person is not able to move forward and what they think. I get a lot of calls for, even though we’re an alternative lender, there still standards, if you will. And but so it doesn’t mean that we can finance everybody that calls. So we try to be very, very, very quick in making an evaluation of what the situation is and what what options we may have to actually be able to help people. And, you know, I mean, I’m working with someone who says they want to buy a piece of property. What we see a lot of times is businesses that’s been in business for a number of years and maybe even very successful, you know, according to their tournament. But what they do is they’ll take their tax returns for the business and minimize tax consequences. Right. Was that OK? Yeah. You know, I’m a two-million-dollar business, but I made twenty-five thousand dollars, you know, will don’t they help you when you do that to minimize what kind of taxes you pay? They don’t help you when you come to an organization or you now try to do things like, OK, I want to buy a piece of real estate through my business that my business can consider or expand my business because we’re doing well. I want to open a second location. Well, if you can’t prove to your business operations that you can afford that, it’s going to be very difficult and are the types of things that we see. And people don’t understand that correlation. What they what they have is one objective. That objective is to minimize my taxes. But then they say, oh, yeah, well, you know, I’m doing well. I want to renovate my bill. And that may be a half a million dollar type of renovation or expansion of that building to do more in it, to actually generate more revenue. All great things. But if your current revenue doesn’t show that it can support that new debt and we’ve got a problem, and unless they want to go back and restate those numbers, they probably won’t be successful because those are some of the reasons. But we do a lot of good things. For instance, we can help people consolidate debt. We can help people get out of some of those emotions that they got Murchú cash advances that they got because they were hungry for cash and they went and got one and that one turned into four. You know, we can help businesses. I’m helping a company right now move from a rented location to a place that becomes their own because they’re buying a location. You know, I’m helping another person who’s expanding their smoothie shops. They’re going from five of them to about seven or eight. You know, we’re helping them get money for those expansions. So there are a number of things that we do that are very, very positive in terms of helping business owners advance their own cause. And and we have products that once we hear what you’re trying to do, we might be able to identify a product that you might not have thought of that allows you to get the resources, maybe not in the way that you thought, but allows you to get the resources that help your company. I have tons of companies and all that come in and they may say, hey, look, I need one hundred thousand dollars working capital. That working capital is really a function of cash flow issues that they’re having in their company. But they they have either heard bad things about how they are financing or don’t know that it exists wanted it to. And once we try to show them the benefits of using that program versus what their intentions are of a term loan, that turns out because what happens in a turnaround is you get you get an advance of money. I don’t care what the number is. One hundred thousand, ten thousand or a million dollars is dumped in your accounts and now you start to use it. Well, what? Is gone. It can be gone in 30 days, right? But now the the problems that you have in your business that created that, don’t go away. They’re back in 60 days and you don’t have the opportunity to go back to that lender and say, oh, I need another hundred thousand or another million. Many times the problem isn’t trying to get the term loan. The problem is your cash flow isn’t what it needs to be based on how people are paying you or how you invoicing them or how you’re collecting on those invoices. And those are solvable with the types of loans that are replenished based on your customers pay. Because if you don’t have the ability for it to regenerate itself based on those customers paying, you’re going to be back in the same position in a very short period of time and you won’t realize how you got there. And when you do that and you’ve got a term loan now, you’re back in that same position and you’ve got another being a long time for that term limits.

And that gets crazy, squeezing money out of money that potentially didn’t have to be that way.

That’s exactly right. And they didn’t look at all these things and think that I can do it based on how I have one client who kept solving a short term need with long term money. What that means is they kept going back to real estate, that they had refinancing real estate long term, but they were having a short term problem. So they just kept trying to refinance. And of course, at some point you have opportunities to refinance that real estate because you reach for maximums and they reach that, then they didn’t have anywhere to turn. So he finally listened to what we were telling them about the affiliates and that solved all their problems. Permanent, not not permanent.

They are definitely great insight. So on the journey of success is always perceived to be a 20 year thing. Right. And and on the front end, people always see it as something that happened overnight. How long did it take you to get to where you are currently?

My first year was I think I did two or three deals, my my second year obviously was better because you learn stuff as you go along and, you know, now we we have what we call great referral partners. I network with bankers, mortgage lenders, CPAs, business consultants. All of those people are people who refer business to me at one point or another. Those opportunities now are plentiful versus when I started. When I started, nobody knew who I was. And even though they knew I was, many people didn’t know I was in business to do what it is that I currently do. So part of the challenge is how do you how do you come out of the gate and get customers to know who you are, where you are, what you’re doing? Our company does business all over the country and, you know, our ability to do local networking, but also Internet marketing and what have you allows us to find customers who are looking for services that we can assist them with. We certainly aren’t the only lender out there, but our relationships continue to grow daily, weekly, monthly annually that allow us to be in front of people who know they need help and they are referring to us on a consistent basis. So you’re right. It takes a it takes a while to get to where you want to be. But depending on how various people are in those various things, networking and Internet marketing and what have you, because we we think that we are in business and to do what it is that we are here to do whatever that service is. But quite frankly, if you don’t know these other things, your business is going to be stagnant or not grow or not flourish in the way that you want to. You know, it was you know, I think that we sometimes get caught up in what we do and think that’s the end all be all. You know, you can talk to people who are in business. Some don’t have their websites that well. That’s that’s a common thing now. But if you’re in business and you’re not getting those referrals or what have you, that’s the first thing that people do when they say you’re in business. They go look for U.S. They’re the first things they do and this is not there. They may sometimes not consider you to be legitimate. And then and whether or not that’s true really depends on where suckers you’re running and where your business depends on that type of presence. You know, certainly people can operate and not have a website that’s you can do that. But if you’re if your business depends on people’s impressions and what it is that they need to see about you, that legitimizes you. If you don’t have one, you’re not in this business. And so that’s that’s one of those little small things. And, you know, the better it is doesn’t mean because you create it doesn’t mean that you get traffic because you have it. So all of those things, how do you drive people to your website and how do you get customers that filter out of that Web site? All of those things are critical for businesses these days because everything is so accessible. Everything as I state is

definitely so going back to that. So, I mean, what year did you open up the doors to your business?

What year?

What year did you start?

I started in 2013.

So you’re right, around eight years, so less than 20 years. You made a hell of achievement in leaps and bounds in less than a decade. Really?

Yeah, we’ve we’ve grown tremendously since the start. I mean, as I said, I, I went to a training program for my industry and came out of the gate, got my website prepared and allowed that organization that I was training with to do some marketing for me, which immediately got my phone to ring and several deals out of that. But that actually started me on my path. Of course, you have some ideas of how you generate traffic for yourself. And I followed some of those. What I found very quickly was that me being in business did not determine that my phone was ringing or that people would be knocking on my door either happened because I said I was in business. So that has to be a motion that moves people to you. I started immediately doing things like going around to talk to bankers and, you know, some were nice. But what I also found was because there was no affiliation and they had no clue who I was. Most were reluctant to even talk to me. And I certainly didn’t get any referrals in Michigan where I started to really pick up on referrals. And just just the referral partners was when we started doing the networking. You spoke and I spoke. And when we met once I started to do that, I started to see the real benefits of those types of things in my business. And my business really took off and took us to another level, because now your ability to meet those people who are legitimate referral partners is through those associations in those networks. So you already got something in common. They’re more willing to talk to you. I think also the thing that that I’ve been trying to talk to people about and make sure they understand is no matter what your service is, I don’t care if you sit behind a computer all day long. We are all salespeople and you need to remember that because your business is dependent upon how you can get in front of people to actually help them understand what your services are and whether or not they want to do business with. But if you’re selling, you’re not doing business every day, you’re selling every day.

You’re right about that. And that that goes to a very serious point that I mean, a lot of people think that it’s OK to market one time or to put one ad or to send one email. In today’s world, everybody’s complaining about all the ads they complain about on emails. But if you don’t ramp up your content, you’re going to get lost in the noise. You have to put that content out there as frequently as you could humanly possibly do it. So that way, when people do check because you don’t know when people are going to check the e-mails, you don’t know when they go to Facebook. Your content needs to be fresh in their streams on a regular basis. So just it’s going to taste right. I mean, obviously, you have the business hustle. You have a mindset as an entrepreneur. Does that come from your family upbringing? Your family was a business owner?

Well, oh no, my family was educators and my father was a manufacturing worker. And so it was so but I I saw a number of things when I was growing up. My family owns a lot of property down in South Georgia, and I wasn’t necessarily surrounded by entrepreneurial ones, but I always thought a little little about owning businesses and I thought that that was the way to take some steps. And it took me a long time to take the leap, if you will, because we’re so indoctrinated into get an education, get a job in education, get a job that’s sort of the the for most of us, that’s literally what happens in your in your home. Your parents want you to become educated and then get a job, get a job. I saw that there were other people who were doing things from owning businesses and operating in a different way. And I was very intrigued by that. I was always intrigued by business. I would be in college or high school. I would get out the old Thomas register and see how all these companies have built up all of these sorts of under them, all this kind of stuff that always intrigued me. So as I went through my corporate career, I one of the things I was trying to do was figure out what what can I live myself to that will actually be mine. That would also allow me to go out. It would be an entrepreneur and of course, I I went in a couple directions or tried to own a sandwich shop at once but didn’t have a right partner. I went into business being a distributor of of suppliers. Office supplies didn’t have the right path. And then I did real estate for about five years prior to the crash. I just fixed them flip houses on my own. And after I left corporate America the first time I did that for about five years, then got sucked back in to corporate America just because there was an opportunity. It wasn’t even something I was looking for, but it was an opportunity that came there. And all of a sudden that became an offer. That opportunity became my life for like another eight to nine years. And as I was doing that, corporate opportunity again got frustrated with corporate America again and decided that I needed to step out on my own and started my research, found the opportunity because I was I was also looking for a particular type of opportunity. I was I was at the age where I didn’t want to necessarily manage a whole lot of people. I didn’t want to go to somebody else’s office. I didn’t want there to be certainties for me. So I wanted something with flexibility. I wanted something that allowed me. I didn’t have a cap on what my income was and my efforts would prove that we could actually make it. And I found all of that in what I do currently in my company provides me with enormous opportunity for income. We help companies and individuals with their goals of moving their their business or their investment goals forward. We do that every day. So we’re helping people and we’re serving them in a way that allows us to reap the rewards financially from that service that we provide for them. So we’re able to do all of that. But that’s what my business did for me and that’s what it continues to do.

So, I mean, obviously on that journey, I would think that you’ve started a family. So understanding that as a entrepreneur, it takes a lot of time. So how do you juggle your hustle with your family life?

Well, you know, my I’ve always felt like I’ve always felt like the work and life needs to balance, so I’ve always spent a lot of time with my family, my son and my wife, and and then allow work to dominate me in that way. And that’s and frankly, I’ve always had a great work ethic. What have you. And that’s translated into me working for myself. What I do now is actually much more fun than what I’ve done throughout my corporate career. So I find myself sometimes putting in more time than I should. So I have to back it up. I have to take days, you know, so I balance things out by doing the things that I enjoy doing even during the week when I create the opportunity for it. So during the week, on a Friday, because Friday is a slow day for me, I might go play golf in the middle of the day, you know, and my wife has taken up golf, so sometimes I’m doing it with her.

It’s nice

spend some time together. Same thing in the middle of the week. If I have a Wednesday or a day where my calendar is free in the afternoons because I work for myself, my phone can ring even while I’m on the golf course. So, you know, I’m still working, but also doing some things for myself. This weekend, we’re going to go up to Gatlinburg just to get away for the weekend. And we do that quite often these days just because we have the flexibility to do it. My wife is retired, so we’re not restricted to you know, she got to go to work every day. So we’re ready to go. We go.

So. So with that. Right. So, I mean, I think earlier when we got on this podcast, you have like a morning routine, right? So you work out. So this is going to make what is your morning routines look like?

Well, as you mentioned, I work out in the mornings and I love to do workouts first thing. So I wake up probably five-thirty every day and by six o’clock I’m in a circuit or on that by doing cardio half. And so and that’s every day. So my my workday typically starts at around nine o’clock, so I’m up at five-thirty working out before I come into the office. I’ve already determined what my day is going to look like based off of the previous and day some the end of the day. On the previous day, I’ve already outlined what tomorrow needs to look like or things that I need to focus on who the people I need to contact, if it’s a lender, if it’s a borrower, or if it’s a new client or if it’s a networking opportunity. All of those things are sort of lined up for. Of course, I have appointments lined up already that we work around and then those opportunities for admin work in the business come around. Those opportunities for networking or appointments that we have on includes. So my days are pretty filled with those types of activities and I try to do certain things. As I say, you’re always selling, so you have to time to write, in my opinion. So even though those networking and referral partners that we have create calls for me, I also want to actively pursuing relationships that also will turn into referral type opportunities for me. So I schedule on Tuesday like a Thursday in non-covid times. Those are my days to be out of the office if you will. I’m doing things in front of the people who could conceivably be good reform a partner or referral partner types. Those are my days for that. And Monday, Wednesday and Friday were directly in the office catching up with them and were following through on ones that you are moving through the process talking to a real estate investor about what their needs are and what we need to do to help them get to what they’re trying to do and so on. So that’s how my ideas feel.

Right.

And it’s pretty. It’s pretty, you know, because I have customers all over the place. I get calls from California and those people because we’re in front of them sometimes I’m in my office at six, six thirty-seven o’clock talking to people depending on where they are, because. They’re doing their work during the day and they called in the afternoon, so,

yeah, makes sense. So as I’ve been developing this podcast, I realized that everybody I would say probably 90 per cent of people that have had on the show are successful in many different ways. And part of that success Journey books helped them get there. So I decided to create a Boss uncaged book club. So what what are you currently reading or you have read before that you would recommend to someone?

What I think would be very good is who moved my cheese? I don’t know who moved my cheese is about action. It’s about and it’s a very simple bill, but it’s a very direct about what it is that it takes for you to actually achieve. And it speaks to the promises. You know, they show you how in some ways people are complacent in their way of thinking. And because of their being complacent, they’re waiting for somebody to tell them what to do versus taking action. And that’s really what the premise of the book is. It’s a great little farce read is what it is, but it’s a great business book in my mind that I think is very good and instrumental. Another book that I’m reading right now is called Options Trading

Nice.

What I want to become more versed in trading options. So I’m eating and then I’m going to take a course on it and learn how to actually use options as an investment.

who is the author of the book The Obstacles,

Warren Buffet Benjamin is the author of this book.

So with these two recommendations, who would you recommend should read either one of these books?

If you’re interested in investments, that’s the options trading book. But because people all people should who moved my cheese. I even think it’s good for people who are not entrepreneurs to read again. It costs more about the things you do that you create. The change you want is when speaking to and I think is great book for everybody. I guess it is a very, very easy book to read. And it’s a you know, I remember the exact number of pages, but I can remember reading that book and what it meant to read it and the the thought process of what you encounter as you read a wonderful book. What book? And I think, you know, a great read for people. There are there are a couple of others that I can no one is thinking which a black choice. And then the other one is by Napoleon Dennis Kimbro. I wrote that thinking a Blackshirts. That’s Dennis Kimbro, that Napoleon Hill, I believe, is the writer of Thinking Rich, which is also Dennis Kimber’s book is a takeoff of his book. But but both are great books and great reads actually the another. I can’t think of a name of his book, but George Fraser wrote a book about network and. And he talks about the value of networking and how what it is that if you do those things that you talk about. In terms of networking in how to network is also important. I think, you know, you and I met through a networking function, that function opened my eyes to a lot of things because I think when I first I know it throughout my entire career, no matter what group I was part of, I always thought of networking from the perspective of what do you get out of it? Right. What can I get from it? And if if you have first impressions in any network group or that you’re not going to continue with that group, that’s that’s the bigger thing. So and the group that we were part of, the first thing that we were taught was you got to get to get right. And as you do that, you reap the benefits of people giving to you. It’s a powerful lesson, I think. And and if you drink that Kool-Aid, you also see the benefits, because the more you give, you absolutely reap the benefits. And that’s biblical.

So, yeah, definitely.

And as you as you see that do that, comprehend that your rewards in your business grow exponentially. You know, and some people sort of determine early on that that’s the kind of person they want to be and become very good at. Others keep wanting people because we saw even in our groups how people came to that and was like, I got nothing out of it. Nobody’s making any referrals. And Mr Fraser says, if you have nothing, it’s because you have given that that is real.

That’s definitely real. So so I think I mean, because you listen, I think I did a definitely great books. And the irony of all that is I think Michael Richards came up on his podcast at least probably like two out of every five episodes. Somebody always recommends that book. It’s like the timeless book from 1930 that still holds Wait Till His Date is a golden book. So so from from books to like tools and software, what tools or software do you use that you would not be able to run your business without?

e-mail? Obviously, a CRM because, you know, you need a CRM and your system that that can track what’s going on with the customer that you interact with from your calls to documents you may have sent to them and places to store those documents, you know, and how you go about doing that marketing, you know, and some of this is stuff that you even if you don’t know, you got to get proficient at expanding, even if you’re using somebody else to do it for you.So and I think that that’s critical. I mean, a good accounting software I also think is important in a review of your financials on a consistent basis that helps you understand where you are, how you’re getting there, whether you’re making money or not. And it needs to do things for you that you don’t think of in your own mind. If you have different product lines, you need to be able to separate them to determine what’s profitable and what’s not, what’s making revenue for you and what’s not. Those things are critical, I think. And because some of them some of those things are free, some of those things you got to pay for and not versed in understanding financial statements, you need to surround yourself with people who can give you that knowledge. The other thing I think is important is good mentors, good mentors, you know, I think are invaluable to people. I in my work and I’m always talking to people about how to make themselves better early because I you know, I talk to people about what it is that they can do even in the process of borrowing money. I will send them back to somebody that they may have just left, for instance, many times they will come to me as I just left the bank, the bank said no, because they’ll take me all the reasons why. Well, I’m listening and I’m trying to determine how I can help them. Well, sometimes I’ll send them back to that bank that they just got turned back, which doesn’t pay me, but I’m helping somebody do something that helps them. And, you know, I’m not looking for compensation. I’m trying to get them to where they are, trying to get based on what they’re doing. Well, even in doing that, again, I’m giving and I’m not receiving from that end. But, you know, it comes back to and I don’t have a problem doing that or helping people with knowledge. I get people who call who want to be in my business. I tell them, hey, look, I’ll tell you everything I know. You know, we we shouldn’t be stingy with that for two reasons. One is it’s not good for you, that’s one. But to everything we do is written somewhere and nothing is a secret, even though people think it’s a secret, you know, some people become more proficient at it than others because they’re doing it well, they’re enjoying it or they understand all the dynamics that make it successful. That doesn’t mean that it’s not somewhere where I can read it, to understand it and actually even implement. If I chose to spend that amount of time so that people talk to me about my business, I tell them everything I know or anything, but I tell them how it is I got in, I tell them what it is and it costs me. I tell them what it is that you have to do to stay in front of people. I tell them how it is that I create my lending opportunities with the lenders that I talk to about all of that. But here’s what I’ve learned. No matter what you say to people, some people still are going to do anything that’s I’m going to do anything whether you, you know, adhere to that philosophy or not. But some people are going to be the type of people that are committed to action and committing yourself to action will move the needle tremendously. If you’re willing to do that. Doesn’t matter what the process is. It could be real estate investing. If you start, you’ll start figuring out something. You know, you start figuring out what you can do, what you can’t do. But we get stuck in the start. We’re also people who, because of that indoctrination, are going to work. We’re afraid of what it means when I don’t have a job and now I’ve got to depend on myself to create my own income. Some of us cannot fathom that this is not the way we think. So we’re not wired that way. And the false sense of security that comes from working with a corporate America, what have you stifles many people. It’s like, yeah, I will do that, but I’m scared or I don’t know if I have enough money. I don’t know if I know. One of the interesting about that whole process is the number of people that are already working in, quote-unquote, commission type roles, sometimes 100 per cent or also some of the same people who will never go into business for themselves.

Definitely. It’s a great I mean, I think you’re leading into my next question. I think you’ve given some like a lot of I think it’s a golden nugget. I would say like liquid diamonds. Right. What final words of wisdom do you have for someone that may be coming to you or somebody that is younger to you, that wants to become you follow in your footsteps? What advice would you give to them?

Explore. Read and commit yourself to action. That’s what I was saying, because exploring allows you to find out what the world can offer you. That’s what it does. And, you know, in spite of what’s going on in terms of politics and what have you, it’s a big rule out there with a lot of different ways that people can make money. You know, I’m amazed that the things that people can do that create income opportunities for them. And in today’s digital age, it’s actually even escalated that even more people are doing digital stores and selling millions of dollars. And so there are a number of things that people can do that create opportunities. You should read all the time. Most successful people I remember Dennis out here heard Dennis Kimbro speak once. And one of the things he said was readers are leaders, readers are leaders. And inevitably readers comprehend and understand so much more than people who are getting their information off the news or off the television or having because the reading allows you to comprehend it a whole lot more and visualize what’s going on and even sometimes visualize how you can make it happen for yourself and then commit yourself to action. Action. Action doesn’t mean that you’re blindly going out here. And just doing this means that you have a plan of action that allows you to go out here and be successful in this wide world that we have. That speaks to how you can do business. I mean, there like I said, I’m amazed at the number of ways that people are supporting themselves and doing business. And it doesn’t matter what it is, you know, because what you might do, somebody else won’t do with it. I mean, I know people who call garbage, people who haul waste. And, you know, the first thing some people are going to say, well, I can’t do that. Well, you know, but then you go and you look at what kind of revenue these people are generating based on them hauling garbage, you know, it may not be for you, but it could be for somebody else. Another thing I heard somebody say. Don’t be the negative person in somebody’s life. Don’t tell them what they can’t do. You know, the the opportunity for you is very different sometimes than the opportunity for somebody else, you know, just because you don’t like what is it called, network marketing. Some people don’t consider it a business, and I understand that. But because it because of your perception of it or your lack of success with it doesn’t mean that somebody else will make money off of you.

And you definitely right

have to be open to that. You’ve got to be open to these types of things that will allow some people to make money. That’s what I struggled with network marketing was. And it’s not for me. But what I do see is the people that believe in the process and believe in how you go about creating the business that they’re working. You actually do have success. They have success. Can you get there? You got you got a one buy in and you got a buy in, whether it’s the product, the product, the process or what have you first got to buy in. And that goes for any type of business you are trying to do. You can’t go out here and not be happy what you’re doing and think that you’re going to have a flood of customers.

Yeah, definitely. Definitely right about that. So how could people find you? I mean, what’s your Facebook, your website, your phone number or email address?

My website is w w w. Barrington consult Barrington Capital Commercial Capital.com. I’m thinking out loud here for Capital.com. That’s my Web site. My email address is R Johnson at B, C, C, FIR.com. My phone number for my business is four four seven six two four four six to nine one zero zero four or four six to nine one zero zero. LinkedIn is Ray Johnson and I have a my business behind me on my LinkedIn profile. There’s a Barrington commercial capital Facebook page. There is a Barrington commercial capital LinkedIn page. So all of that’s out there. We’d love to hear from your audience. I’d love to help them with any of their commercial capital needs, be that real estate investing or business funding needs that they have very.

So going and going into the bonus round, I just feel like my favourite question. Maybe one day I may change it. But right now I still love this question. Right? If you could spend twenty-four hours in a day uninterrupted with anybody dead or alive, who would it be and why?

You know, I’ve gotten that question from another podcast. I was just on a podcast for entrepreneurs and finance. The question was asked and the person I said was, and I still believe it’s Frederick Douglass. And you know what’s what’s interesting about a person like Frederick Douglass is he was born into slavery. Right. And you escaped death and became a free man, but still owned by somebody in the south. As he was living his life, he became a voice for black of America in a time where we were already oppressed people. And he was a very outspoken person, a great speaker and what have you. I just like to talk to a person like that about what is it like to be in an environment that spoke to you being somebody’s property and and living a life outside of that. How did that come to be? And and then how did you figure out or determine that your life would be speaking out against that? That you were a part of and went because and during that time, it was just so fascinating to me that that person existed, thrived, escaped his enslavement, and then became an outspoken proponent for a Guesclin very outspoken front from being a slave to going to visit people in the White House, this incredible journey. And I just think that he’d have a whole lot to say. That would be very interesting on front. And I’m pretty much an inspiration in a number of ways. So that’s that’s that’s the kind of person I would love to spend some time with and learn more from figure out what it is that we can do. So,

yeah, definitely. I appreciate that is a very thought out answer. And I mean, obviously, to your point, you had an opportunity to answer that question before. So like when you’re filling in the blanks right now, it’s definitely a fulfilling answer. So this is the point in the podcast where I give you the microphone, my guests, to interview me. Any questions that you may have come up with during the show that you may have for me?

Well, you know, obviously we’ve known each other a little while, know we’ve witnessed part of your journey. I mean, I. I like the idea that you’re doing this podcast and exposing entrepreneurs to different people who go into business. Why don’t you talk a little bit about what what caused you the transition that you’ve gone? Because you’ve you’ve done a lot of things and some of which you’ve dropped, but some you’ve kept going. But you’ve done a lot of things that speak to what we talk about, how you make money and also the types of things that could sustain you over time. You’re good at what you do, but I’d like to know your thought process and moving through the journey that you.

Yeah, so it’s like the evolution of boss uncaged essentially came from like you said, I’ve tried multiple things. It’s kind of like my left brain always fights my right brain. So once I’m creative it and the other side I’m analytical. I jump at the business structures. But I had opportunity to kind of think about it like what’s the best way? Like you say, can I give first? And then by giving you would receive and through our networking groups and going through. That’s what we were doing. We were standing up, we were pitching who we were. We were saying to our target audience is a mom, a soccer mom. She may be your neighbour and she may be working from home and she’s looking at X, Y and Z. So painting these pictures to that journey sort of realizing, well, we’re paying pictures, but we need more information. Like, for example, which you today I’ve heard parts of your story, but today you’ve kind of outlined all the pieces of the puzzle to kind of make a complete picture. And so I’m taking that picture and I’m like, OK, here’s my audience. Here’s other people that may find this podcast three, four or five years from now that may one opportunity to understand how capital works, how to raise funding. And this podcast can now give them that opportunity, but by default is associated to me. So in that journey, again, I have a lot of people in my Rolodex that I can give them opportunities to broadcast to my audience. And by default, things will come back to me through osmosis because I am the facilitator of this environment. But my goal is to give people opportunities to understand that business is everything. Business is in all aspects. And that’s why every guess I’ve had on my show, I’ve been uniquely different. There’s some overlaps here and there, but I could get somebody else does a capital guy and he could be 100 per cent investing into not real estate. Maybe he’s a hundred percent commercial business lender versus you’re more in the real estate lending. So his demographic, his story, his missioning will be completely different than yours

right outstanding,

appreciate. Appreciate it. Well, let me if you got to hear the questions, this is a time. If not, then then we’re good.

I think I’m good. I’m good.

Oh, well, I definitely appreciate you taking time out of your busy schedule, man. I think this was definitely an impactful episode. I think you gave a lot like I said, not even Golden Nugget. You give liquid diamonds is stating them right. So you give a lot of information that I mean, anybody’s looking for, you know, secondary lending, anybody looking for funding and just wants more information. I mean, I would definitely recommend that they give you a call to talk to you and particularly our audience of small business owners. Right. Our audience are entrepreneurs, solo partners. So you’re the guy is going to be able to kind of help them grow their businesses and take it to the next level. So I definitely appreciate you coming on the show.

Absolutely, I appreciate being here and it’s been a pleasure. I’ve enjoyed every minute of it. It’s not necessarily talking about myself, but what we do is always doing this for me and you,

oh great, great, great. All right, guys. S.A. Grant over now.

Leave A Comment